Portals DeFi Weekly - 13th February, 2026

Welcome to the Portals DeFi Weekly, your weekly dose of the latest insights and analysis in DeFi.

Market Pulse

- Total Market Cap: $2.352T (-1.5%)

- DeFi TVL: $95.292B (-0.22%)

- 24h Volume: $107.458B

- Fear & Greed: 9 (Extreme Fear)

- BTC Dominance: 56.7%

Summary

The market experienced a significant downturn this week, with the total market cap falling to $2.365 trillion, a 1.5% decrease. DeFi TVL saw a slight contraction to $95.292 billion. Market sentiment has shifted deeper into Extreme Fear, with the Fear & Greed Index at 9, a sharp drop from the previous week. Bitcoin dominance remains high at 56.7%, while Ethereum gas fees have plummeted to a low of 0.061 Gwei, indicating a significant reduction in network activity.

The Yield Market Pulse

The yield market is currently characterized by caution and a preference for lower-risk, sustainable yields. The recent market correction has compressed yields across the board, with many high-risk strategies becoming less attractive. Investors are prioritizing capital preservation, as evidenced by the popularity of lending and delta-neutral strategies. The sentiment is bearish, with a focus on established protocols with a proven track record of security and reliability.

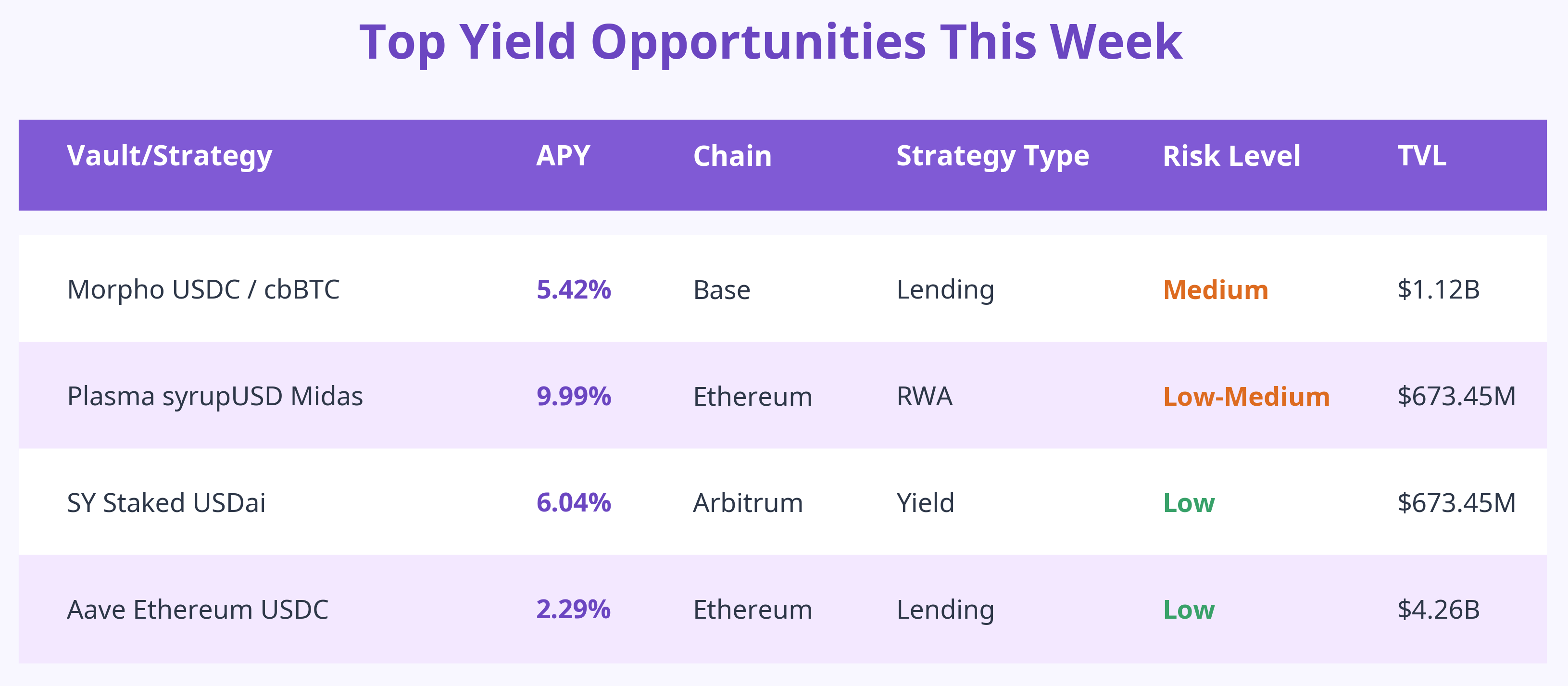

Top Opportunities This Week

This week's top yield opportunities, straight from the Portals Explorer, highlight a mix of high-performing RWA vaults and stable lending markets.

- Plasma syrupUSD Midas Vault leads with a significant 9.99% APY, reflecting the growing demand for institutional-grade RWA yields.

- SY Staked USDai on Arbitrum follows with a 6.04% APY,

- Morpho USDC / cbBTC on Base offers a competitive 5.42%.

- Aave Ethereum USDC remains a reliable benchmark at 2.29%, for those seeking maximum stability.

DeFi News

Key Developments in DeFi This Week

