Portals DeFi Weekly - January 23, 2026

Welcome to the Portals DeFi Weekly, your weekly dose of the latest insights and analysis in DeFi.

Market Pulse

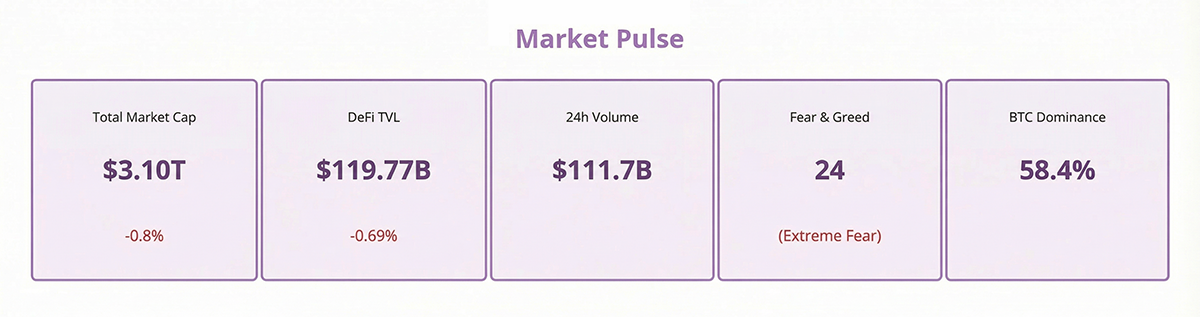

- Total Market Cap: $3.10T (-0.8%)

- DeFi TVL: $119.77B (-0.69%)

- 24h Volume: $111.7B

- Fear & Greed: 24 (Extreme Fear)

- BTC Dominance: 58.4%

Summary

The market experienced a notable correction this week, with sentiment plunging from "Neutral" (49) last week to "Extreme Fear" (24) today. The total market cap stands at $3.10 trillion, down approximately 0.8% over the past 24 hours. DeFi TVL has contracted to $119.77 billion, representing a 7-8% decline across most major chains over the past seven days.

This week's downturn was driven by several converging factors: geopolitical tensions escalated as:

- U.S. President Trump threatened European nations with tariffs over the Greenland dispute.

- Pushing gold to a new all-time high above $4,700/oz while risk assets sold off.

- The anticipated Clarity Act legislation stalled after Coinbase unexpectedly withdrew support.

- Fed rate cut expectations were pushed back, with consensus now pointing to September at the earliest.

- ETF outflows resumed with -$74.2M in 24h flows.

The resulting market rout triggered approximately $1.07 billion in liquidations, with Bitcoin falling for six consecutive sessions, its longest losing streak since November 2024.

Despite the short-term weakness, Bitcoin dominance has increased to 58.4%, indicating a flight to relative safety within the crypto ecosystem. On-chain data shows institutional players like BitMine Immersion continuing to accumulate ETH (over $100M purchased this week) and Strategy adding $2.13B in BTC, suggesting smart money may be viewing this correction as an opportunity rather than a cause for concern.

DEX volumes remain robust at $15.7 billion daily, with weekly volumes up 31.9% despite the price correction. This elevated trading activity during a downturn indicates active portfolio rebalancing rather than capitulation. Ethereum gas fees remain exceptionally low at 0.071 Gwei, providing an opportune environment for on-chain activity and DeFi participation.

