Portals.fi DeFi Weekly - January 2, 2026

Welcome to the first DeFi Weekly of 2026! We hope you had a fantastic holiday season. As we enter the new year, the market is showing signs of life after a period of extreme fear. This week, we cover the improving market sentiment, major DeFi news, including Arthur Hayes’ latest moves, and a brief recap of Portals.fi’s progress in 2025.

Market Pulse

Summary

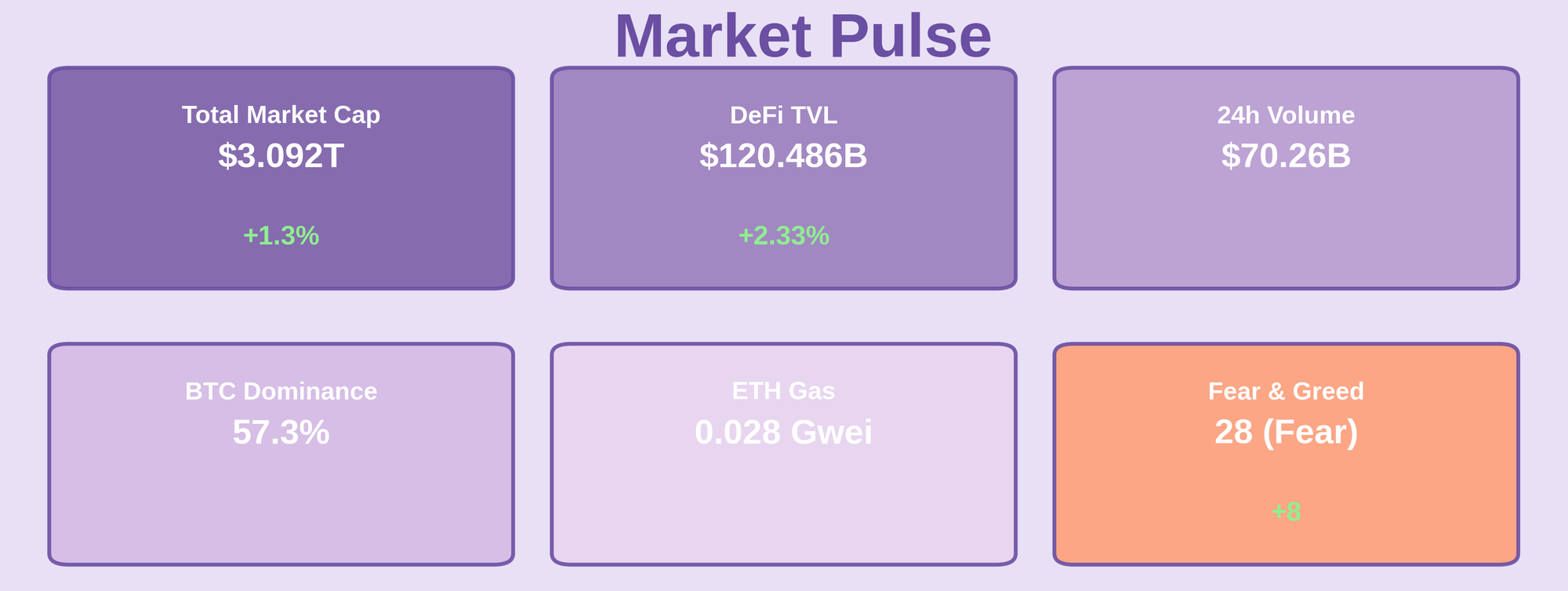

The market has started the new year with a cautious sense of optimism. The total market cap has climbed to $3.092 trillion, a 1.3% increase over the last 24 hours, while DeFi TVL has also seen a healthy 2.33% jump to $120.486 billion. This positive momentum is reflected in the Fear & Greed Index, which has risen from a state of "Extreme Fear" (20) to "Fear" (28), its highest single-day gain in recent weeks .

Despite the improved sentiment, trading volumes remain relatively low, with 24-hour volume at $70.26 billion. Bitcoin dominance stands at 57.3%, and Ethereum gas fees are exceptionally low at 0.028 Gwei, suggesting that retail activity has not yet fully returned after the holidays. The market appears to be in a consolidation phase, with institutional players making strategic moves while the broader market waits for a clear direction.

