Portals.fi DeFi Weekly - January 9, 2026

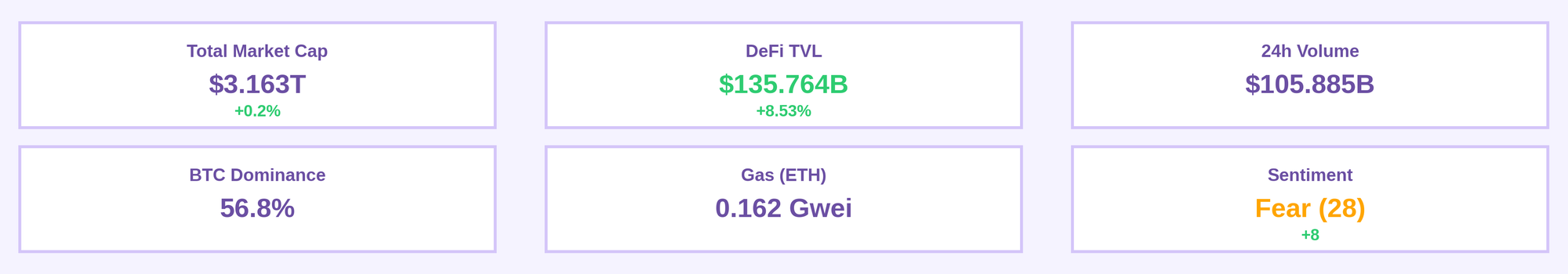

Market Pulse

- Total Market Cap: $3.163T (+0.2%)

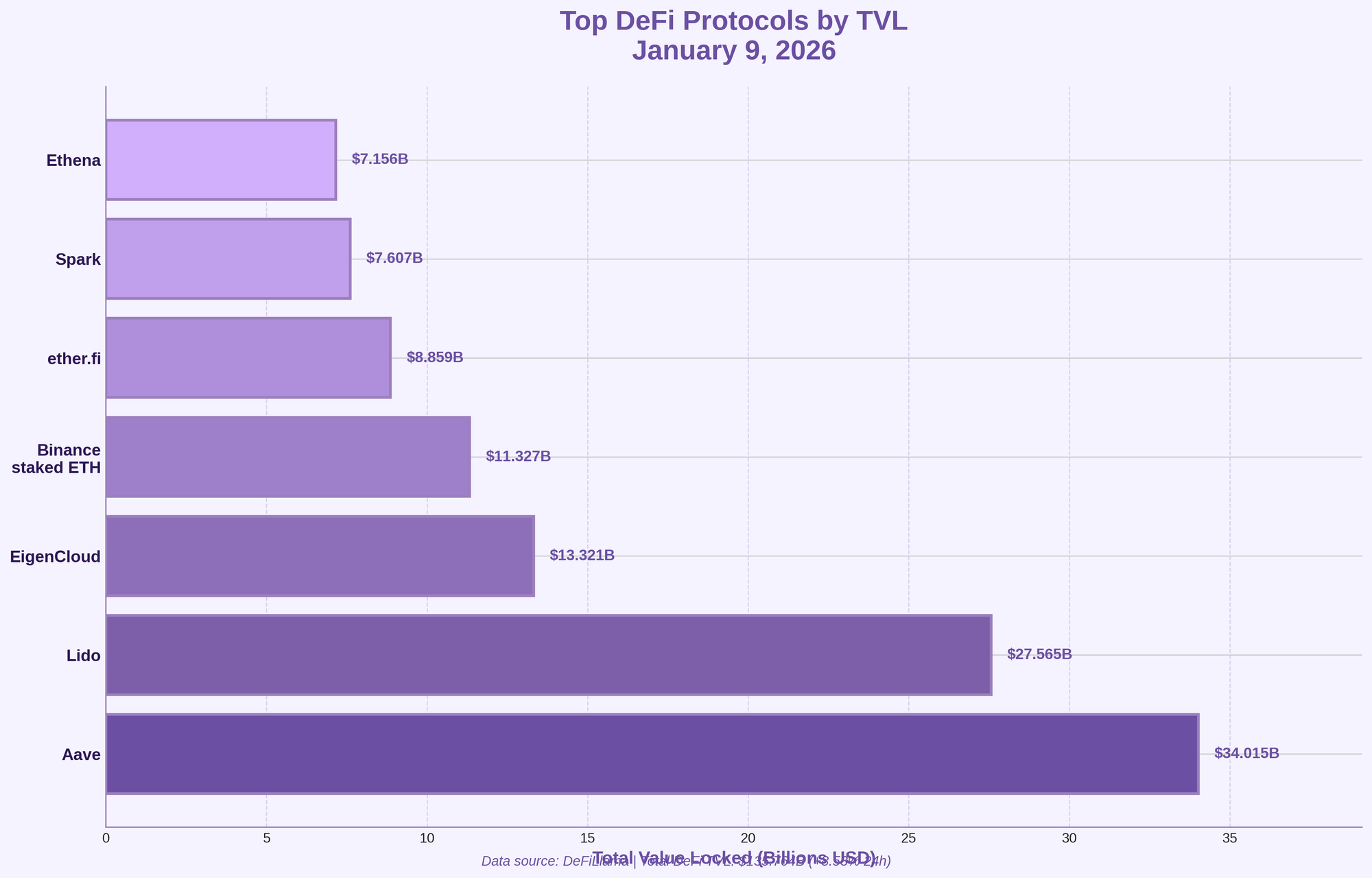

- DeFi TVL: $135.764B (+8.53%) - massive surge!