- Real-World Assets (RWAs) Drive DeFi Expansion: The tokenization of real-world assets continues to be a major growth driver for DeFi. The market cap of public-market RWAs tripled to $16.7 billion in 2025, and this trend is expected to continue in 2026 as more institutional players enter the space.

- Ondo Finance Global Expansion: Ondo Finance partnered with MetaMask and Blockchain.com to offer tokenized U.S. stocks and ETFs directly to European users.

- Aave Proposes to Redirect Revenue to DAO: Aave Labs has put forth a proposal to redirect 100% of its product-related revenue to the Aave DAO. This move, if approved by the community, would significantly empower the DAO and further decentralize the governance of one of DeFi's largest lending protocols.

- BlackRock's BUIDL Fund Integrates with Uniswap: BlackRock has brought its tokenized fund, BUIDL, onto the UniswapX protocol. The integration, coupled with BlackRock's purchase of UNI governance tokens, signals a growing convergence between traditional finance and DeFi.

- Stabilising Liquidations: Following a volatile period, daily liquidations fell to approximately $300 million, with funding rates beginning to stabilize after being negative across the board last week.

- Hyperliquid Volume Milestone: The decentralized exchange Hyperliquid saw daily perpetual trading volumes hit $5 billion this week, driven by a surge in metals-based trading activity.

- New Security Threats: Google's Mandiant warned of sophisticated North Korean hacking groups using AI-generated deepfakes in fake Zoom meetings to target DeFi executives.

Portals Platform Updates

The New Portals Explorer Homepage is here!

Say hello to improved and advanced Portals Explorer Homepage! Now you have a unified and intuitive interface for all your DeFi activities, from in-depth analytics to seamless execution.

The new Explorer is designed to empower both new and experienced DeFi users with a comprehensive suite of tools and features that enhance authenticity, ease of use, and discoverability.

The new Explorer introduces a suite of features designed to provide seamless access to verified and trustworthy opportunities:

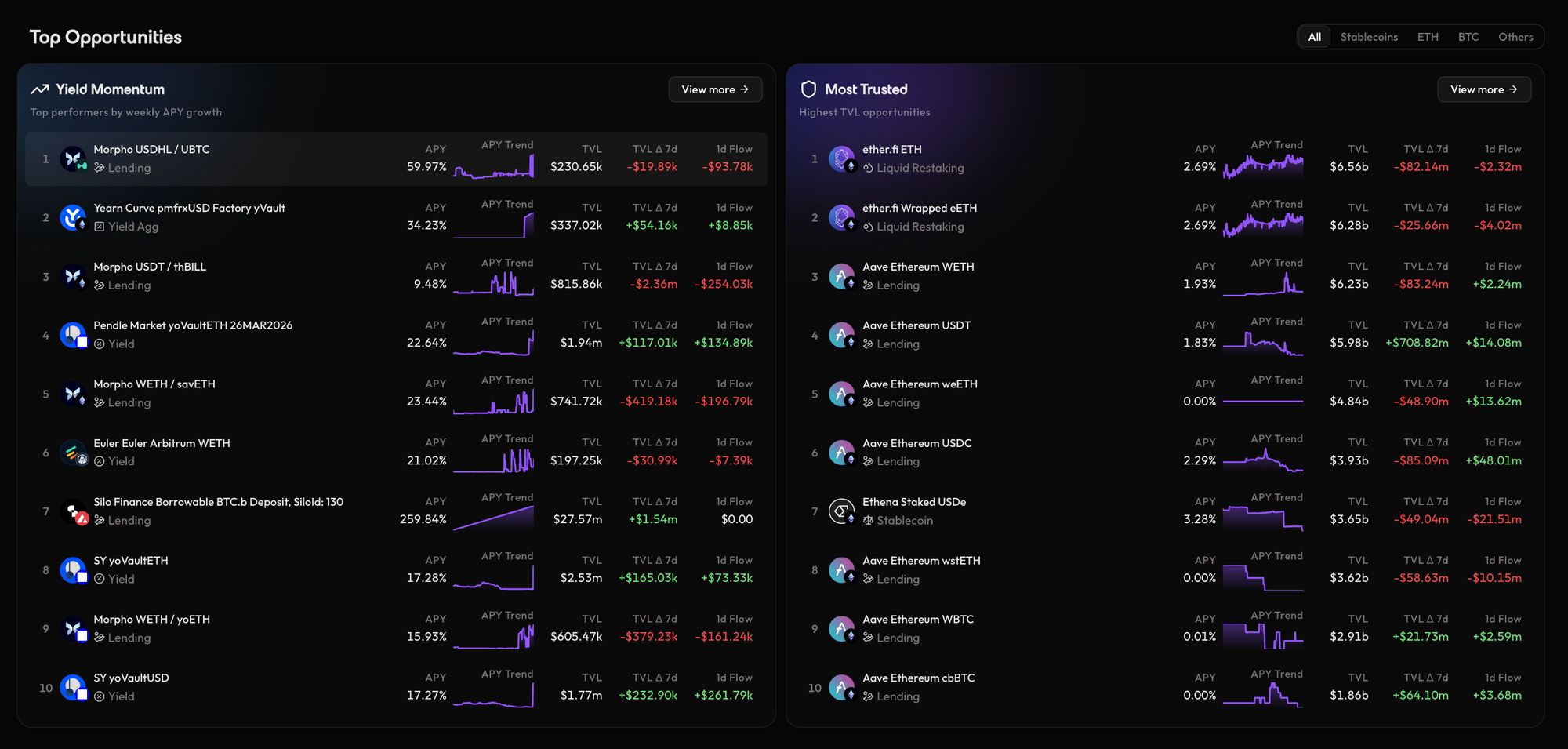

- Trending Now: Stay ahead of the curve with real-time insights into the most popular and active opportunities in the market.

- Top Opportunities & Most Trusted: Quickly identify the most promising and reliable yield opportunities, curated based on performance, community trust and verified data.

