Portals.fi DeFi Weekly - December 19, 2025

Market Pulse

- Total Market Cap: $3.06 Trillion (24h: -0.8%)

- DeFi TVL: $118.77 Billion (24h: +1.86%)

- BTC Dominance: 57.5%

- Gas (ETH): ~0.107 Gwei

- Sentiment: 16, Extreme Fear

This week, the market has continued its downward trend, with the total market cap falling to $3.06 trillion, a 0.8% decrease in the last 24 hours. In contrast, the DeFi sector has shown some resilience, with the TVL at $118.77 billion. Bitcoin dominance remains high at 57.5%, indicating a continued preference for safety among investors. The Fear & Greed Index has dropped to 16, firmly in the 'Extreme Fear' territory, reflecting significant market anxiety. Ethereum gas fees are extremely low at 0.107 Gwei, signalling a continued slowdown in on-chain activity.

Summary

The market is currently in a state of contradiction. While the broader crypto market continues to decline, the DeFi sector is showing signs of life with a slight steadiness in TVL. This divergence could indicate that capital is rotating within the crypto ecosystem, with some investors moving from more speculative assets into DeFi protocols that offer yield-generating opportunities. The 'Extreme Fear' sentiment suggests that the market may be oversold, but the lack of significant buying pressure indicates that a bottom has not yet been established. The low gas fees on Ethereum further confirm the reduced on-chain activity, as users wait for a clearer market direction.

The Yield Market Pulse

The yield market is currently a tale of two cities. On one hand, the 'Extreme Fear' sentiment is driving a flight to quality, with investors seeking safety in established, low-risk protocols. On the other hand, the more adventurous are capitalizing on the market volatility to find high-yield opportunities in more nascent or riskier protocols.

Top Opportunities This Week

In the current market, we are focusing on a selection of sustainable and risk-managed yield opportunities. Here are the top picks based on our analysis of the most reliable and consistent protocols through Portals:

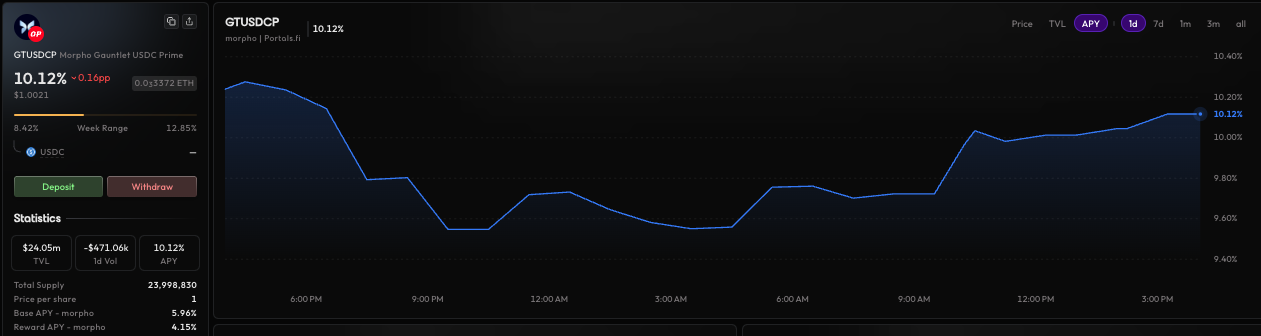

•Morpho Gauntlet USDC Prime: A lending opportunity on Optimism with a 10.12% APY. This presents a higher-yield option with a Low-Medium risk profile, suitable for those seeking enhanced returns within a managed risk framework.

