Portals.fi DeFi Weekly - December 5, 2025

Market Pulse

- Total Market Cap: $3.17 Trillion (24h: -1.43%)

- DeFi TVL: $121.185 Billion (24h: -1.93%)

- BTC Dominance: 57.02%

- Gas (ETH): ~0.062 Gwei

- Sentiment: Fear & Greed Index: 28 (Fear)

This week, the crypto market experienced a notable downturn, with the total market cap falling to $3.17 trillion. DeFi TVL also saw a significant pullback, dropping to $121.185 billion. Bitcoin dominance remains high at 57.02%, suggesting a flight to safety amid the uncertainty. The Fear & Greed Index has fallen to 28, indicating a state of 'Fear' in the market. The extremely low gas fees on Ethereum (~0.062 Gwei) reflect a slowdown in on-chain activity as investors become more cautious.

Summary

The DeFi landscape was dominated by regulatory discussions this week, as Citadel Securities sent a letter to the SEC urging for greater oversight of DeFi protocols. This move comes at a time of market weakness, with both the total crypto market cap and DeFi TVL seeing a decline. The market sentiment has shifted firmly into 'Fear', and another DeFi exploit, this time on Yearn Finance, has further highlighted the security challenges in the space.

The Yield Market Pulse

The yield market is currently in a state of healthy consolidation. While the high-flying APYs of previous weeks have subsided, we are now seeing more sustainable and realistic yields emerge. This is a positive sign for the long-term health of the DeFi ecosystem, as it indicates a shift towards more mature and stable protocols.

