Portals DeFi Weekly - January 30, 2026

Welcome to the Portals DeFi Weekly, your weekly dose of the latest insights and analysis in DeFi.

Market Pulse

- Total Market Cap: $2.90T (+4.1%)

- DeFi TVL: $115.63B (-5.12%)

- 24h Volume: $215.25B

- Fear & Greed: 16 (Extreme Fear)

- BTC Dominance: 57.0%

Summary

The market experienced one of its most volatile weeks of 2026, culminating in a $1.68 billion liquidation cascade that sent Bitcoin to a two-month low of $81,000 before a sharp recovery. As of January 30, the total market cap stands at $2.90 trillion, up 4.1% in the past 24 hours as prices rebound from oversold conditions.

The week's turmoil was caused by a perfect storm of factors. Leverage concentration across derivatives markets reached unsustainable levels, with funding rates persistently positive for weeks as traders piled into long positions. When prices began to slip, margin calls triggered a self-reinforcing liquidation cascade. Hyperliquid alone accounted for approximately $598 million in forced closures, with 94% of liquidated positions being longs. Bybit followed with $339 million and Binance with $181 million.

Institutional outflows compounded the selling pressure. U.S. spot Bitcoin ETFs recorded net outflows of approximately $818 million on January 29 alone the third consecutive day of redemptions. ETF outflows reached $975.7 million in the past 24 hours, removing a critical source of buy-side liquidity from the market.

Adding to the uncertainty, speculation about the next Federal Reserve chair rattled risk assets broadly. Reports suggesting the incoming chair might adopt a more hawkish stance triggered a flight to safety, with gold hitting new highs while Bitcoin and equities sold off in tandem.

Despite the carnage, several constructive signals are emerging. DeFi TVL stands at $115.63 billion, down 5.12% in 24 hours but showing resilience relative to the magnitude of the price decline. Perps volume surged 10.99% weekly to $230.9 billion, indicating active volatility trading rather than capitulation. Ethereum gas fees remain exceptionally low at 0.268 Gwei, providing an opportune environment for on-chain activity.

Perhaps most notably, Solana is outperforming with TVL up 8.99% daily and 12.24% weekly, a contrast to Ethereum's 6.65% daily decline. This divergence suggests capital rotation within DeFi rather than wholesale exodus from the ecosystem.

The Yield Market Pulse

The yield market is demonstrating remarkable resilience amid this week's volatility, with stablecoin yields on tier-1 protocols actually increasing as lending demand surges during the correction. Aave Ethereum USDC yields have risen to 4.35% APY (up from 3.72% last week), reflecting heightened borrowing activity as traders seek leverage or hedge positions.

Top Opportunities This Week

We have identified the following top-tier, sustainable yield opportunities for this week, from Portals:

Morpho Hyperithm USDC: The highest-yielding stablecoin opportunity at 6.08% APY with $1.655B in TVL. Morpho's optimized lending markets continue to attract capital seeking enhanced returns through efficient rate matching.

Maple Syrup USDC: Institutional-grade lending on Ethereum offering 5.41% APY with $1.46B in market cap. Maple's overcollateralized loan pools provide consistent yields backed by vetted institutional borrowers.

Ethena sUSDe: The delta-neutral stablecoin vault maintains a solid 4.53% APY with $3.79B in TVL. Ethena generates yield through ETH staking and perpetual futures funding rates, remaining stable even during this week's volatility.

Aave Ethereum USDC: The gold standard for decentralized lending now offers 4.35% APY (up 0.63pp from last week) with $4.26B in TVL. The yield increase reflects higher borrowing demand during the market correction.

Yield Tip of the Week

"Volatility is yield's best friend." During market corrections, lending rates typically spike as traders seek leverage or need to manage positions. This week's Aave USDC yield increase from 3.72% to 4.35% demonstrates this dynamic.

DeFi News

This week marked a pivotal moment for crypto regulation and institutional adoption, with significant developments on Capitol Hill, record ETF outflows, and continued progress in real-world asset tokenization.