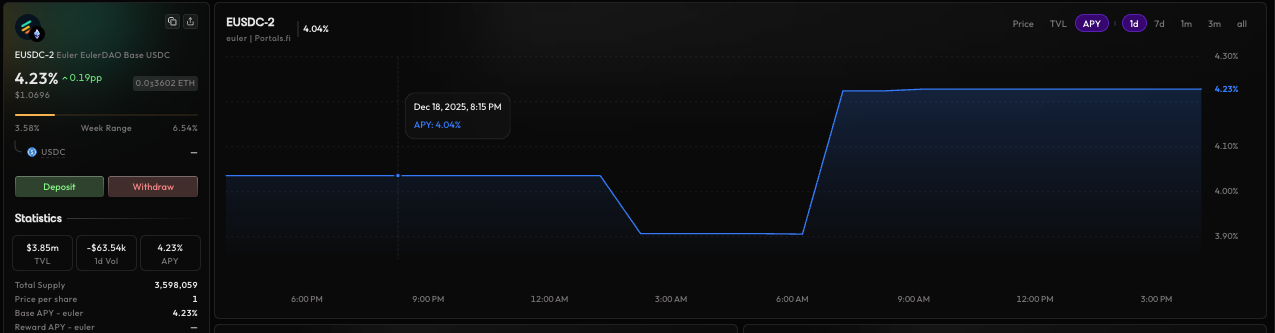

•Euler EulerDAO Base USDC: A lending opportunity on Arbitrum with an 4.23% APY. This is an established lending protocol with a strong TVL, offering a solid yield for a medium-risk tolerance.

•Syrup Finance: A stablecoin vault on Ethereum offering a 5.61% APY. With a massive TVL, this opportunity indicates a high level of trust and stability, making it a reliable low-risk option for stablecoin holders.

•PT Ethena sUSDE (Feb 2026): A yield tokenization opportunity on Ethereum with a 5.79% APY. This provides a low-risk option for yield exposure, leveraging the innovative Pendle protocol.

DeFi News

This week in DeFi was marked by a mix of significant regulatory developments, protocol updates, and market movements. Here’s a comprehensive overview of the key developments:

Regulatory and Institutional Integration

- SEC Drops Aave Investigation: In a major win for the DeFi, the US SEC has closed its multi-year investigation into the Aave Protocol without recommending enforcement action. This removes a significant regulatory overhang and provides a degree of clarity for other DeFi lending platforms.

- Bank of Japan Rate Hike: The Bank of Japan raised its interest rates to the highest level since 2008. While this was expected to be a risk-off event, the crypto market reacted positively, with Bitcoin rallying to $88,000. The crypto market is becoming increasingly decoupled from traditional macroeconomic trends.

Protocol and Platform Updates

- Ethereum's On-Chain Adoption Surges: Ethereum's on-chain activity has surged in 2025, driven by a combination of technological upgrades and macroeconomic tailwinds. The network now dominates 90% of the DeFi lending revenue, solidifying its position as the leading smart contract platform .

Market Performance and Key Movements

- Crypto Market Cap Hits Eight-Month Low: The global market cap has fallen to its lowest level in eight months, wiping out much of the gains from 2025. This clearly indicates the bearish sentiment that is currently gripping the market. Will it change?

- Bitcoin Outperforms S&P 500: Despite the recent downturn, Bitcoin is still up 7% since January 2025, outperforming the S&P 500, which is up 15% over the same period. This highlights the potential of Bitcoin as a long-term store of value, even in a bear market.

The State of the Chains

Summary

The multi-chain landscape continues to be dominated by Ethereum, but other chains are showing signs of life. Solana remains a strong contender, and Layer 2 solutions like Arbitrum and Optimism are gaining traction. The overall trend is a flight to quality, with capital flowing to established ecosystems with strong developer communities and a clear roadmap for the future.

