Portals DeFi Weekly - January 16, 2026

Market Pulse

- Total Market Cap: $3.317T (-0.7%)

- DeFi TVL: $128.93B (-0.79%)

- 24h Volume: $121.76B

- Fear & Greed: 30 (Fear)

- BTC Dominance: 57.5%

Summary

The market experienced a slight pullback this week, with the total market cap declining by 0.7% to $3.317 trillion. DeFi TVL also saw a minor correction, down 0.79% to $128.93 billion. Despite the short-term dip, the broader trend remains positive, with Bitcoin up 5.5% and Ethereum up 6.7% over the past seven days. Market sentiment holds steady in "Fear" territory at 30, while Bitcoin dominance remains elevated at 57.5%. Ethereum gas fees continue to be exceptionally low at 0.101 Gwei, providing an opportune environment for on-chain activity and DeFi participation.

The Yield Market Pulse

The yield market is responding to the renewed capital inflows, with stablecoin yields on tier-1 protocols remaining a reliable anchor for portfolios. Rates for top-tier lending and stablecoin vaults are holding steady in the 3.4% to 5.1% APY range. The record-high Ethereum staking activity is putting a supply squeeze on liquid ETH, which could support LST and LRT yields in the coming weeks. With the market sentiment improving, we may see a greater appetite for risk, potentially driving up yields on more volatile assets.

Top Opportunities This Week

We have identified the following top-tier, sustainable yield opportunities for this week.

Maple USDC (Syrup): A lending opportunity on Ethereum with a solid 5.10% APY and a massive $2.68B in TVL. Maple's institutional-grade lending pools provide consistent yields backed by overcollateralized loans.

Ethena sUSDe: Ethena's staked USDe vault on Ethereum offering 4.92% APY with $7.29B in protocol TVL. The yield is generated through delta-neutral strategies using ETH staking and perpetual futures funding rates.

Sky sUSDS: The savings rate vault from Sky (formerly MakerDAO) on Ethereum with a 4.00% APY and $6.79B in protocol TVL. A battle-tested stablecoin savings option with one of the longest track records in DeFi.

Aave V3 USDC: A conservative lending option on Ethereum with a 3.41% APY and an enormous $35.39B in total protocol TVL. Aave remains the gold standard for decentralized lending with extensive audits and a proven security track record.

ether.fi eETH: A liquid staking opportunity on Ethereum with a 2.54% APY and $9.59B in TVL. ether.fi offers non-custodial staking with the added benefit of restaking rewards through EigenLayer integration.

DeFi News

This week saw major developments in regulation, institutional adoption, and on-chain activity, painting a complex but ultimately bullish picture for the DeFi ecosystem.

Crypto Bill Collapse Seen as a Win for DeFi

The DeFi community largely viewed the collapse of the Senate Banking Committee's crypto market structure bill as a positive development. Industry leaders, including Ether.fi founder Mike Silagadze, argued that the proposed legislation was overly restrictive and would have stifled innovation, particularly by limiting stablecoin yields. While the bill's failure provides short-term relief, the expectation is that a more refined and collaborative version will be negotiated in the future.

Crypto Bill Collapse Seen as a Win for DeFi

The DeFi community views the collapse of the crypto bill as a win, not a setback, as it removes the threat of overly restrictive regulations for now. The bill's failure provides a temporary reprieve, allowing the industry to continue innovating without the immediate pressure of a new, potentially burdensome regulatory framework.

Ethereum Staking Reaches New All-Time High

Ethereum staking has reached a new all-time high, with 35.9 million ETH (29.6% of the total supply) now staked. This indicates strong long-term confidence in the Ethereum network and its future upgrades. The increasing amount of staked ETH also contributes to the network's security and stability.

Tom Lee's Bitmine Becomes a Major ETH Staker

Tom Lee's Bitmine has staked over $600 million in ETH, now controlling over 1% of the total supply. This significant investment from a major player highlights the growing institutional interest in Ethereum staking as a source of yield and a long-term investment.

