Portals.fi DeFi Weekly - November 14, 2025

Market Pulse

This week, the crypto market experienced a significant downturn, with a sharp pullback across the board. Here is a snapshot of the key market dynamics:

- Total Market Cap: $3.27 Trillion (24h: -6.14%)

- DeFi TVL: $129 Billion (24h: -1.7%)

- BTC Dominance: 57.84%

- Gas (ETH): ~18 Gwei

- Sentiment: Fear & Greed Index: 25 (Extreme Fear)

Summary

The market has entered a phase of extreme fear, with a significant sell-off impacting all major assets. The total market cap has dropped to $3.27 trillion from $3.49 trillion last week, and DeFi TVL has fallen to $129 billion, reflecting a strong risk-off sentiment as investors react to a combination of negative news and market uncertainty.

Bitcoin dominance has increased to 57.84%, indicating a flight to safety within the crypto market. Ethereum gas fees have risen to ~18 Gwei, suggesting a high level of on-chain activity, likely driven by panic selling and liquidations. The Fear & Greed Index has plummeted to 25, a clear sign of extreme fear among market participants.

The Yield Market Pulse: A Flight to Quality

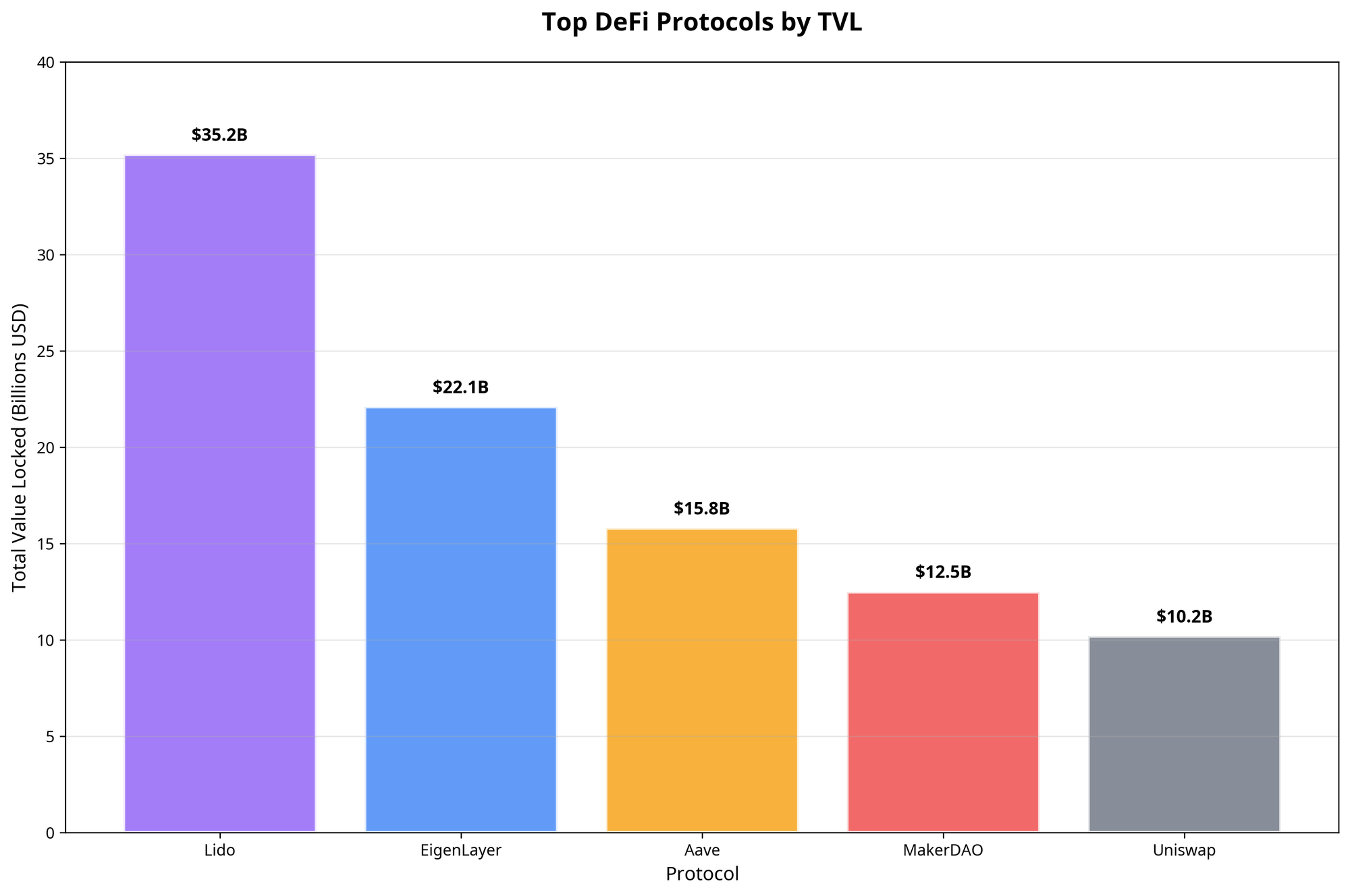

In times of market turmoil, the focus shifts from chasing high APYs to preserving capital and seeking out sustainable, low-risk yields. The current environment is no exception. While the overall DeFi TVL has decreased, capital is rotating into more established, battle-tested protocols that are perceived as safer havens.

Top Opportunities This Week

This week, we are highlighting several yield opportunities that offer a balance of reasonable returns and manageable risk in the current market.

- Curve 3pool: A classic stablecoin liquidity pool, offering a 5-10% APY on multiple chains, providing a reliable source of yield from trading fees.

- Aave USDT: Lending USDT on Aave on Avalanche is currently yielding 8.5%, a simple and low-risk way to earn a return on your stablecoins.

- Pendle USDe: This yield tokenization strategy on Ethereum is offering a 15.2% APY, allowing users to speculate on future yields.

- Beefy GMX: This auto-compounding vault on Arbitrum is providing a 12.8% APY, leveraging the real yield of the GMX platform.

- Uniswap USDC-USDT LP: Offering a 7.5% APY, this stablecoin liquidity provision strategy on Uniswap remains a popular choice for those looking to earn fees from trading volume.

DeFi News Spotlight

This week was marked by several significant events that have contributed to the current market sentiment.

Hyperliquid, Lighter, and Aster Dominate Perp DEX Trading