Crypto Market Structure Bill Advances in Senate

The U.S. Senate Agriculture Committee formally advanced the Digital Asset Market Clarity Act on January 29, marking the first time crypto legislation has progressed this far in the Senate. The bill passed 12-11 on a party-line vote, with Republicans pushing forward despite unified Democratic opposition.

Record ETF Outflows Signal Institutional Repositioning

U.S.-listed Bitcoin and Ethereum ETFs experienced their largest single-day outflows in months, with nearly $1 billion exiting on January 29 alone. BlackRock's IBIT led the exodus with $317.8 million in redemptions, followed by Fidelity's FBTC at $168 million and Grayscale's GBTC at $119.4 million.

For the week, Bitcoin ETFs recorded net outflows of approximately $1.82 billion, while Ethereum ETFs saw $455 million depart. This institutional repositioning coincided with Bitcoin's drop below $85,000 and a brief test of $81,000 support.

Tokenized Equities Approach $1 Billion Milestone

The tokenized equities market has crossed $963 million in value as of January 2026, representing a staggering 2,878% year-over-year increase from approximately $32 million in January 2025.

Vitalik Buterin Commits $43M to Ethereum's "Full-Stack Openness" Vision

Ethereum co-founder Vitalik Buterin announced today that he has personally withdrawn 16,384 ETH (~$43 million) to fund open-source security and privacy projects. The allocation supports a broader "full-stack openness and verifiability" initiative spanning software, hardware, and emerging areas like biotech and public health.

Hyperliquid Becomes Precious Metals Trading Hub

Hyperliquid has emerged as a major venue for precious metals trading. Silver futures on the platform recorded over $1.25 billion in 24-hour volume this week, making it the third most active market after Bitcoin and Ethereum. Gold and silver liquidations subsequently spiked to $71 million on January 30, with approximately 3,200 users liquidated.

The HYPE token surged 24% as trading fees from these new markets flow into buybacks through Hyperliquid's Assistance Fund.

Security & Exploits

- Aperture Finance reported a vulnerability exploit in its V3/V4 contracts, leading to an estimated $3.67 million loss; front-end operations temporarily halted.

- Stream Finance suffered a $93 million loss, while a $16.8 million theft hit the SwapNet contract.

Product Launches & Protocol Upgrades

- Uniswap plans to launch an "Auction" tab by February 2 to support Continuous Clearing Auctions (CCA), allowing users to bid for tokens before official listing.

- Lido is introducing "stVaults" to enable L2s to create their own Ethereum staking rules.

- BNB Chain is set to receive a 40% speed boost through an upcoming Fermi upgrade.

Institutional Moves & Funding

- Mastercard is reportedly acquiring crypto startup ZeroHash for $2 billion, a significant move into the stablecoin space.

- Bitwise established a Delaware statutory trust as an initial step toward launching a potential ETF linked to Uniswap.

- Valour received UK regulatory approval to offer yield-bearing crypto ETPs to UK retail investors via the London Stock Exchange.

Market Trends

- RWAs projected to surpass $50 billion in 2026 as financial institutions increasingly use them for yield products and on-chain settlement. RWAs have now surpassed DEXs to become the fifth-largest DeFi category by TVL.

- JustLend DAO on TRON has surpassed $6.71 billion in TVL.

- Paradex announced it will refund $650,000 to approximately 200 users after a maintenance glitch caused unexpected liquidations.

Portals Platform Updates

New January Edition #2 of the Developer newsletter is out, with in-depth updates including growth, recent releases and what's coming soon. Find more here.

Subscribe to Dev Newsletter if you haven't already: https://build.portals.fi/?newslettersignup=true

Additionally, this week on The DeFi Drop Podcast we were pleased to host Fensory. Coming out next week. Stay tuned to find who is next on the DeFi Drop. You can watch full segment of previous episodes here.

State of Chains

The DeFi landscape this week reflects the broader market correction, with total TVL standing at $115.69 billion, down 5.07% in 24 hours. However, beneath the surface, significant divergences are emerging between chains and protocols, revealing where capital is flowing during the turbulence.