Fireblocks Acquires TRES for $130M

Fireblocks has acquired crypto accounting platform TRES for $130 million. This acquisition will bolster Fireblocks' tax compliance and accounting infrastructure, providing institutional clients with a more comprehensive suite of tools for managing their digital asset operations.

South Korea Legalizes STOs

South Korea has legalized Security Token Offerings (STOs), opening up new avenues for tokenized assets in the country. This move is expected to attract significant investment and drive innovation in the Korean crypto market.

Polygon Plans to Acquire Coinme for $100-125 Million

Polygon is planning to acquire Bitcoin ATM provider Coinme for a valuation between $100 million and $125 million. This move signals Polygon's intent to expand its reach into the physical crypto infrastructure space and broaden its user base.

The State of the Chains

DeFi TVL currently stands at $128.927 billion, experiencing a minor 0.79% correction in the past 24 hours. Despite the short-term dip, the broader trend remains positive with most major chains showing strong weekly gains. Ethereum continues to dominate the landscape with approximately 58% market share.

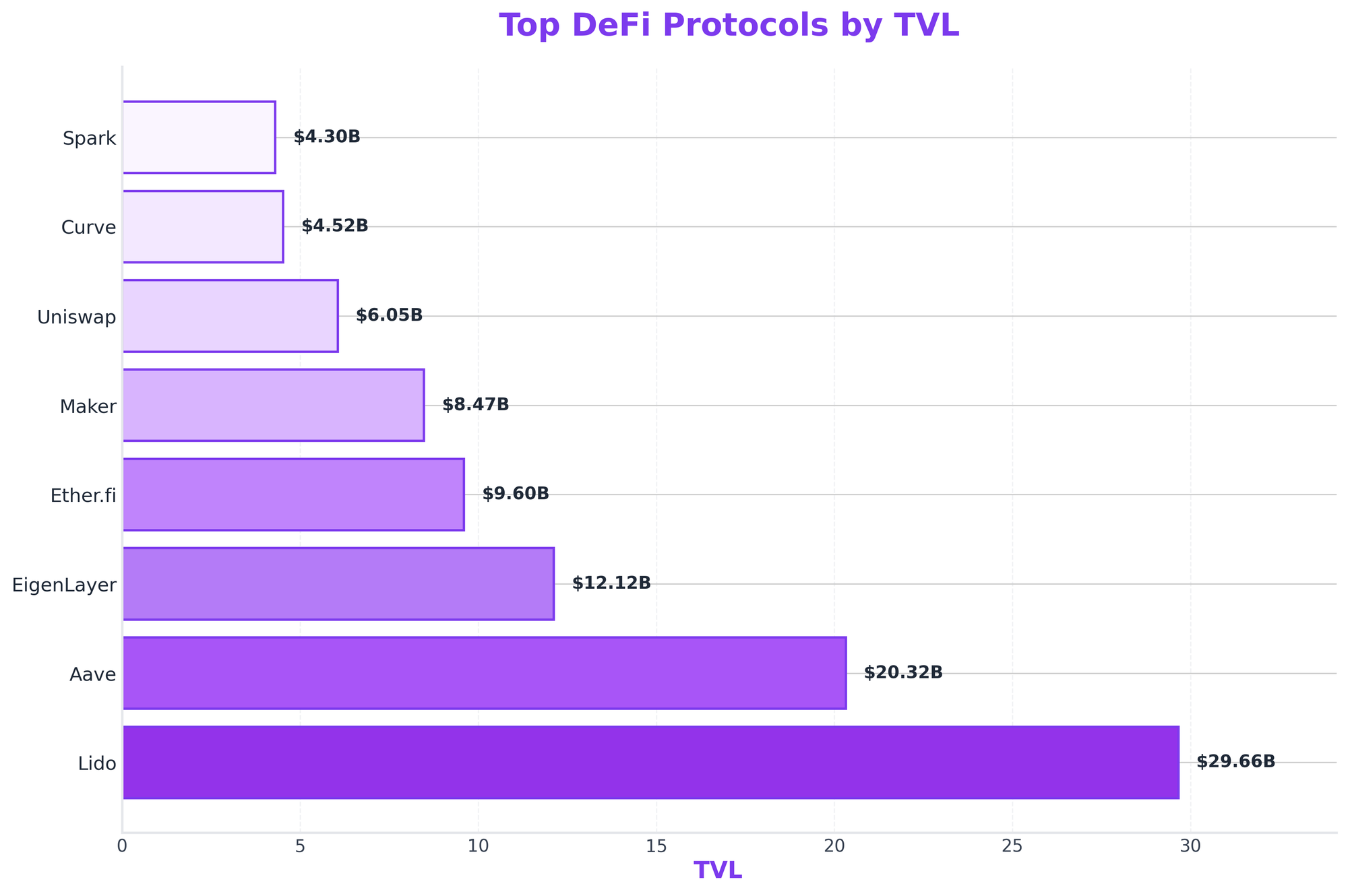

Top DeFi Protocols by TVL

Chain Performance Analysis

- Ethereum: Ethereum's TVL surged by an impressive 5.33% over the past week to $74.985 billion, reinforcing its position as the undisputed leader with approximately 58% of the total DeFi market share. The network's active addresses remain high at 1.25 million, and it continues to generate the most fees.

- Bitcoin: The Bitcoin ecosystem's DeFi TVL increased by 5.99% to $7.398 billion, demonstrating continued growth in its DeFi capabilities.

- BSC: BSC saw its TVL rise by 5.08% to $7.13 billion and maintains a very high number of active addresses at 2.94 million.

- Base: Base has been a standout performer, with its TVL growing by an impressive 9.05% over the week to $5.147 billion. This growth highlights its increasing adoption as a leading Layer 2 solution.

Portals.fi Platform Updates

Our team has been hard at work expanding the capabilities of the Portals.fi platform. Here are the key updates with exciting stuff coming soon:

New Edition #2 of the Developer newsletter coming out next week, loaded with in-depth updates of what's new and coming up with the Portals.

Subscribe to Dev Newsletter: https://build.portals.fi/?newslettersignup=true