- Sentiment: Fear (28), up from Extreme Fear (20)

- ETH Gas: 0.162 Gwei (extremely low)

- Bitcoin Dominance: 56.8%

Summary

The market showed modest growth with total market cap reaching $3.163T (+0.2%). DeFi experienced a remarkable surge with TVL jumping +8.53% to $135.764B, driven primarily by Ethereum's explosive +15.29% 24h growth. Market sentiment improved from Extreme Fear (20) to Fear (28), suggesting cautious optimism. Ethereum gas fees remain extremely low at 0.162 Gwei, facilitating cost-effective transactions. Bitcoin dominance holds steady at 56.8% while trading volume remains robust at $105.9B.

The Yield Market Pulse

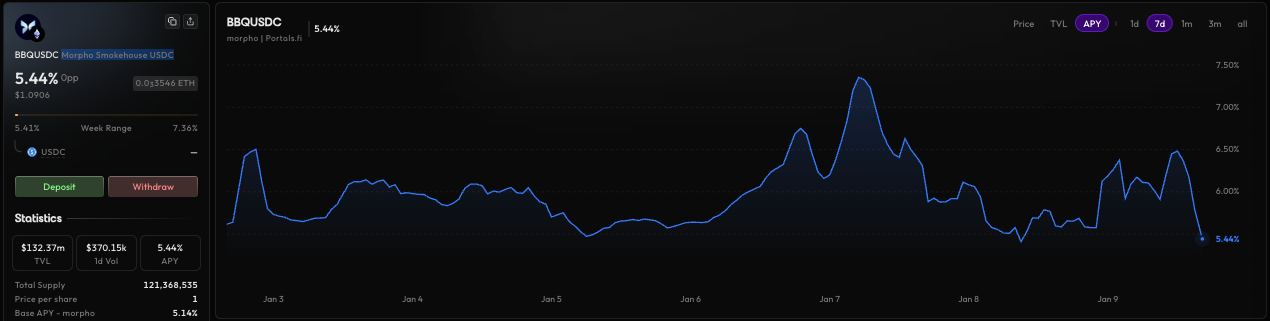

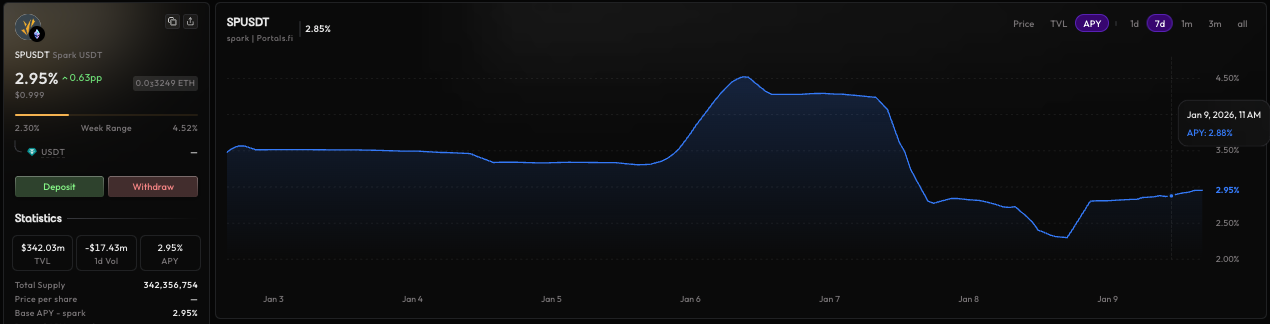

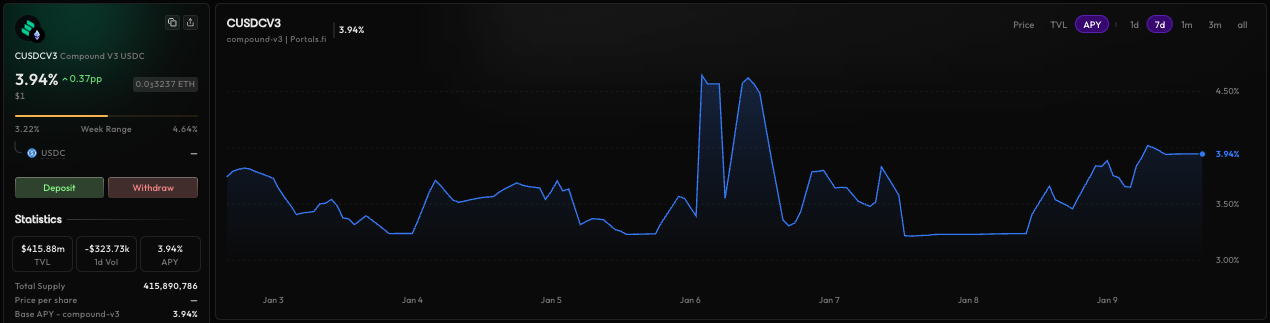

The yield market is showing signs of a significant shift as we enter 2026. The growth in Ethereum's TVL (+15.29% in 24h) shows that capital is flowing back into DeFi, which could lead to increased demand for yield-generating opportunities. Stablecoin yields from blue-chip protocols remain a reliable option, with rates holding steady in the 2.8-5.1% range.

Top Opportunities This Week

Here are some of the top yield opportunities for this week from Portals:

- APY: 5.44%

- Chain: ETH

- Type: Lending

- Risk: Low-Medium

- APY: 2.95%

- Chain: ETH

- Type: Lending

- Risk: Low

- APY: 3.94%

- Chain: ETH

- Type: Lending

- Risk: Low

DeFi News

Key Developments This Week

Market Volatility and Token Unlocks

January 2026 is marked by significant token unlocks across major L1 and DeFi projects, with cumulative values potentially reaching up to $2 billion. These unlocks are expected to drive heightened market volatility as new supply enters circulation.

Ethereum's 2026 Roadmap: Glamsterdam and Hegota Upgrades

Ethereum is set for two major upgrades in 2026, Glamsterdam and Hegota, which will focus on improving scaling capacity and transaction efficiency. These upgrades will lay the foundation for future parallel transaction execution, further enhancing the network's capabilities. While users may not notice immediate changes, these developments are crucial for the long-term growth and stability of the Ethereum ecosystem.

RWAs Continue to Grow on Ethereum

Ethereum's dominance in the RWA sector continues to expand, with a stablecoin market cap of $170.9B and a tradable RWA value of $12.6B. The platform's $4.6B in tokenized U.S. Treasuries makes it the largest hub for institutional-grade tokenized assets, attracting significant capital from traditional finance.

Regulatory Scrutiny

