Portals.fi DeFi Weekly - December 11, 2025

Market Pulse

- Total Market Cap: $3.16 Trillion (24h: -2.2%)

- DeFi TVL: $120.64 Billion (24h: -2.76%)

- BTC Dominance: 56.91%

- Gas (ETH): ~0.136 Gwei

- Sentiment: Fear & Greed Index: 29 (Fear)

This week, the market has experienced a continued downturn, with the total market cap falling to $3.16 trillion. The DeFi sector has mirrored this trend, with the TVL dropping to $120.64 billion, a 2.76% decline. Bitcoin dominance remains robust at 56.91%, indicating a sustained preference for safety among investors amidst market uncertainty. The Fear & Greed Index, while slightly up to 29, remains firmly in the 'Fear' territory, reflecting a cautious market sentiment. Ethereum gas fees are notably low at 0.136 Gwei, signaling a slowdown in on-chain activity.

Summary

The broader market continues to navigate a period of consolidation and decline. The persistent 'Fear' sentiment, coupled with decreasing market capitalization and DeFi TVL, suggests that investors are exercising caution. While Bitcoin maintains its dominance, the overall market trend points towards a risk-off environment. The low Ethereum gas fees further underscore reduced speculative activity, indicating a market grappling with uncertainty and a lack of immediate bullish catalysts.

The Yield Market Pulse

The yield market is currently reflecting the broader cautious sentiment in DeFi. While exceptionally high APYs are less prevalent, there is a continued focus on sustainable and verifiable opportunities. Investors are prioritizing capital preservation and looking for yields from established protocols with strong security track records and substantial TVL.

Top Opportunities This Week

In the current market, we are focusing on a selection of sustainable and risk-managed yield opportunities. Here are the top picks from the Portals.fi:

- Morpho Gauntlet USDC Prime: A lending opportunity on Optimism with a 12.89% APY and a TVL of $22.54M. This presents a higher-yield option with a Low-Medium risk profile, suitable for those seeking enhanced returns within a managed risk framework.

- Syrup Finance: A stablecoin vault on Ethereum offering a 6.53% APY with a very large TVL of $1.54B. This opportunity indicates a high level of trust and stability, making it a reliable low-risk option for stablecoin holders.

- PT Ethena sUSDE (Feb 2026): A yield tokenization opportunity on Ethereum with a 5.61% APY and a TVL of $391.24M. This provides a low-risk option for yield exposure, leveraging the innovative Pendle protocol.

- Morpho Smokehouse USDC: A lending opportunity on Ethereum with a 5.58% APY and a TVL of $147.53M. This offers a solid yield with low risk, appealing to investors seeking consistent returns from a reputable lending platform.

- Ether.fi Liquid ETH: A liquid staking opportunity on Ethereum with a 2.78% APY and a massive TVL of $9.64B. This represents a conservative and highly liquid option for participants looking to earn yield on their ETH holdings with minimal risk.

DeFi News

This week in DeFi was marked by a mix of significant infrastructure upgrades, growing institutional adoption, and notable market movements. Here’s a comprehensive overview of the key developments:

Regulatory and Institutional Integration

- USDT Approved in Abu Dhabi: Abu Dhabi's digital asset regulator approved USDT (Tether) as an Accepted Fiat-Referenced Token (AFRT).

- DeFi Technologies Faces Securities Lawsuit: DeFi Technologies (DEFT) is facing a securities fraud class action lawsuit, with a deadline of January 30, 2026, for affected investors to seek lead plaintiff status.

- BlackRock's Spot Ethereum ETF Sees Outflow: BlackRock's spot Ethereum ETF experienced a significant outflow of $75.2 million on December 6, 2025, reflecting the ongoing volatility and shifting sentiment in the institutional crypto investment landscape

- SEC Discussions on DeFi Regulation: Citadel warned the SEC that a potential DeFi exemption from certain registration requirements, combined with equity tokenization, could create a "shadow" U.S. equity market. The SEC also halted approval of high-leverage ETFs over risk concerns, indicating a cautious and evolving regulatory stance towards DeFi.

Protocol and Platform Updates

- Ethereum's Fusaka Upgrade: Ethereum successfully implemented the Fusaka upgrade on December 3, 2025. This major upgrade aims to improve network efficiency and significantly reduce transaction fees, especially for Layer-2 (L2) networks. Key changes include increasing the block gas limit and introducing Peer Data Availability Sampling (PeerDAS) to support larger blob capacity, with the goal of driving L2 transaction costs down.

