Portals.fi DeFi Weekly - December 26, 2025 🎄

Happy Holidays from the Portals.fi team! As we close out the year, we are grateful for your continued support and wish you a joyful and prosperous holiday season.

Market Pulse

Summary

The market is showing signs of a slight recovery, with the total market cap increasing by 1.4% to $3.02 trillion. However, sentiment remains firmly in "Extreme Fear" territory, with the Fear & Greed Index at 20 for the 14th consecutive day. DeFi TVL has remained resilient, posting a modest 0.38% gain to $118.77 billion. Bitcoin dominance holds steady at 57.5%, while Ethereum gas prices are extremely low at 0.241 Gwei, indicating reduced network congestion.

Despite the uptick in market cap, the overall sentiment suggests that the market is still in a precarious position, with traders remaining cautious during the holiday season.

The Yield Market Pulse

Current State and Sentiment

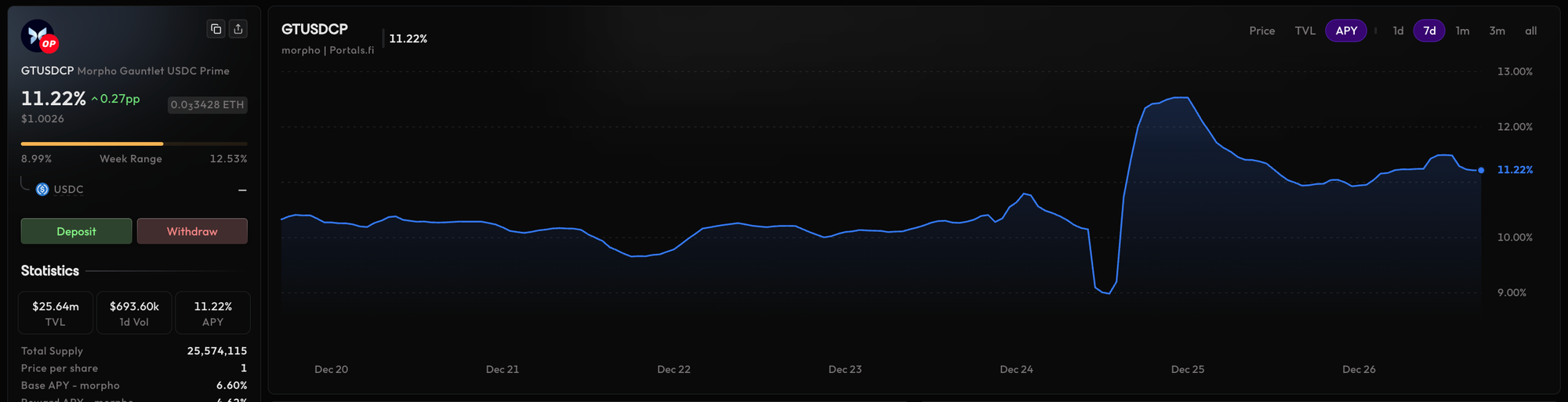

The broader market has led to a flight to safety, with stablecoin borrow rates hovering in the 4.2-4.5% range and average DeFi yields sitting around 5%. On the other hand, attractive opportunities for higher yields still exist for those willing to take on more risk, particularly on Layer-2 networks. The Morpho Gauntlet USDC Prime on Optimism, for example, is offering a 111.22% APY. The significant drop in perpetuals trading volume suggests a decrease in speculative appetite, which may impact funding rates and yield opportunities in the short term. However, the continued growth in DeFi TVL indicates that long-term confidence in the ecosystem remains strong.

Here are some top opportunities picked by Portals:

The Morpho Gauntlet USDC Prime on Optimism

- APY: 11.22%

- Chain: ETH

- Type: Lending

- Risk: Medium

- APY: 6%

- Chain: ETH

- Type: Stablecoin vault

- Risk: Low

- APY: 5.22%

- Chain: ETH

- Type: Yield

- Risk: Low

- APY: 6.47%

- Chain: ETH

- Type: Lending

- Risk: Low

DeFi News

Key Developments in DeFi This Week

This week in DeFi was dominated by a record-breaking Bitcoin options expiry, a major governance crisis at Aave, and a significant strategic shift by influential investor Arthur Hayes. These events, set against a backdrop of low holiday trading volume and institutional positioning, have created a complex and uncertain market environment.