Preview the edition #1: https://www.blog.portals.fi/portalsfi-dev-update-december-edition/

- The Portals Explorer has received numerous refinements to improve user experience, data presentation for yield opportunities, and tracking for deposits and withdrawals.

- ERC-4626 Indexer: Our generic indexer for the ERC-4626 tokenized vault standard is in its final stages of development.

- The DeFi Drop Podcast by Portals keeps growing! Who would you like to see next on The DeFi Drop? New Episodes coming next week featuring Superform Labs and Ipor Fusion

Looking Ahead

Market Outlook

Ethereum staking reaching an all-time high of 35.9 million ETH (nearly 30% of supply) demonstrates strong conviction from long-term holders. The entry of major custodian banks like State Street and BNY Mellon into digital assets this week signals that institutional infrastructure is rapidly maturing. With DeFi protocols now dominating fee generation over base-layer blockchains, the sector is proving its value proposition as a revenue-generating layer of the crypto economy.

Key Catalysts to Watch

- US Crypto Legislation: The delayed Senate vote on the crypto market structure bill will be a key focus. The DeFi community is advocating for provisions that protect innovation while addressing legitimate regulatory concerns. Expect continued lobbying efforts and potential revisions to the bill in the coming weeks.

- Institutional Onboarding: State Street's new digital asset platform and BNY Mellon's tokenized deposit service are now live. Watch for announcements of institutional clients utilizing these services, which could drive significant new capital into the ecosystem.

- ETH Supply Dynamics: With the staking queue at 2.5 million ETH and the unstaking queue at zero, the supply squeeze on liquid ETH could intensify. This may create favorable conditions for LST and LRT protocols and potentially support ETH price action.

- Security Posture: The recent Trubit (8,535 ETH) and Fusion Arbitrum ($336K USDC) exploits are reminders to prioritize security. Users should verify audit status and consider protocol track records before depositing funds.

- Asian Market Expansion: Indonesia's second crypto exchange license and South Korea's STO legalization signal growing regulatory acceptance in Asia. These markets could become significant drivers of DeFi adoption in 2026.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.