The Yield Market Pulse

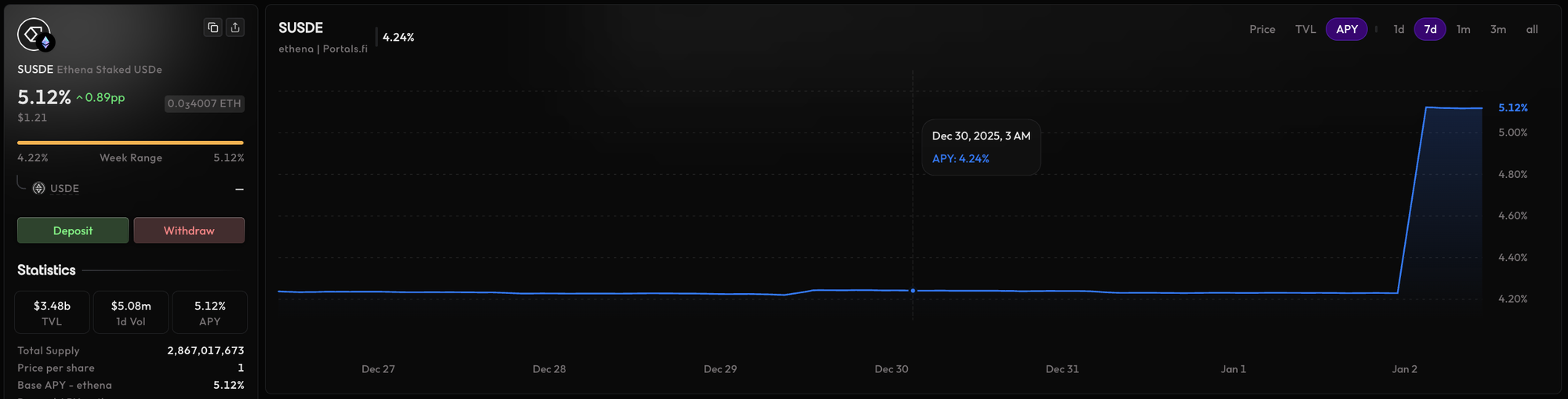

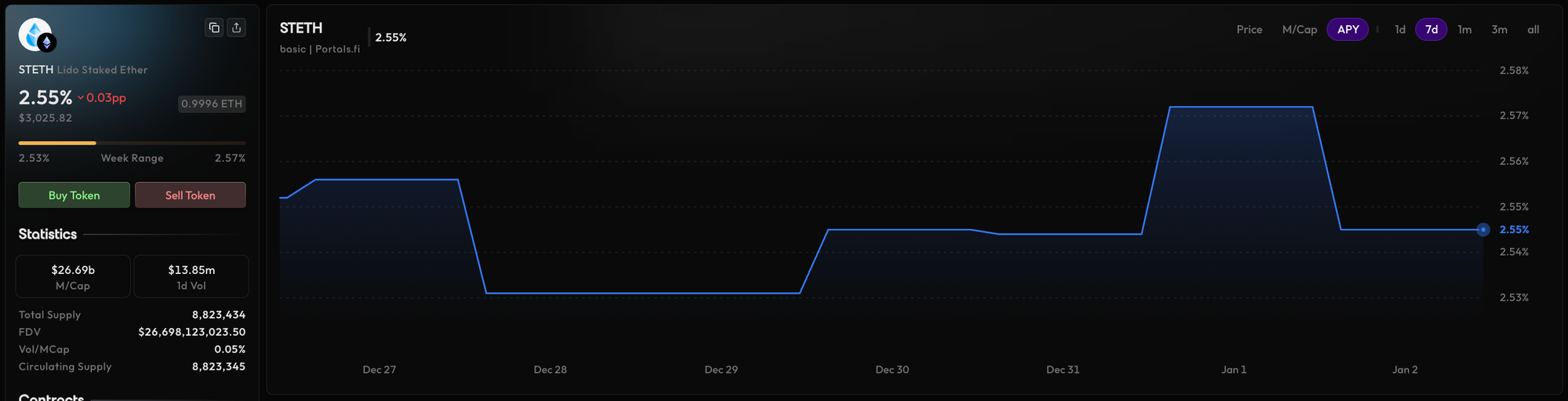

The yield market is reflecting the broader market’s cautious optimism. Stablecoin borrow rates are holding steady in the 4-5% range, providing a safe haven for risk-averse investors. However, with the recent uptick in market activity, opportunities for higher yields are emerging, particularly on Layer-2 networks and in more complex strategies. The significant drop in perpetuals trading volume over the holidays suggests a decrease in speculative appetite, which may impact funding rates in the short term. However, the continued growth in DeFi TVL indicates that long-term confidence in the ecosystem remains strong.

Top Opportunities This Week

Here are some of the top yield opportunities we’ve identified for this week:

- APY: 5.12%

- Chain: ETH

- Type: Yield

- Risk: Low

- APY: 3.47%

- Chain: ETH

- Type: Lending

- Risk: Low

- APY: 2.55%

- Chain: ETH

- Type: Staking

- Risk: Low

DeFi News

Key Developments in DeFi This Week

This week was marked by significant strategic moves from major players, including influential investor Arthur Hayes and digital asset manager Bitwise. These events, set against a backdrop of improving market sentiment, provide a glimpse into the trends that may shape the DeFi landscape in 2026.