- Bitcoin Options Expiry and Market Volatility

On December 26th, the market witnessed the largest Bitcoin options expiry in history, with over $23.7 billion in contracts expiring on Deribit. The event was characterized by a heavy 3:1 call-to-put ratio, indicating a strong bullish sentiment among traders. The max pain level was estimated to be near $95,000, with a significant $1.4 billion cluster of open interest at the $85,000 put level, which was expected to act as a short-term floor. The expiry was preceded by a two-stage gamma flush on December 19th and 26th, which created a liquidity vacuum and the potential for significant price swings. While the market has remained relatively stable in the immediate aftermath, the unwinding of these positions could lead to increased volatility in the coming days.

- Aave Governance Crisis

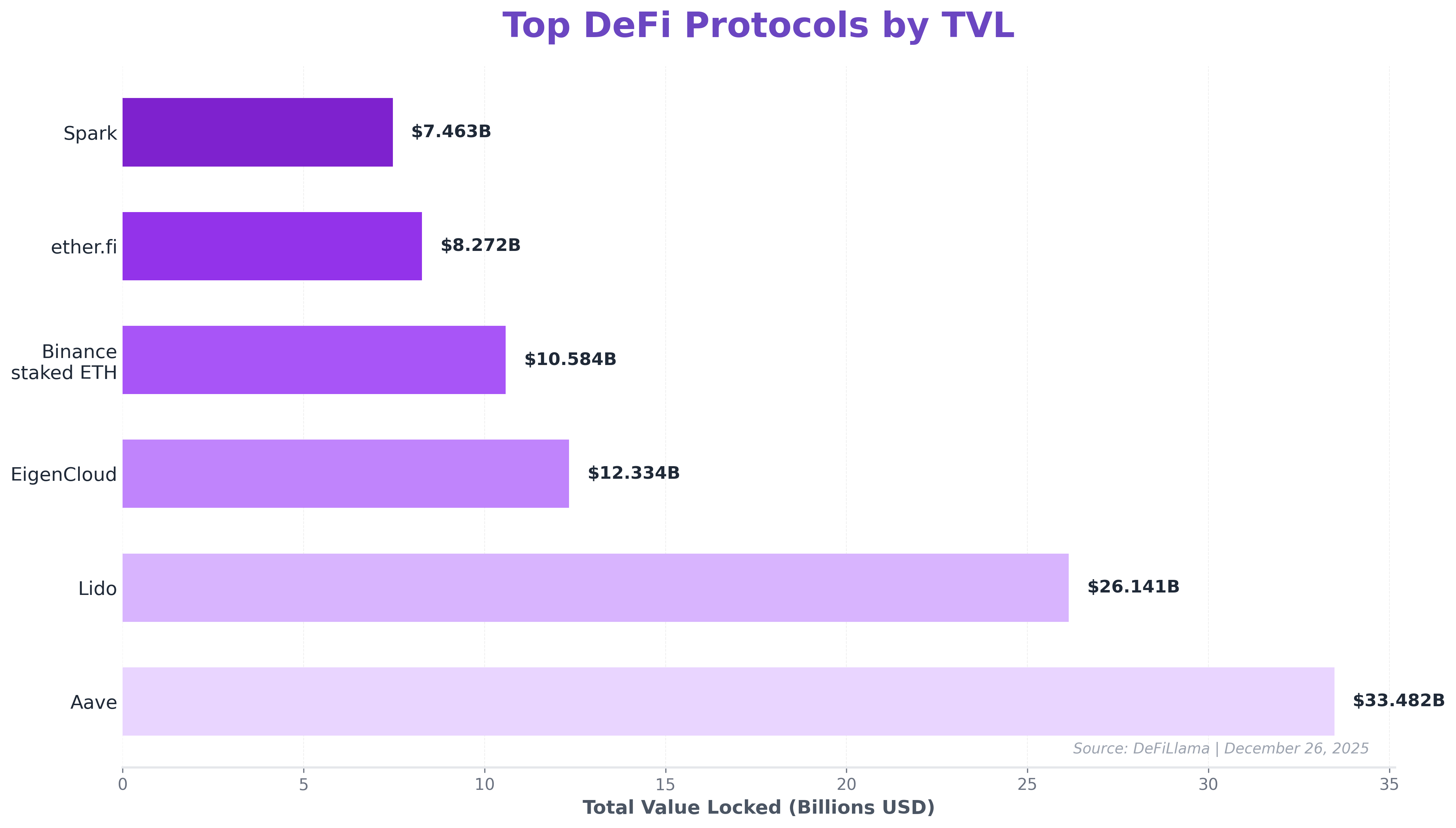

A controversial governance vote at Aave, one of DeFi's largest lending protocols, was rejected by the community on Christmas Day. The proposal, which sought to transfer control of Aave's brand assets to the DAO, was met with strong opposition, with 55.29% voting against and only 3.5% in favor. Critics raised concerns about the timing of the vote, which was pushed through during the holiday period, and the broader implications for DAO governance and token holder rights.