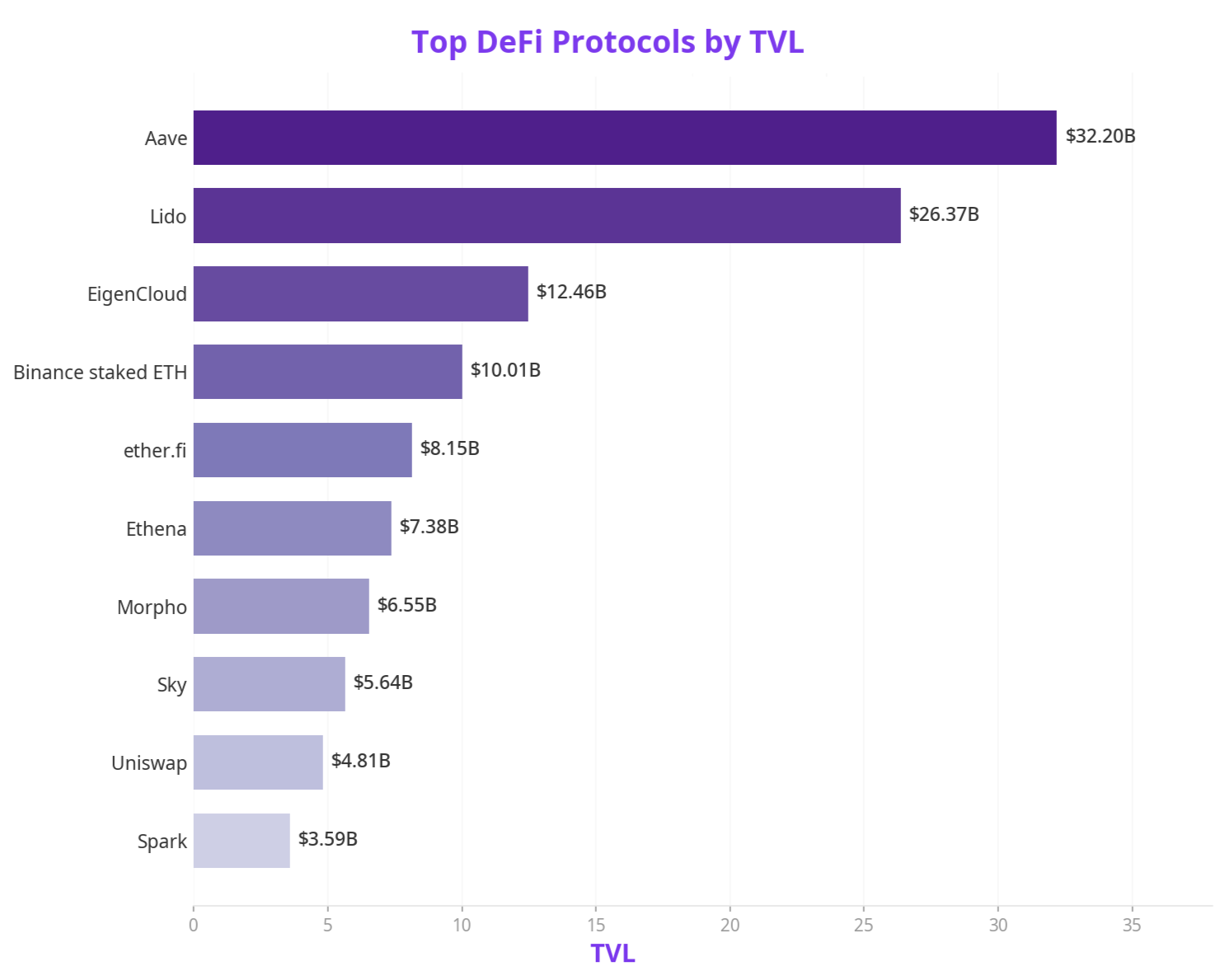

Top DeFi Protocols by TVL

Key Protocol Insights:

- Ethena continues to demonstrate remarkable stability, posting the smallest weekly decline among top-10 protocols at just -0.87%. Its delta-neutral strategy appears to be weathering the volatility well, with monthly TVL actually up 3.27%.