- Solana Ecosystem Developments: Solana's DeFi ecosystem is expanding with new asset integrations and increased accessibility. Figure Technology Solutions is minting $YLDS, a yield-bearing security backed by U.S. Treasuries, natively on Solana to enable real-world asset (RWA) utility.

- Ripple Upgrade: Ripple released a major upgrade to the XRP Ledger (XRPL) to boost stability and introduce new DeFi features, further expanding the capabilities of the network.

- Robinhood Integrates Arbitrum DEX: Robinhood has announced the integration of the Arbitrum DEX for its Wallet users, providing them with access to a wider range of DeX services and liquidity pools.

The State of the Chains

The multi-chain landscape continues to evolve, with Ethereum maintaining its dominant position while other chains like Solana and various Layer 2 solutions demonstrate significant activity and growth. The overall trend indicates a flight to quality and efficiency, with capital flowing towards established ecosystems and innovative solutions that address scalability and cost. Despite a general market downturn, specific chains are showing resilience and strategic development.

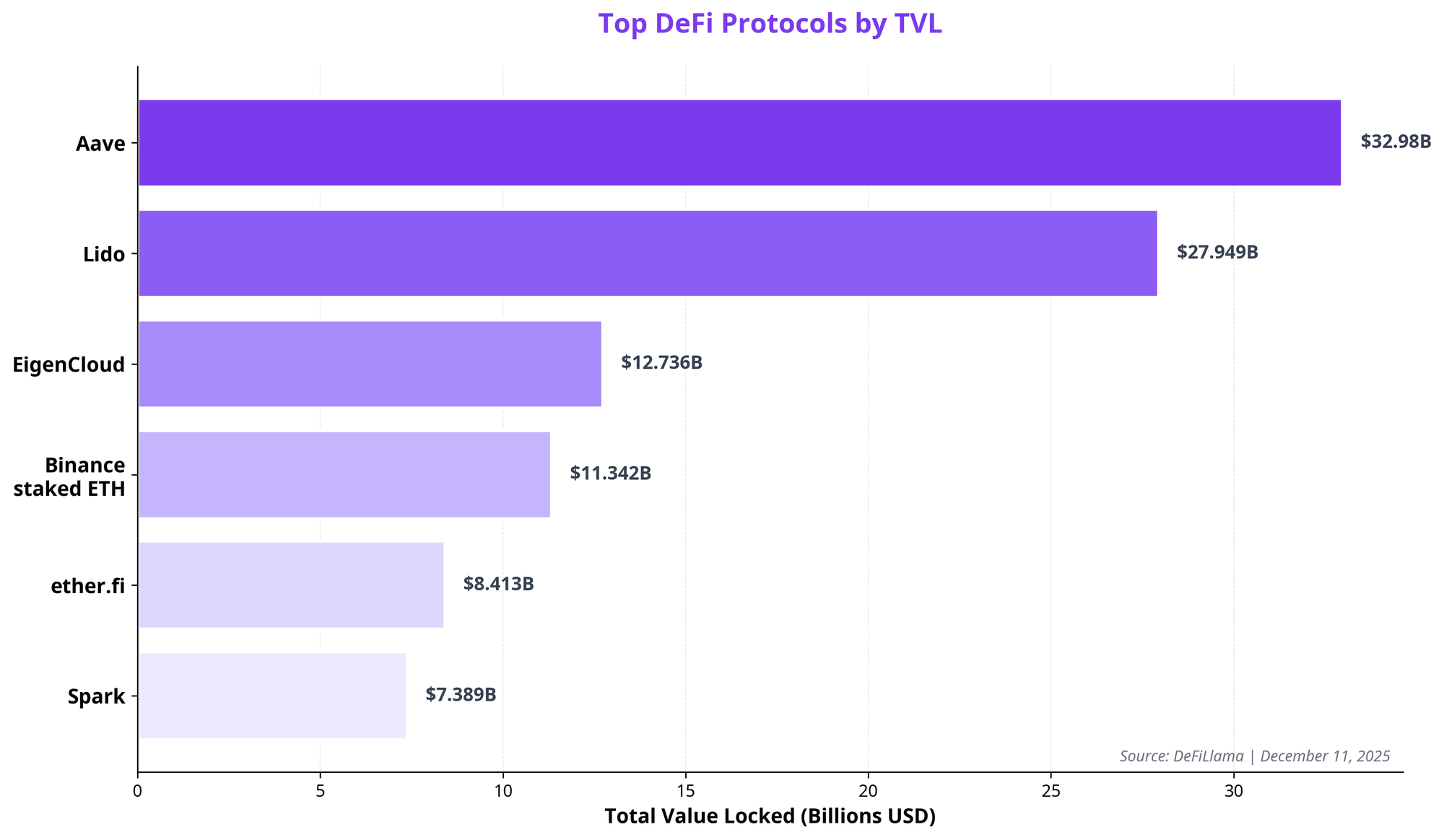

Top DeFi Protocols by TVL

Chain Performance Analysis

- Ethereum: As the foundational layer of DeFi, Ethereum continues to command the largest share of TVL, currently at $70.11B, representing 58.23% of the total DeFi market.

- Solana: Solana has shown remarkable resilience and growth, with a TVL of $8.734B and a 24-hour DEX volume of $4.015B, indicating high user activity.

- Layer 2 Solutions (Arbitrum, Optimism, Base): Layer 2 solutions continue to be critical for scaling Ethereum. Arbitrum has historically led in TVL among L2s. Base and Optimism are also demonstrating steady growth, with Base recording a TVL of $4.476B and a 24-hour DEX volume of $1.258B.

Portals.fi Platform Updates

Dev Newsletter

We’re launching our new developer newsletter, and I’d love to invite you to subscribe: here

You can also preview the #1 edition: https://www.blog.portals.fi/portalsfi-dev-update-december-edition/

ERC-4626 Vault Indexer

Instantly index vaults from protocols like Morpho, Fluid, Euler, and many other yield protocols the moment they're deployed. Give your users a first-mover advantage on the best yields!

Explorer Mobile PWA

Portals users can now add the Portals Explorer to their home screen as a true app, complete with drawer-based tooltips for touch UX. So, if you’re a protocol with your own positions, we’ve just broadened your reach.