The Yield Market Pulse

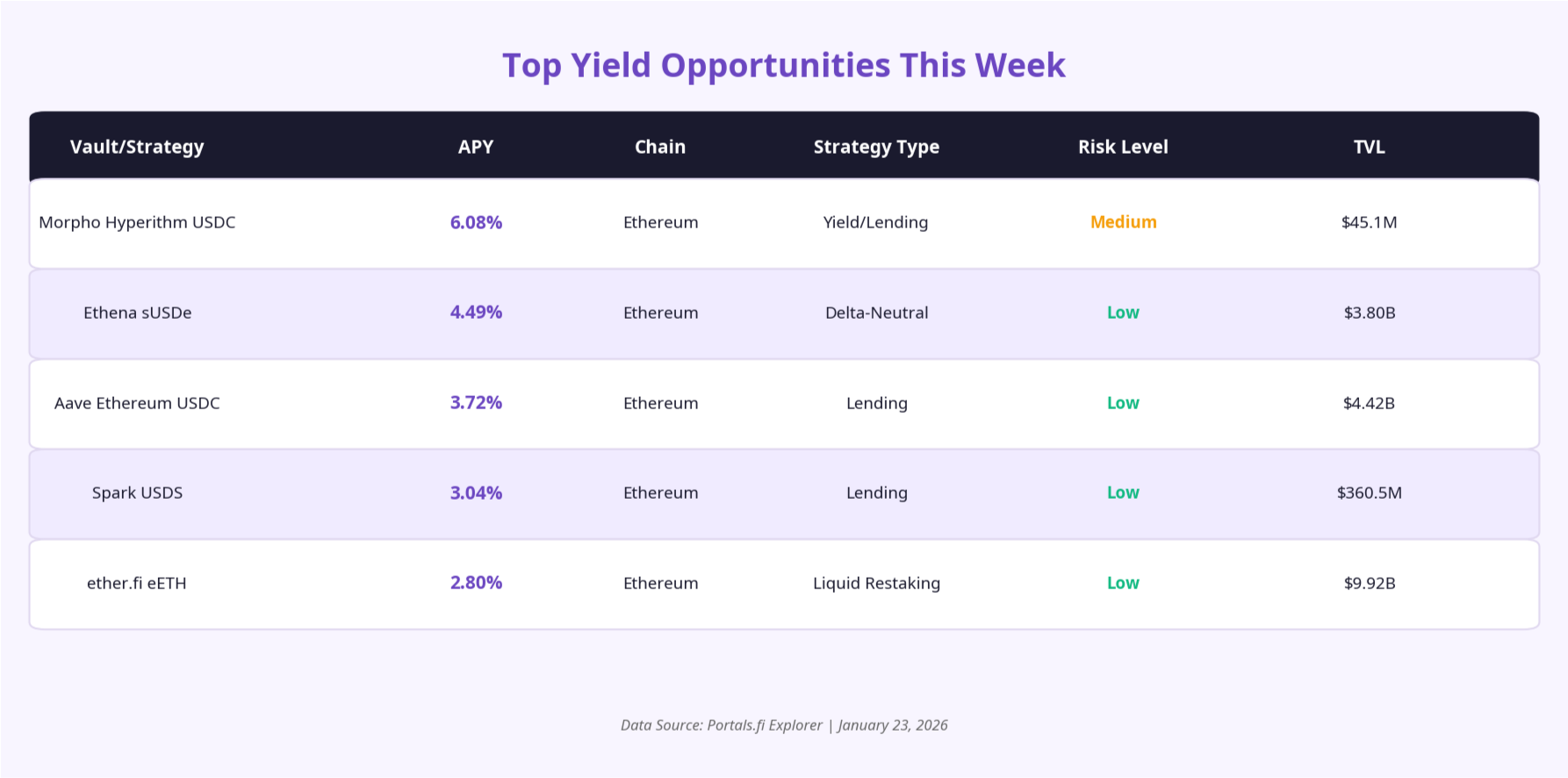

The yield landscape this week reflects the broader market correction, with stablecoin yields remaining relatively stable while risk-adjusted opportunities become more attractive for patient capital. Despite the sentiment, top-tier stablecoin vaults continue to offer yields in the 3.0% to 6.1% APY range, providing a reliable anchor for portfolios during volatile periods.

Top Opportunities This Week

We have identified the following top-tier, sustainable yield opportunities for this week. All opportunities have been verified for credibility, sustainability, and risk profile.

Morpho Hyperithm USDC: A yield-optimized lending vault on Ethereum offering 6.08% APY with $45.1M in TVL.