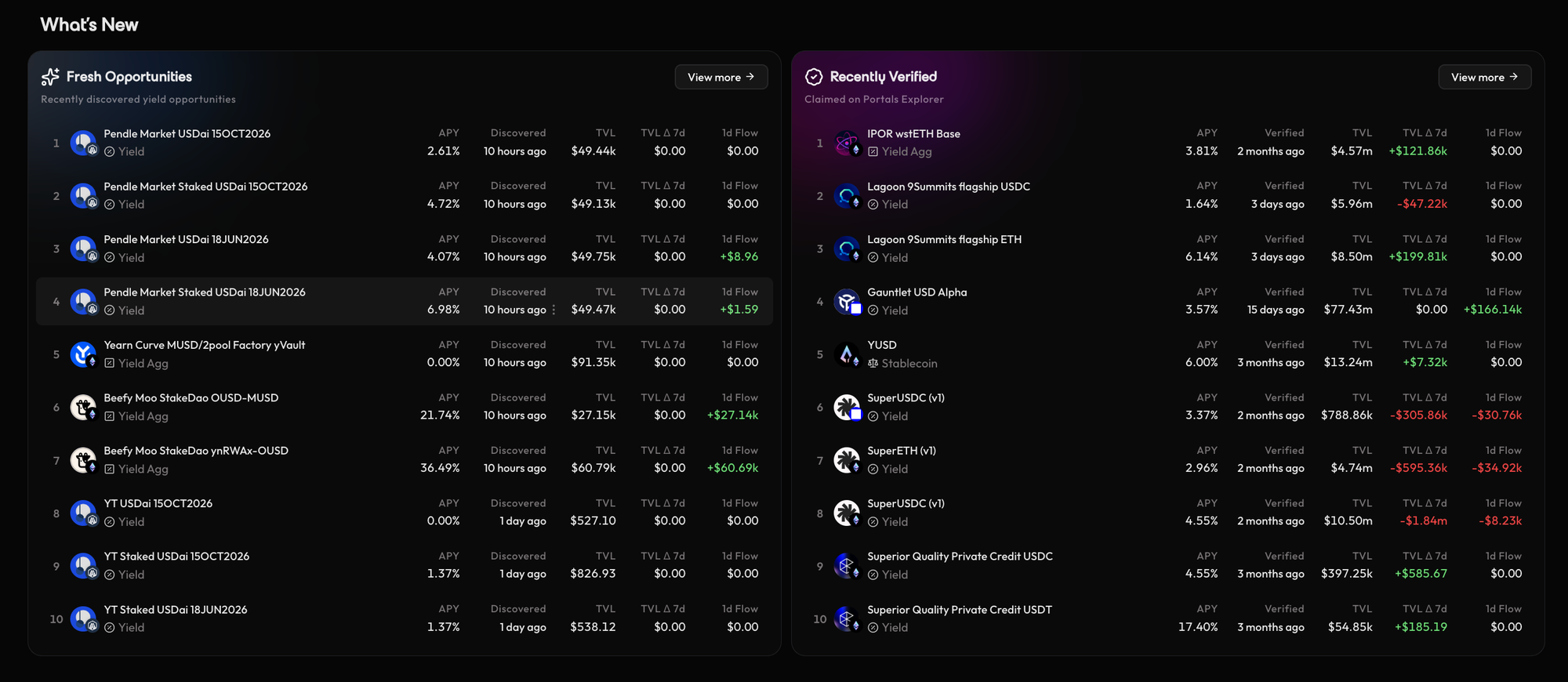

- Fresh Opportunities & Recently Verified: Discover new and emerging yield opportunities as they are listed, and trade with confidence knowing that positions are verified on-chain.