Top Opportunities This Week

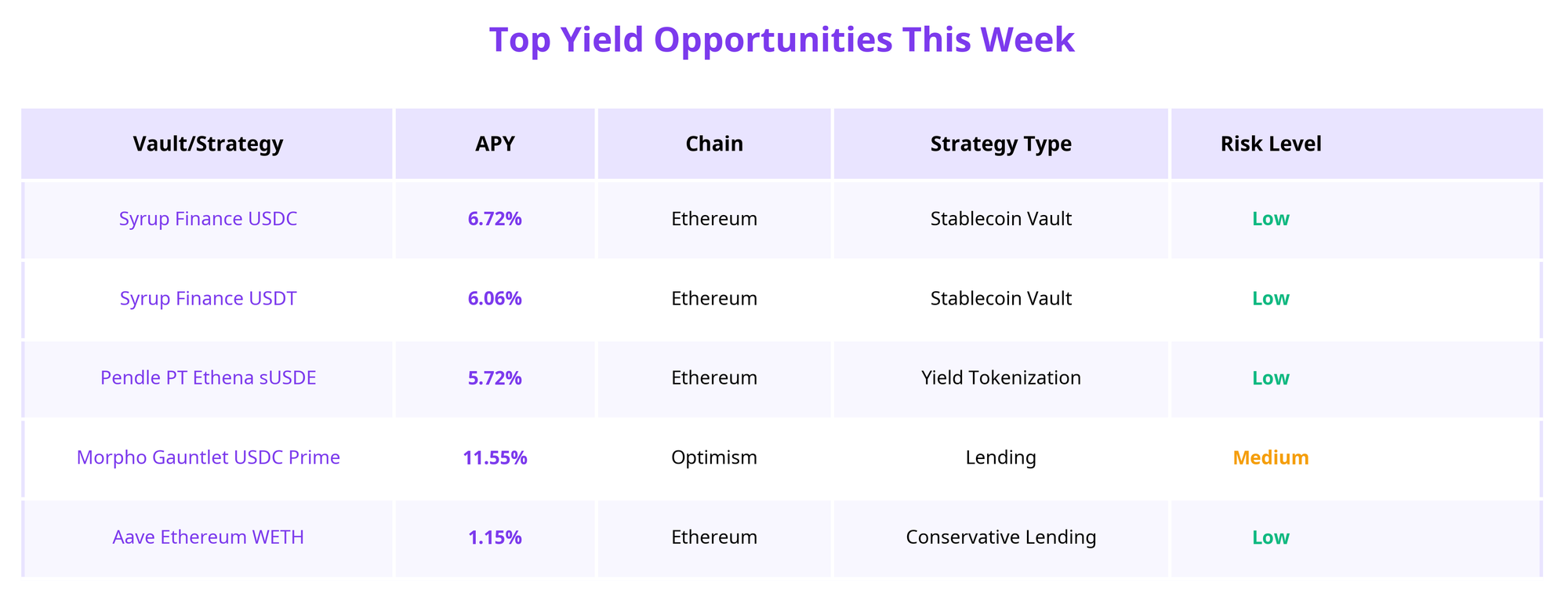

This week, we are focusing on a balanced selection of yield opportunities that prioritize sustainability and risk management:

- Syrup Finance USDC: A stablecoin vault on Ethereum with a solid 6.72% APY and a massive $1.46B in TVL.

- Syrup Finance USDT: Another stablecoin vault on Ethereum, offering a 6.06% APY with a strong $671.39M TVL.

- Pendle PT Ethena sUSDE: A yield tokenization opportunity on Ethereum with a 5.72% APY and a substantial $286.54M TVL.

- Morpho Gauntlet USDC Prime: A lending opportunity on Optimism with an attractive 11.55% APY and a TVL of $19.17M.

- Aave Ethereum WETH: A conservative lending option on Ethereum with a 1.15% APY and an enormous $9.88B in TVL.