- Arthur Hayes Continues DeFi Accumulation: BitMEX co-founder Arthur Hayes has continued his rotation into DeFi, deploying an additional $3.4 million into four DeFi tokens on January 1st. His recent investments include $1.97 million in ENA, $735,000 in ETHFI, $515,000 in PENDLE, and $260,000 in LDO. This follows a previous conversion of $5.5 million in ETH into a basket of DeFi protocols. Hayes’ strategy appears to be focused on accumulating what he considers to be high-quality, undervalued DeFi assets in anticipation of a 2026 market recovery.

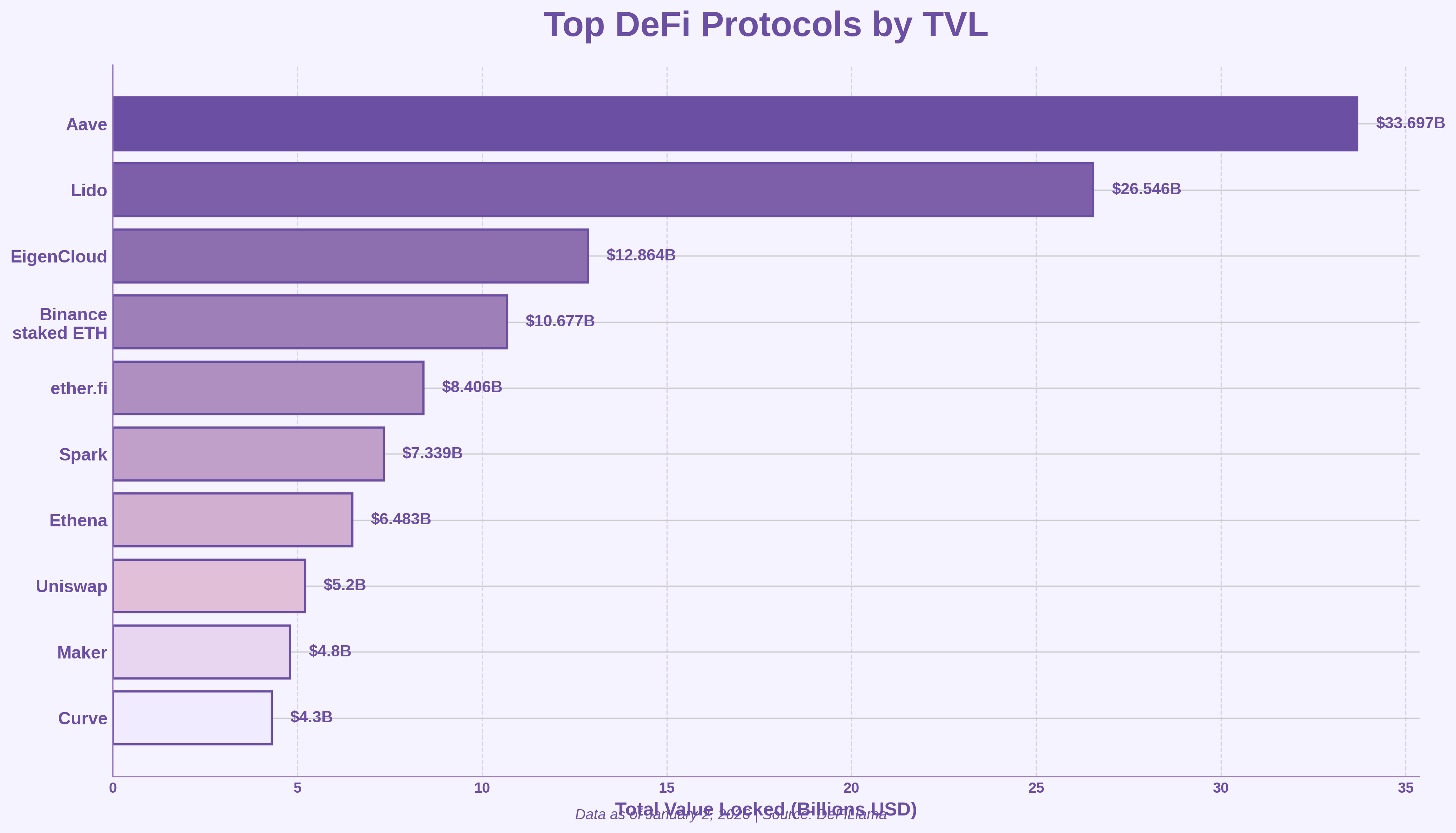

- Whale Moves $400 Million USDT to Aave: In a significant show of confidence in DeFi, a whale transferred $400 million in USDT from the HTX exchange to Aave on January 1st. This is the largest single stablecoin inflow into a DeFi protocol this year and provides a substantial boost to Aave’s lending liquidity.