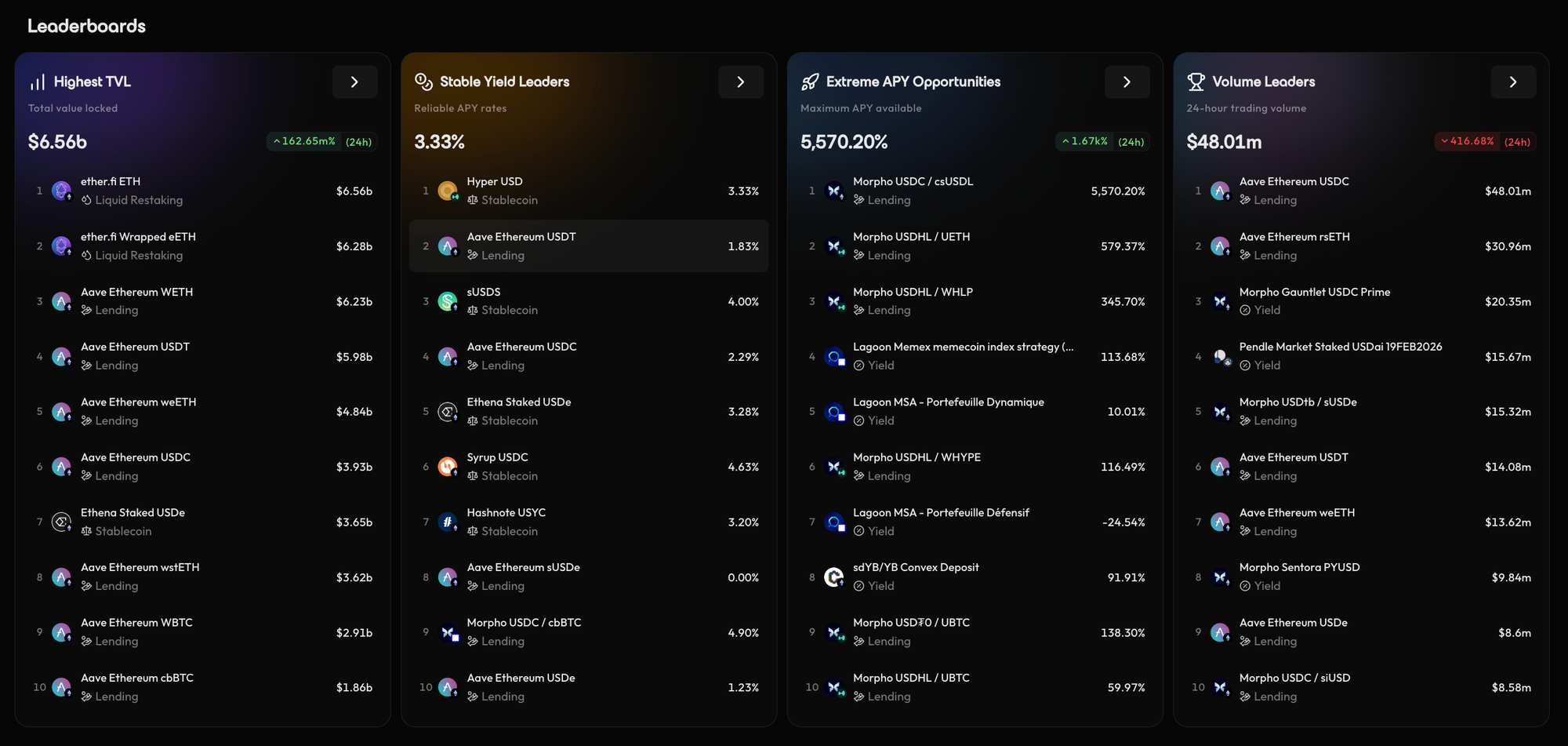

- Leaderboards: Get a comprehensive overview of the market with leaderboards for Highest TVL, Stable Yield Leaders, Extreme APY Opportunities, and Volume Leaders.

These features, combined with Intent-Powered Zaps for single-transaction execution and Comprehensive Data & Analytics, make the new Portals Explorer the ultimate tool for navigating the complexities of DeFi with ease and confidence. Experience the new Portals Explorer Homepage today and discover the future of DeFi.

Additionally, this week on The DeFi Drop Podcast, infiniFi episode is Live! You can watch the full segment here. Next week guest? Stay tuned