Ethena sUSDe: Ethena's staked USDe vault on Ethereum offers 4.49% APY with $3.80B in protocol TVL. The yield is generated through delta-neutral strategies using ETH staking and perpetual futures funding rates.

Aave Ethereum USDC: The flagship USDC lending pool on Aave V3 with 3.72% APY and $4.42B in TVL. Aave remains the gold standard for decentralized lending with extensive audits, a proven security track record, and $168.64M in daily volume demonstrating deep liquidity.

Spark USDS: A lending opportunity on Spark Protocol (Sky ecosystem) offering 3.04% APY with $360.5M in TVL.

ether.fi eETH: The leading liquid restaking protocol on Ethereum with 2.80% APY and $9.92B in TVL. ether.fi offers non-custodial staking with the added benefit of EigenLayer restaking rewards, providing enhanced yield potential compared to traditional liquid staking.

DeFi News

This week brought significant developments across DeFi governance, security incidents, and institutional infrastructure, highlighting both the sector's growing maturity and ongoing challenges.

Geopolitical Relief

The primary driver of the week's volatility was the U.S. President's threat of tariffs on European nations as part of a bid for Greenland, which caused an initial selloff on Tuesday. Markets rebounded sharply after he softened his stance on Wednesday, leading to two consecutive days of gains for major U.S. indexes.

World Economic Forum Discusses Crypto Regulation

The World Economic Forum in Davos featured ongoing discussions about global crypto regulation and institutional adoption this week. In the US, debate continues over a crypto market structure bill, with an advocacy group lobbying against current proposals, particularly concerning provisions for DeFi and stablecoins.

DeFi Lending Share of TVL Reaches 21.3%

The lending protocols now account for 21.3% of total DeFi TVL, up from 16.6% in January 2025. This increase reflects the growing importance of lending and borrowing protocols within the DeFi ecosystem, with Aave leading the sector at $33.17B in TVL.

Security Incidents: Saga and Makina Exploited

Two significant exploits occurred this week. Saga's SagaEVM chain was hit by a $7 million exploit on January 21, forcing the Layer-1 protocol to temporarily pause operations. The attack involved an "infinite mint and dump" technique through coordinated contract deployments.

Separately, Makina Finance lost $4.2 million in a flash loan price oracle attack on January 19, with 1,299 ETH drained. In a positive development, an MEV builder returned approximately 920 ETH (~$2.7M) to Makina's recovery wallet.

Chainlink Acquires Atlas to Expand MEV Recapture

Chainlink has acquired Atlas from FastLane to expand its oracle-based MEV recapture protocol, Chainlink SVR. The deal includes intellectual property and core personnel, with SVR now live on Arbitrum, Base, BNB Chain, Ethereum, and HyperEVM.

Ethereum Transactions Hit All-Time High Amid Address Poisoning Surge

Ethereum daily transactions reached an all-time high of 2.8+ million on January 16, 2026, with new addresses created in the past 30 days topping 12.6 million, the highest rolling 30-day total ever. However, security researchers revealed that much of this activity was driven by mass address poisoning attacks.

The State of the Chains

Total DeFi TVL stands at $119.48 billion, down 0.93% over the past 24 hours. The weekly correction has been broad-based, with most major chains experiencing 5-12% TVL declines as the market digests geopolitical uncertainty and shifting rate expectations. Despite the pullback, monthly trends remain positive for several chains, indicating that the current correction is occurring within a broader uptrend.