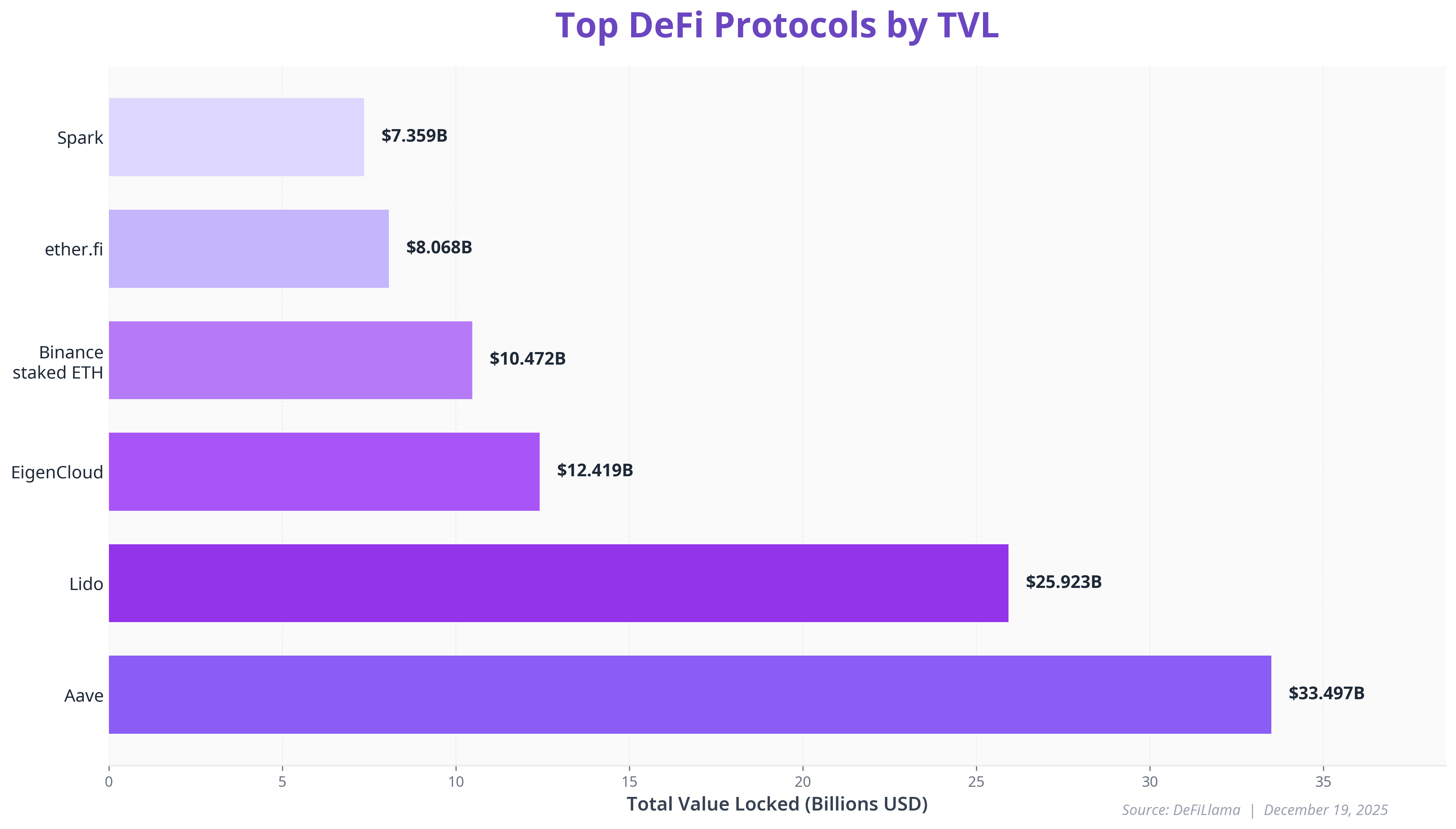

Top DeFi Protocols by TVL

Chain Performance Analysis

- Ethereum: As the foundational layer of DeFi, Ethereum continues to command the largest share of TVL, currently at $69.02B, representing 58.25% of the total DeFi market. Despite a slight decline in market share, its robust ecosystem and recent upgrades position it for long-term stability and growth.

- Solana: Solana has shown remarkable resilience, with a TVL of $8.52B and a 24-hour DEX volume of $3.27B, indicating high user activity. Its market share stands at 8.43%. The recent focus on RWAs and institutional adoption is a strong bullish catalyst for the ecosystem.

- Layer 2 Solutions (Arbitrum, Optimism, Base): Layer 2 solutions are becoming increasingly important for scaling Ethereum. Arbitrum has a market share of 2.81%, and Base has a TVL of $4.34B. These solutions are vital for providing faster and cheaper transactions, enhancing the overall user experience in DeFi.

- BSC: BSC maintains a significant presence with a TVL of $6.50B and a 24-hour DEX volume of $2.45B. Its lower transaction costs continue to attract a large user base, particularly for retail DeFi activities.