The State of the Chains

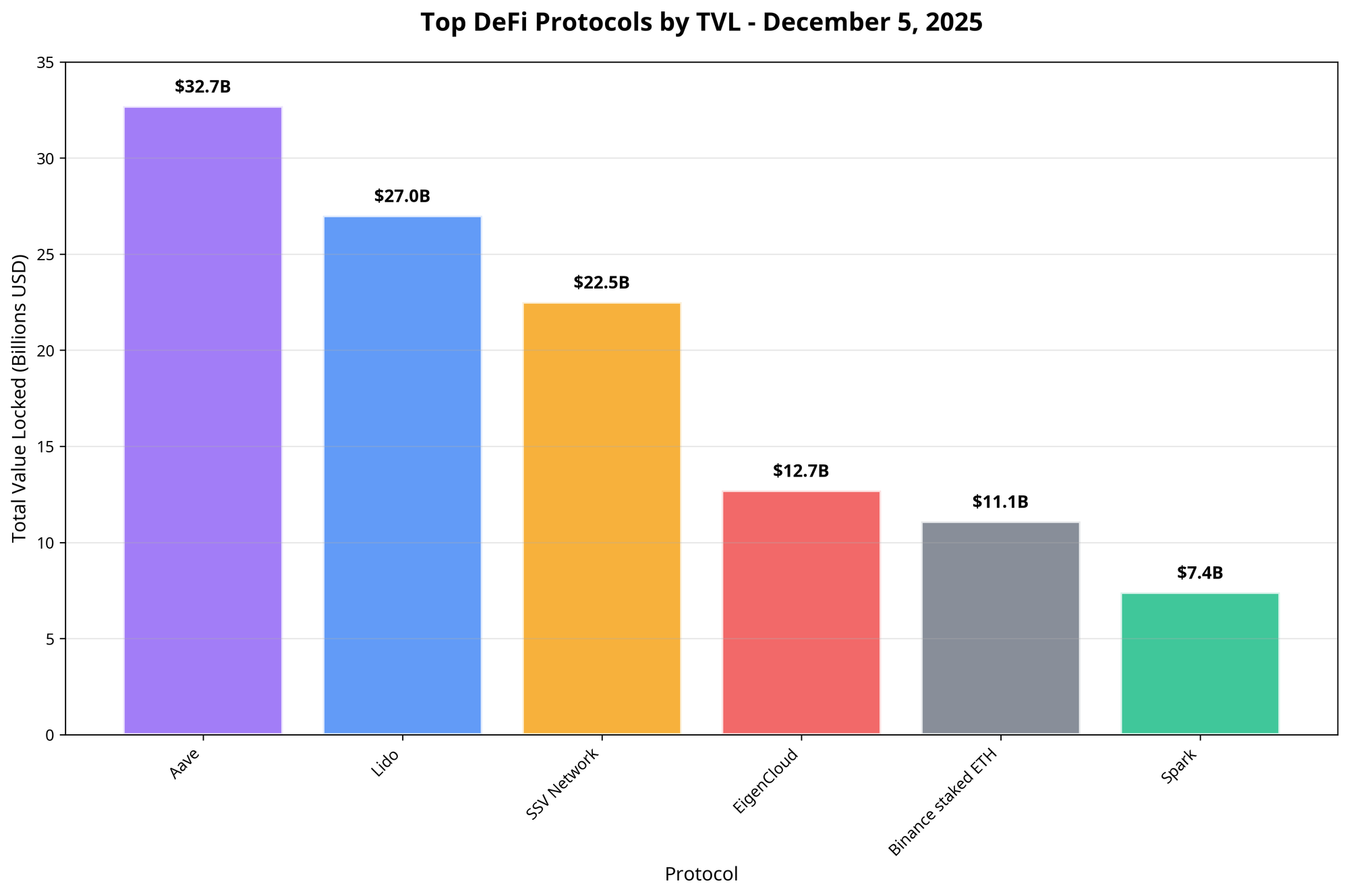

Ethereum continues to dominate the DeFi landscape, with the top protocols by TVL all residing on the network. Aave and Lido remain the clear leaders, with TVLs of $32.7B and $27.0B respectively. However, we are also seeing strong growth from other protocols like SSV Network and EigenCloud, which are quickly gaining traction.

Chain Performance Analysis

This week, we saw a slight pullback in TVL across most major chains. However, the overall trend remains positive, with DeFi TVL remaining above the key $120B level. This indicates that while the market is consolidating, capital is not leaving the DeFi ecosystem. Instead, we are seeing a rotation of capital into more established and secure protocols.

DeFi News

- Citadel's Push for SEC Oversight of DeFi: The biggest news of the week was Citadel Securities’ letter to the SEC, urging for greater regulation of DeFi protocols. Citadel argues that many DeFi platforms operate like traditional exchanges and should be subject to the same rules. The outcome of this debate could have a significant impact on the future of DeFi.

- Yearn Finance Exploit: Yearn Finance reported an “incident” in its yETH liquidity pool this week, resulting in a loss of approximately $9 million. This incident serves as another reminder of the security risks inherent in the DeFi space and the importance of thorough due diligence before investing in any protocol.

- Institutional Adoption on Sei: The Sei network has seen a surge in institutional involvement, with its Total Value Locked (TVL) reaching an all-time high. Binance became a validator on the network, asset manager Apollon_Fi launched tokenized credit products, and PayPal integrated its stablecoin, $PYUSD.

- Crypto Market Recovery?: There has been a recent crypto market recovery, with a sharp increase in expectations of US interest rate cuts. Could this be contributing to the turnaround?

- Bitcoin Sell-Off: In related crypto market news, a recent sell-off of riskier assets, including cryptocurrencies, had occurred due to economic concerns.

Portals.fi Platform Updates

Cross-Chain Zaps Are Live!

This new feature allows you to seamlessly move your assets between different chains with just a few clicks. Check out our blog post for more details: The Portals DeFi API is Now Cross-Chain

Docs will be Updated with AI Search Integration

We will update our developer documentation with a new AI-powered search integration. This will make it easier for developers to find the information, as well as redirect to ai chat models.

Full doc: https://build.portals.fi/docs

The DeFi Drop Podcast by Portals.fi

The DeFi Drop Episode with Turtle and Squid are LIVE this week. More episodes coming next week. Stay tuned to find out. If you missed the previous episodes, the full segment is available here.

The DeFi Drop is a podcast by Portals.fi, 20-minute conversations with DeFi builders, vault curators, and protocol founders.

If you are building in DeFi and want to join us on a future episode, reach out via DM or Portals.fi We’d love to hear your story.

Looking Ahead

The coming weeks will be crucial for the DeFi space as the regulatory debate heats up. The outcome of the Citadel vs. DeFi debate could have a lasting impact on the industry. In the meantime, we expect the market to continue its consolidation, with a focus on security and sustainability. We will be closely monitoring the situation and will provide updates as they become available.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.