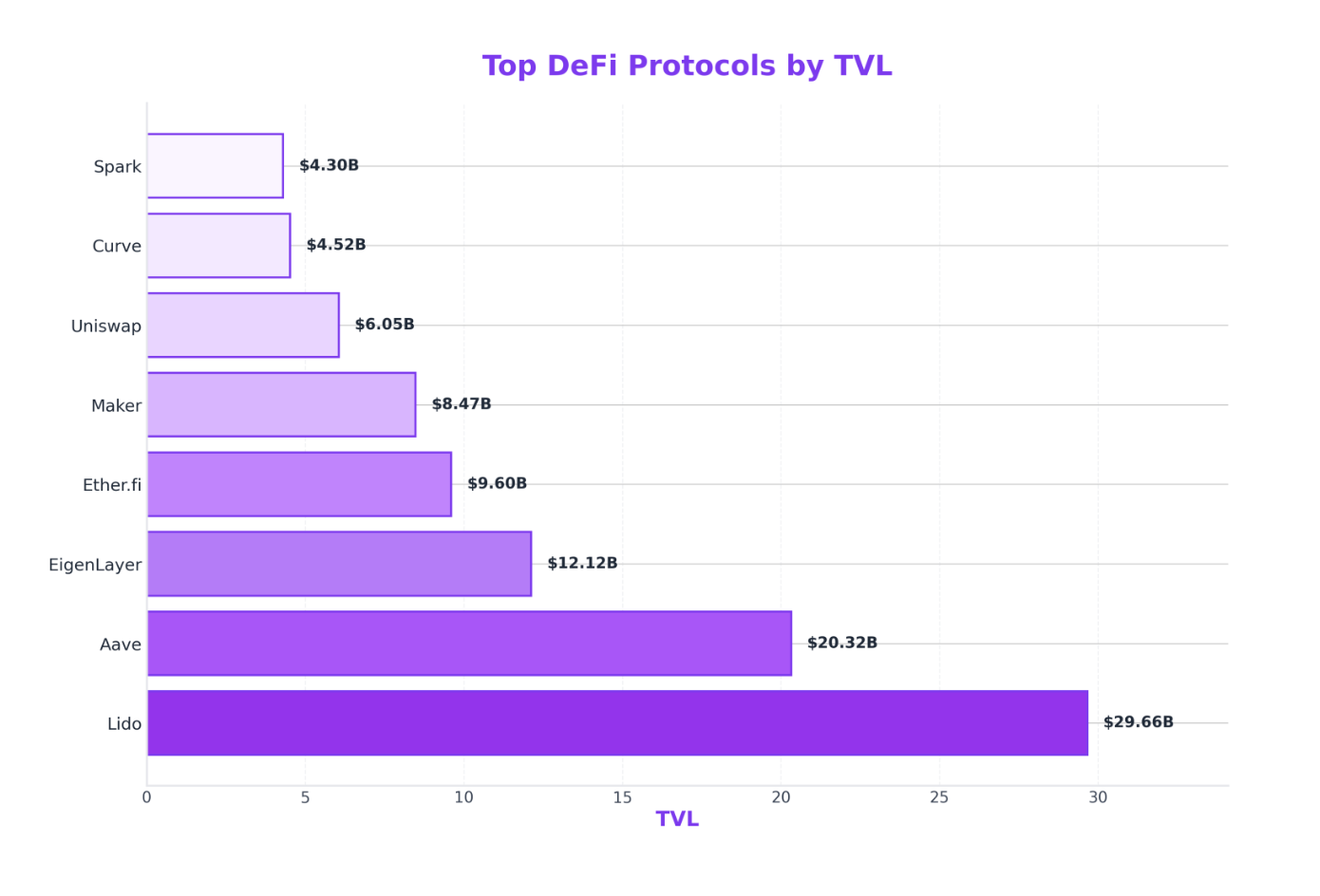

Top DeFi Protocols by TVL

- Aave maintains its dominant position with $33.17B in TVL across 18 chains, despite an 8.19% weekly decline. The protocol's cumulative loan issuance is approaching $1 trillion, cementing its status as the backbone of DeFi lending.

- Ethena stands out as the only top-10 protocol with positive weekly performance (+0.77%), demonstrating resilience in its delta-neutral synthetic dollar strategy during market volatility.

- Morpho shows exceptional monthly growth (+16.43%), reflecting strong demand for its yield-optimized lending vaults as users seek enhanced returns on stablecoin deposits.

- ether.fi experienced the steepest weekly decline (-14.41%) among top protocols, likely due to ETH price weakness amplifying the TVL drawdown in liquid restaking positions.