The DeFi Drop Podcast by Portals.fi

This week, we featured Frax. Coming soon on The DeFi Drop Episode -> Aegis, and Rosetta. If you missed the previous episodes, the full segment is available here.

The DeFi Drop is a podcast by Portals.fi, 20-minute conversations with DeFi builders, vault curators, and protocol founders.

If you are building in DeFi and want to join us on a future episode, reach out via DM or Portals.fi We’d love to hear your story.

Extra:

- The tracking for cross-chain transactions has been improved

- Warp drive just got upgraded with more integrations

Looking Ahead

Market Outlook

The DeFi market is currently navigating a period of heightened caution and consolidation. While the overall sentiment remains in 'Fear' territory, the underlying infrastructure continues to strengthen with significant upgrades like Ethereum's Fusaka and growing institutional interest in tokenized assets. This suggests a maturing ecosystem that is building resilience despite short-term price volatility. We anticipate a continued focus on security, regulatory clarity, and real-world asset integration as key drivers for future growth.

Key Catalysts to Watch

- Institutional Adoption of Tokenized Assets: The increasing involvement of traditional finance giants like State Street and Galaxy Digital in tokenized funds is a powerful long-term catalyst. This trend is expected to bring substantial capital and legitimacy to the DeFi space.

- RWA Integration: Successful integration of tangible assets could unlock new liquidity and use cases, bridging the gap between traditional and decentralized finance.

- Ethereum Scalability and Efficiency: The Fusaka upgrade and ongoing developments in Layer 2 solutions will continue to enhance Ethereum's capacity and reduce transaction costs. This improved efficiency is crucial for attracting and retaining users, fostering broader adoption of DeFi applications.

- Regulatory Clarity: As the DeFi space matures, regulatory frameworks are evolving. Clear and supportive regulations could significantly boost investor confidence and accelerate institutional participation, while overly restrictive measures could stifle innovation.

- Market Sentiment Shift: A sustained period of stability or positive news could gradually shift the Fear & Greed Index towards 'Neutral' or 'Greed', potentially triggering a broader market recovery. Monitoring on-chain activity and social sentiment will be key indicators.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.