- Bitwise Files for 11 Altcoin ETFs: Digital asset manager Bitwise has filed with the SEC for 11 new altcoin ETFs, including one for Aave. This move signals a growing institutional appetite for a wider range of crypto assets beyond Bitcoin and Ethereum and could pave the way for significant institutional inflows into the DeFi sector in 2026.

- Aave Governance Dispute Continues: The governance dispute at Aave over CoWSwap fees and IP ownership continues to be a topic of discussion in the community. The rejection of a controversial governance proposal on Christmas Day has highlighted the ongoing challenges of decentralized governance and the importance of token holder rights.

- Real-World Assets (RWAs) Growth: RWA protocols have surged to become the fifth-largest DeFi category by total value locked (TVL), surpassing decentralized exchanges (DEXs), with approximately $17 billion in TVL. This shows a growing institutional interest in tokenized assets like US Treasurys and private credit, which offer predictable yields.

The State of the Chains

Top DeFi Protocols by TVL

Chain Performance Analysis

- Ethereum continues to dominate the DeFi landscape, with a TVL of $69.74 billion, representing over 58% of the total market. However, the multi-chain narrative is stronger than ever, with several other chains showing impressive growth.

- Bitcoin’s role in DeFi is expanding, with its TVL growing to $6.87 billion. The development of new protocols for bringing Bitcoin liquidity into the DeFi ecosystem is a key trend to watch in 2026.

- Solana has solidified its position as the second-largest DeFi ecosystem, with its TVL surging by over 11% in the past week to $9.241 billion. The chain’s high throughput and low transaction fees continue to attract a vibrant community of users and developers.

- Layer-2 solutions like Arbitrum and Base are also gaining significant traction, with TVLs of $2.953 billion and $4.512 billion, respectively. These platforms are playing a crucial role in scaling the Ethereum ecosystem and making DeFi more accessible to a wider range of users.

Portals Platform Updates

A Look Back at 2025

2025 was a huge year for Portals. Portals is now powering 60M+ API calls per month across 1,400+ DeFi builders. Our top integration alone drives more than 4M monthly calls, showing just how critical Portals has become in powering the next wave of DeFi infrastructure.

Our Price Engine now aggregates on-chain data from all major DEXs and DeFi platforms to deliver the most accurate real market price for any asset, from the simplest tokens to the most complex derivatives. we are committed to providing the tools and support necessary for building the future of DeFi.

Brief recap Q4, 2025

- Token Claiming is live, allowing projects to manage their token's presence and provide verified information, such as brand icon and socials, to the community.

- We launched our cross-chain zaps, enabling seamless asset movement across different chains with a single click.

- We integrated Hyper EVM support with Warp Drive, our powerful DeFi aggregator.

- We updated and enhanced our documentation and launched a new developer newsletter to better support our growing community of builders.

- New: ERC-4626 Vault Indexer now instantly indexes vaults from protocols like Morpho, Fluid, Euler, and many other yield protocols the moment they're deployed.

- We are also expanding our presence across Discord, Telegram, and LinkedIn to facilitate a more connected and collaborative community.

- The DeFi Drop Podcast by Portals successfully hosted Squid, Frax, Gauntlet, Upshift, Aegis, YO, Rosetta, Turtle, IPOR Fusion, TAU Labs, Barter,Term, Upshift, cSigma and more. Thanks to all the teams that participated and shared their journey with us. There's more coming in 2026!

We will be sharing a comprehensive Recap of 2025, as well as what's to come in 2026. Stay tuned, there's a lot to uncover!

The Portals.fi team wishes you and your loved ones a happy, healthy, and prosperous 2026. We’re excited for what the new year will bring and look forward to continuing to build the future of DeFi with you.

Looking Ahead

Market Outlook

The market is starting the new year on a more positive note, but caution is still warranted. The recent improvement in sentiment is encouraging, but the macroeconomic environment remains uncertain. We expect the market to remain choppy in the short term, with the potential for increased volatility as trading volumes return to normal levels. Long-term, we remain bullish on the continued growth and adoption of DeFi.

Key Catalysts to Watch

- Institutional Adoption: The potential approval of new crypto ETFs and continued institutional investment in the space could provide a significant tailwind for the market.

- Regulatory Clarity: Any progress on the regulatory front, particularly in the United States, could provide a major boost to market confidence.

- Ethereum Layer-2 Growth: The continued growth and adoption of Layer-2 solutions will be crucial for the scalability and long-term success of the Ethereum ecosystem.

- DeFi Innovation: The development of new and innovative DeFi protocols and applications will continue to be a key driver of growth in the space.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.