Chain Performance Analysis

- Ethereum continues to dominate with 57.8% of total DeFi TVL ($69B), though it experienced a 7.85% weekly decline. The chain hosts 1,695 protocols and maintains the largest stablecoin market cap at $163B. Notably, Ethereum's DEX volume ($1.87B) is lower than Solana's despite its larger TVL, reflecting different user behavior patterns.

- Tron is the only major chain with positive weekly performance (+2.82%), benefiting from its dominant position in stablecoin transfers and the JustLend ecosystem. The chain's $4.81B TVL is supported by $84.4B in stablecoin market cap.

- Base shows the strongest monthly growth (+11.51%) among major chains, continuing its trajectory as the fastest-growing L2 ecosystem. The Coinbase-incubated chain now hosts 810 protocols with $4.88B in TVL.

- Arbitrum experienced a significant 9.27% weekly decline, though it maintains the largest protocol count among L2s with 1,026 deployed applications. The chain's $2.86B TVL positions it as the third-largest L2 behind Base and Plasma.

Portals Platform Updates

New Edition #2 of the Developer newsletter is coming soon, with in-depth updates of what's new and coming up with the Portals.

Subscribe to Dev Newsletter if you haven't already: https://build.portals.fi/?newslettersignup=true

Preview the edition #1: https://www.blog.portals.fi/portalsfi-dev-update-december-edition/

Additionally, this week on The DeFi Drop Podcast by we were pleased to host HyperNest and Superform. Episodes are out now, and you can watch full segment here. More coming next week.

Looking Ahead

Market Outlook

While the short-term correction has been driven by geopolitical tensions and regulatory uncertainty, several macro tailwinds are emerging. December's Core CPI printed at 2.6% YoY, below market expectations, reinforcing the view that inflationary pressures continue to moderate. This softer inflation data has been well-received across both equities and crypto, though the Federal Reserve is widely expected to maintain its current policy stance.

The Fed's January 27-28 FOMC meeting will be the week's most significant macro event. According to a Reuters poll, 100% of economists expect rates to hold steady at 3.50%-3.75%, with 58% forecasting no change through March. Rate cuts are not anticipated until at least June, meaning risk assets will need to find support from factors other than monetary easing in the near term.

Despite the challenging sentiment environment, on-chain fundamentals remain constructive. DEX volumes surged 31% weekly to $89 billion, indicating active portfolio rebalancing rather than capitulation. DeFi applications continue to capture an increasing share of industry revenue relative to underlying blockchains, suggesting the sector's value proposition is strengthening even during market stress.

Key Catalysts to Watch

Federal Reserve Rate Decision (January 27-28)

The FOMC meeting will set the tone for risk assets heading into February. While no rate change is expected, market participants will scrutinize Chair Powell's commentary for signals about the timing of future cuts. Any hawkish surprise could extend the current correction, while dovish language may provide relief for oversold crypto assets.

Bitcoin ETF Flow Reversal Watch

U.S. spot Bitcoin ETFs recorded $1.22 billion in weekly outflows—the largest since November 2024. Historically, such significant outflow spikes have often coincided with local price bottoms and preceded rebounds. With 2026 ETF flow projections ranging from $15-50 billion according to various analysts (Galaxy being most bullish), any stabilization or reversal in flows could signal renewed institutional appetite.

Ethereum Upgrade Momentum

Following the recent Fusaka upgrade, which sparked an activity spike (though JPMorgan analysts doubt it will last), Ethereum's roadmap continues to advance. The Glamsterdam upgrade is expected in H1 2026, followed by Hegota in H2 2026. Meanwhile, Vitalik Buterin's advocacy for DAO redesign to be more robust and manipulation-resistant could drive governance innovation across the ecosystem.

Regulatory Clarity Progress

Senate Banking Committee Chairman Boozman has announced new market structure legislation with a business meeting scheduled. While the Clarity Act remains stalled following Coinbase's withdrawal of support, the ongoing legislative efforts suggest progress toward a comprehensive crypto regulatory framework. Any positive developments could provide a significant sentiment boost for DeFi protocols.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.