In a sign of the seriousness of the situation, Aave founder Stani Kulechov purchased $10 million in AAVE tokens ahead of the vote in an attempt to shore up confidence.

- Arthur Hayes' DeFi Rotation

Influential investor and BitMEX co-founder Arthur Hayes made waves this week by announcing a significant rotation out of Ethereum and into what he described as "high-quality DeFi names." Hayes sold 1,871 ETH (worth approximately $5.53 million) and purchased over $2.52 million in DeFi tokens, including PENDLE, LDO, ENA, and ETHFI. His on-chain portfolio is now reportedly over 60% USDC. Hayes' strategy is based on the belief that these beaten-down DeFi tokens, which have fallen 60-80% year-to-date, are poised to outperform as fiat liquidity improves.

Other Notable Developments

- BlackRock moved $200 million in BTC and ETH to Coinbase on Christmas Eve, sparking speculation about whether the move was a prelude to a sell-off or simply year-end rebalancing.

- DeFi Technologies (DEFT) is facing a class-action securities lawsuit, with a deadline of January 30, 2026, for affected investors to join.

- Ethereum developers are planning two major upgrades for 2026, the "Glamsterdam" and "Heze-Bogota" forks, which will focus on improving MEV fairness, speed, and privacy.

The State of the Chains

Top DeFi Protocols by TVL

Chain Performance Analysis

- Ethereum remains the dominant force in DeFi, with a TVL of $69.205 billion, representing over 58% of the total market. However, the narrative of a multi-chain future is stronger than ever.

- Solana has firmly established itself as the second-largest DeFi ecosystem, with a TVL of $8.477 billion and a vibrant community of active users.

- Layer-2 solutions like Base and Arbitrum are also gaining significant traction, with TVLs of $4.443 billion and $2.849 billion, respectively.

- Bitcoin's role in DeFi is expanding, with its TVL growing by an impressive 8.40% over the past month to $6.92 billion. The emergence of new protocols and solutions for bringing Bitcoin liquidity into the DeFi ecosystem is a trend to watch in the coming year.

- The overall DeFi TVL has remained relatively stable, indicating that while market sentiment is fearful, capital is not fleeing the ecosystem but rather being reallocated across different chains and protocols in search of yield and new opportunities.

Portals.fi Platform Updates

- Our cross-chain zaps are now live, allowing you to seamlessly move and invest your assets across different chains with a single click. Read more about it here.

- Developer Newsletter: We've launched a new newsletter specifically for developers, providing updates on our API, new features, and opportunities to build on the Portals.fi platform.

Subscribe to Dev Newsletter: https://build.portals.fi/?newslettersignup=true

You can also preview the #1 edition: https://www.blog.portals.fi/portalsfi-dev-update-december-edition/

- This week on The DeFi Drop, we featured Aegis.im. We have a few more coming soon before 2025 ends. Stay tuned. If you missed the previous episodes, the full segment is available here.

Happy Holidays! The Portals.fi team wishes you and your loved ones a happy and healthy holiday season. We're excited for what's to come in 2026 and are grateful for your continued support.

Looking Ahead: Market

Market Outlook

The market is currently in a state of extreme fear, which historically has been a good buying opportunity for long-term investors. However, the macroeconomic environment remains uncertain, and the recent governance crisis at Aave has highlighted the potential risks in the DeFi space. We expect the market to remain choppy in the short term, with a potential for a Santa Claus rally as we head into the new year. Long-term, we remain bullish on the continued growth and adoption of DeFi.

Key Catalysts to Watch

- Resolution of the Aave Governance Crisis: The outcome of this crisis will have significant implications for DAO governance and the future of DeFi.

- Bitcoin ETF Developments: Continued institutional adoption of Bitcoin through ETFs could provide a significant tailwind for the entire crypto market.

- Ethereum Layer-2 Growth: The continued growth and adoption of Layer-2 solutions will be crucial for the scalability and long-term success of the Ethereum ecosystem.

- Regulatory Clarity: Any progress on the regulatory front, particularly in the United States, could provide a major boost to the market.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.