Beyond Yield: What Are RWAs In DeFi

For years, the narrative of DeFi has been dominated by yield farming, liquidity pools, and novel tokenomics. While these innovations have been instrumental in bootstrapping the ecosystem, a new frontier is emerging that promises to bridge the gap between the digital and physical worlds: Real World Assets (RWAs).

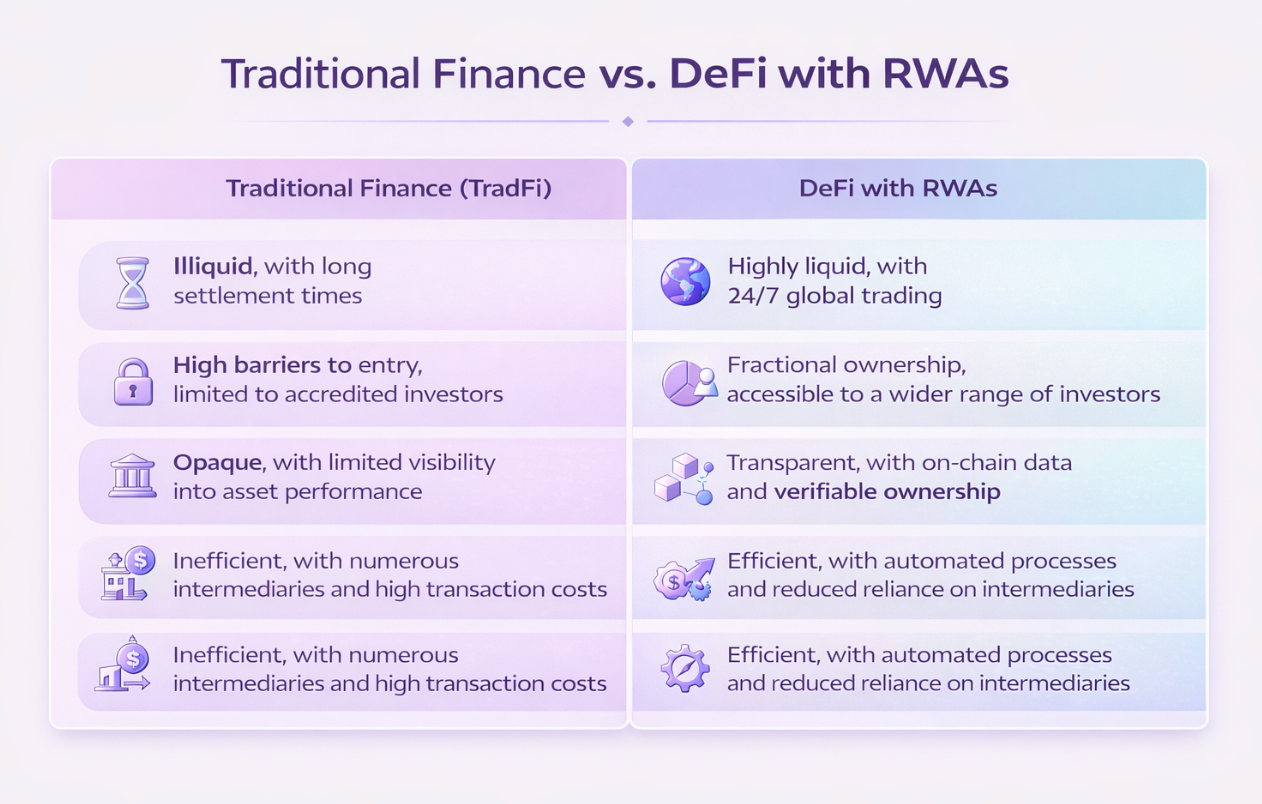

The tokenization of tangible assets like real estate, bonds, and private credit represents a multi-trillion dollar opportunity to bring unprecedented liquidity, transparency, and efficiency to both DeFi and TradFi.

As we move into 2026, the integration of RWAs is no longer a theoretical concept but a rapidly growing reality, set to redefine the very fabric of our financial system.

What are Real World Assets (RWAs)?

Real World Assets are tangible or intangible assets that exist outside of the blockchain and are brought on-chain through a process called tokenization. This process involves creating a digital representation of the asset as a token on a blockchain, with the token's value being directly linked to the underlying asset. This allows for fractional ownership, easier transferability, and access to a global pool of liquidity.

The potential market for RWA tokenization is immense. Global real estate alone is valued at over $327 trillion, and the total value of all global assets is estimated to be over $900 trillion. By bringing even a fraction of this value on-chain, DeFi can unlock a new era of financial innovation and accessibility.

The Benefits of Tokenizing RWAs

The tokenization of RWAs offers a plethora of benefits for both asset owners and investors. These advantages are poised to drive significant adoption from both the DeFi and TradFi sectors.

Use Cases of RWA Tokenization

The applications of RWA tokenization are vast and varied, spanning across numerous industries. Some of the most promising use cases include:•Real Estate: Fractional ownership of properties, allowing for smaller investment sizes and increased liquidity in the real estate market.

• Private Credit: Tokenization of loans and invoices, providing businesses with new avenues for financing and investors with access to a previously inaccessible asset class.

• Bonds and Treasuries: More efficient issuance and trading of debt instruments, reducing costs and settlement times.

• Art and Collectibles: Fractional ownership of high-value items, making them more accessible to a broader audience.

Tokenized real-world assets have been a growing segment of the DeFi ecosystem, with RWA total value locked sitting at ~$5B in December 2023, a figure that is expected to grow exponentially.

The Future of RWAs in DeFi

The year 2026 is poised to be a pivotal year for the adoption of RWAs in DeFi. We are already witnessing a surge in interest from institutional players, with major financial institutions exploring the potential of tokenization.

The development of more robust infrastructure, clearer regulatory frameworks, and innovative DeFi protocols will further accelerate this trend. The convergence of TradFi and DeFi, facilitated by RWAs, has the potential to create a more inclusive, efficient, and transparent global financial system.

Conclusion

Real World Assets represent the next evolutionary step for DeFi. By bridging the gap between the on-chain and off-chain worlds, RWAs can unlock trillions of dollars in value, bringing unprecedented liquidity and accessibility to a wide range of assets.

While challenges remain in terms of regulation and infrastructure, the momentum is undeniable. As we continue to unpack the potential of RWAs, it is clear that they will play a crucial role in shaping the future of finance, moving us beyond yield and into a new era of tangible, on-chain value.

About Portals: Portals is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this blog is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.