- Bitcoin: While primarily known as a store of value, Bitcoin's DeFi ecosystem is growing, with a TVL of $6.83B. Its market share of 6.70% indicates increasing integration into broader DeFi strategies, often through wrapped assets and sidechains.

Portals.fi Platform Updates

Developer Newsletter is Live!

We have launched a new newsletter specifically for developers. This newsletter will provide updates on our API, new features, and other technical information in depth.

Subscribe to Dev Newsletter: https://build.portals.fi/?newslettersignup=true

You can also preview the #1 edition: https://www.blog.portals.fi/portalsfi-dev-update-december-edition/

Portals integrates HyperEVM

Teams building on Hyperliquid can now tap into Portals for seamless swaps, bridges, and liquidity routing across HyperEVM. No custom interfaces, no extra steps, just one-click transactions into vaults, campaigns, and yield strategies.

Full blog: https://www.blog.portals.fi/portals-integrates-hyperevm/

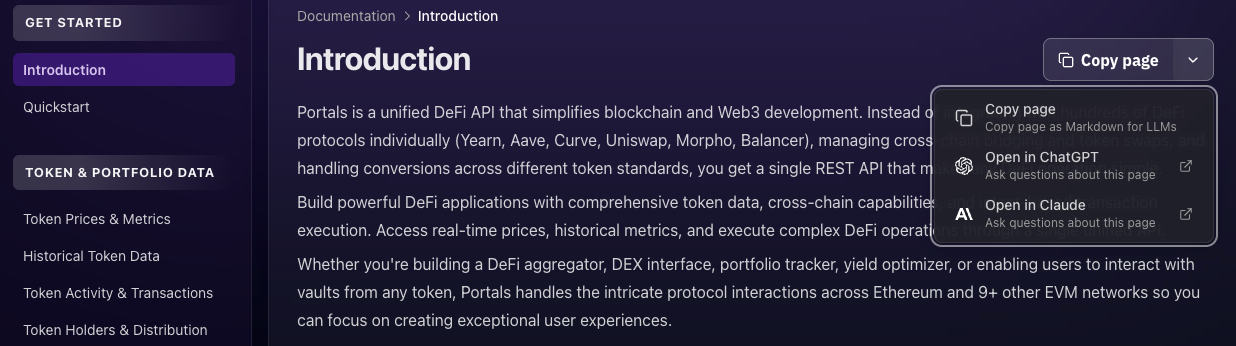

Docs Updated with AI Search Integration

We have also updated our developer documentation with a new AI-powered search integration. This will make it easier for developers to find the information they need to build on top of the Portals.fi platform.

Check out upgraded documentation: https://build.portals.fi/docs

The DeFi Drop Podcast by Portals.fi

This week, we featured YO. We have a few more coming soon before 2025 ends. Stay tuned. If you missed the previous episodes, the full segment is available here.

The DeFi Drop is a podcast by Portals.fi, 20-minute conversations with DeFi builders, vault curators, and protocol founders.

If you are building in DeFi and want to join us on a future episode, reach out via DM or Portals.fi We’d love to hear your story.

Looking Ahead

Market Outlook

The DeFi market is at a crossroads. The 'Extreme Fear' sentiment and declining market cap suggest that we may be in for a prolonged bear market. However, the resilience of the DeFi sector, the continued innovation in the space, and the growing institutional interest are all bullish long-term signals. We believe that the current market conditions present a unique opportunity for long-term investors to accumulate high-quality assets at a discount. Only time will tell.

Key Catalysts to Watch

- Regulatory Clarity: The SEC's decision to drop its investigation into Aave is a positive development, but the broader regulatory landscape remains uncertain. Any further clarity from regulators could be a major catalyst for the market.

- Institutional Adoption: The continued entry of institutional investors into the space is a key long-term bullish catalyst. We will be closely watching for further announcements from major financial institutions.

- Technological Innovation: The pace of innovation in DeFi is relentless. We will be watching for new developments in areas like Layer 2 scaling, cross-chain interoperability, and RWA tokenization.

- Macroeconomic Environment: The broader macroeconomic environment will continue to have a significant impact on the crypto market. We will be closely monitoring inflation data, interest rate decisions, and other key economic indicators.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.