The State of Chains

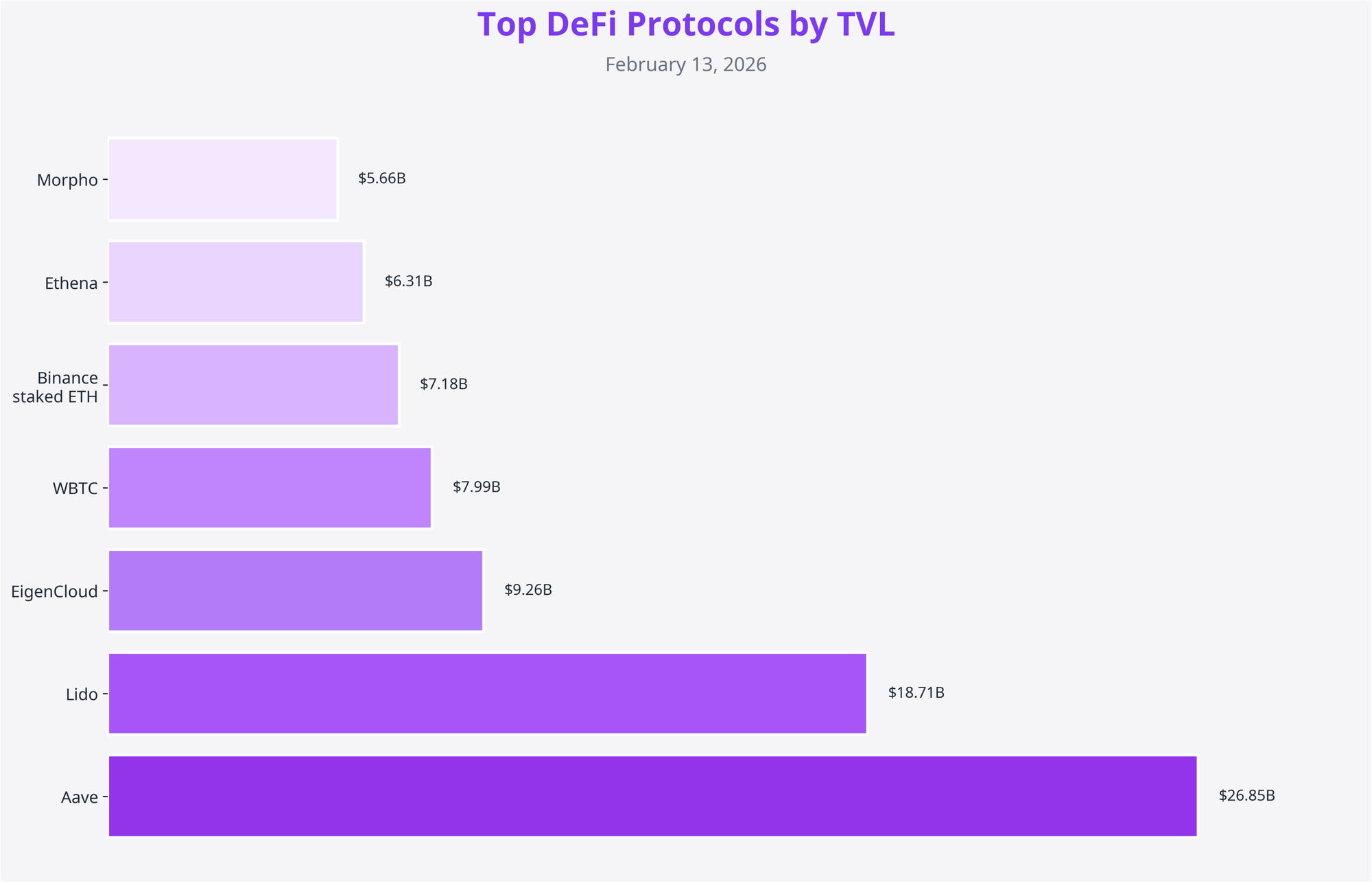

Top DeFi Protocols by TVL

Aave continues to dominate the DeFi landscape with a TVL of $26.85 billion, followed by Lido at $18.71 billion. EigenCloud has seen significant growth, reaching a TVL of $9.26 billion. The top protocols remain largely unchanged, indicating a consolidation of liquidity in established and trusted platforms.

Chain Performance Analysis

Ethereum remains the undisputed leader in DeFi, with a TVL of $54.57 billion. Solana and BSC are in a tight race for second place, with TVLs of $6.35 billion and $5.61 billion, respectively. The market downturn has impacted all chains, with most experiencing a slight decrease in TVL over the past week. However, the overall ecosystem remains resilient, with no major chain outages or disruptions.

Looking Ahead

Key Catalysts to Watch

The market is currently in a state of flux, with several key catalysts that could influence its direction in the coming weeks. The ongoing debate around DeFi centralization, the increasing institutional adoption of crypto, and the development of new and innovative DeFi protocols will all play a role in shaping the future of the market. Investors should keep a close eye on these developments and position themselves accordingly.

Market Outlook

The short-term outlook for the market is bearish, with the recent correction likely to continue in the near term. However, the long-term fundamentals of DeFi remain strong, and the current downturn could present a buying opportunity for savvy investors. The increasing institutional adoption of crypto, the growth of the RWA market, and the development of new and innovative DeFi protocols are all positive signs for the long-term health of the ecosystem.

About portals.fi : portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.