Regulatory discussions in the U.S. Senate are ongoing, with a new crypto bill approaching a critical vote. Key issues include stablecoin interest payments and potential insider trading on prediction markets. In the UK, the FCA has signalled that its crypto licensing gateway will open in September 2026.

Trubit Protocol Hack

The Trubit protocol suffered an exploit, resulting in the theft of approximately 8,535 ETH, valued at around $26.4 million.

Security Initiatives

CertiK and YZi Labs Labs launched a $1 million security grant to help early-stage DeFi startups proactively identify and fix vulnerabilities.

The State of the Chains

Chain Performance Analysis

Ethereum: Ethereum's TVL surged by over 15% in the last 24 hours, a clear sign of renewed confidence in the ecosystem. With the upcoming Glamsterdam and Hegota upgrades, Ethereum is well-positioned to continue its dominance in the DeFi space.

Layer 2 Solutions: Arbitrum and Base are showing strong growth, with Base TVL up 4.67% in the last 7 days. These Layer 2 solutions are playing an increasingly important role in the Ethereum ecosystem, providing users with faster and cheaper transactions.

BSC: BSC's TVL has remained relatively stable, with a slight increase of 2.41% in the last 7 days. The platform continues to be a popular choice for users looking for low-cost alternatives to Ethereum.

Bitcoin: Bitcoin's TVL has seen a modest increase of 1.33% in the last 7 days. While Bitcoin is not typically associated with DeFi, a growing number of projects are building DeFi applications on top of the Bitcoin network.

Portals.fi Platform Updates

Our team has been hard at work shipping new features and improvements to the Portals.fi platform. Some exciting updates COMING SOON! Watch the space, our devs are cooking!

The DeFi Drop Podcast by Portals keeps growing with this new year! Who would you like to see next on The DeFi Drop? New Episodes coming next week!

Looking Ahead

Key Catalysts to Watch

•Ethereum Upgrades: The Glamsterdam and Hegota upgrades are the most significant catalysts to watch in the coming months. These upgrades have the potential to further solidify Ethereum's position as the leading smart contract platform.

•DeFi Regulation: The regulatory landscape for DeFi is still evolving, and any new developments could have a major impact on the market. We'll be closely monitoring the situation and providing updates as they become available.

•Institutional Adoption: The continued migration of institutional capital into the DeFi space is a major tailwind for the market. We expect to see more traditional finance companies enter the DeFi space in the coming year.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.