- Morpho is the standout performer with +12.57% monthly growth, benefiting from its optimized lending rates that become more attractive during volatile periods when borrowing demand spikes.

- Ondo Finance (not shown in top 10) deserves mention with an exceptional +38.56% monthly gain, reflecting the accelerating RWA narrative as tokenized equities approach $1 billion.

- ether.fi and Uniswap experienced the steepest weekly declines at -11.18% and -12.17% respectively, suggesting capital rotation away from liquid restaking and DEX liquidity during risk-off periods.

Chain Performance Analysis

- Solana is the clear winner this week, posting the only positive daily performance (+9.16%) among major chains and leading across all timeframes with +12.42% weekly and +16.85% monthly gains. The chain's DEX volume of $3.86B (24h) now rivals Ethereum's $1.98B, demonstrating its growing dominance in trading activity.

- Hyperliquid L1 shows interesting dynamics—despite an 11% daily decline, its weekly TVL is up 16.71%, driven by the precious metals trading surge that saw silver futures hit $1.25B in 24h volume.

- Bitcoin DeFi is struggling, down 11.22% weekly as the broader BTC price correction impacts wrapped Bitcoin protocols and BTCFi applications.

- Plasma and Tron are quietly outperforming with positive monthly momentum (+6.52% and +4.51% respectively), suggesting capital seeking stability in established, lower-volatility ecosystems.

Looking Ahead: Market Outlook and Key Catalysts to Watch

Market Outlook

The market enters February in Extreme Fear territory with the Fear & Greed Index at 16, its lowest reading since the 2022 bear market. However, contrarian indicators suggest this may represent a local bottom rather than the start of a deeper correction. The $1.68 billion in liquidations has largely cleared overleveraged positions, while the 4.1% market recovery on January 30 indicates buyers are stepping in at these levels.

Several macro factors will shape the coming weeks. The Fed's decision to hold rates at 3.5%-3.75% was expected, but Chair Powell's term expiring in May 2026 introduces uncertainty about future monetary policy direction.

Meanwhile, geopolitical tensions over Greenland and European tariff threats continue to push capital toward traditional safe havens like gold, which hit new all-time highs above $4,700/oz.

On the positive side, Solana's outperformance (+16.85% monthly) and Morpho's TVL growth (+12.57% monthly) demonstrate that capital is still flowing into high-conviction DeFi plays. The tokenized equities market approaching $1 billion and RWA protocols like Ondo Finance surging 38.56% monthly suggest institutional interest remains strong despite the broader correction.

Key Catalysts to Watch

- CLARITY Act Progress

Citi's latest report calls the CLARITY Act "the essential catalyst for advancing/legitimizing digital assets." While the Senate Agriculture Committee has advanced its version, the Banking Committee still controls the most contentious provisions around DeFi definitions and stablecoin yields.

- Uniswap Auction Tab Launch (February 2)

Uniswap plans to introduce a new "Auction" tab supporting the Continuous Clearing Auctions (CCA) protocol, allowing users to bid for tokens before official listing. This could reshape token distribution dynamics and provide early access opportunities for DeFi participants.

- Consensus Hong Kong 2026 (February)

One of the largest crypto events in Asia, Consensus Hong Kong will bring together industry leaders, regulators, and investors. Major announcements and partnership reveals are expected, potentially catalyzing renewed interest in Asian crypto markets.

- ETF Flow Reversal Watch

With $1.82 billion in weekly BTC ETF outflows (the largest since November 2024), institutional positioning is at a critical juncture. Historically, extreme outflow periods have preceded local price bottoms. A reversal in ETF flows would signal renewed institutional confidence and could trigger a relief rally.

Stay informed, stay cautious, and as always DYOR.

About Portals: Portals is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.