In a sign of the maturing DeFi landscape, perpetual DEXes Hyperliquid, Lighter, and Aster have seen a surge in trading volume, with Lighter leading the pack with $73.77B in 7-day volume. This indicates a growing demand for on-chain derivatives trading and the increasing sophistication of DeFi protocols.

R25 Launches Yield-Bearing RWA Stablecoin

Ant Financial-backed R25 has launched a yield-bearing stablecoin protocol on Polygon, backed by real-world assets (RWAs). This move signals the growing trend of tokenizing real-world assets and the increasing demand for compliant, asset-backed stablecoins.

DeFi’s November Nightmare Continues

The fallout from the Balancer and Stream Finance exploits continues to ripple through the DeFi ecosystem, with total losses now estimated at over $220 million. These events have exposed critical vulnerabilities in smart contract composability and have led to a renewed focus on security and risk management.

Enhanced security measures

In response to the breaches, there is an increased focus on enhanced security measures, risk management, and regulatory frameworks. This includes partnerships to set new standards for web3 security, such as the one between Certora, Cork, and Hypernative.

Shift to traditional assets

The market instability has prompted some investors to reallocate capital toward traditional safe-haven assets like gold and silver.

The State of the Chains

The multi-chain landscape is in a state of flux, with capital rotating between different ecosystems in search of safety and yield.

Chain Performance Analysis

- Ethereum: Remains the dominant settlement layer, but high gas fees during periods of volatility are a persistent issue.

- Layer 2 Solutions: Arbitrum continues to be a hub of activity, but the recent market downturn has impacted TVL across all L2s.

- Alternative L1s: Avalanche and other alternative L1s are seeing a mix of inflows and outflows as users reassess risk and opportunity.

Portals.fi Platform Updates

Enhanced Developer Experience

We are committed to providing our developer community with the best possible experience. We are enhancing our documentation and expanding our support channels on Discord, Telegram, and LinkedIn to foster a more connected and collaborative community.

Hyper EVM Support

We have completed the integration of Hyper EVM with Warp Drive, our powerful DeFi aggregator. This brings the high-performance capabilities of Hyper EVM to the Portals ecosystem, enabling developers to build and deploy sophisticated DeFi applications with greater speed and efficiency. The integration is ready for review, with minor testing remaining for balance endpoints.

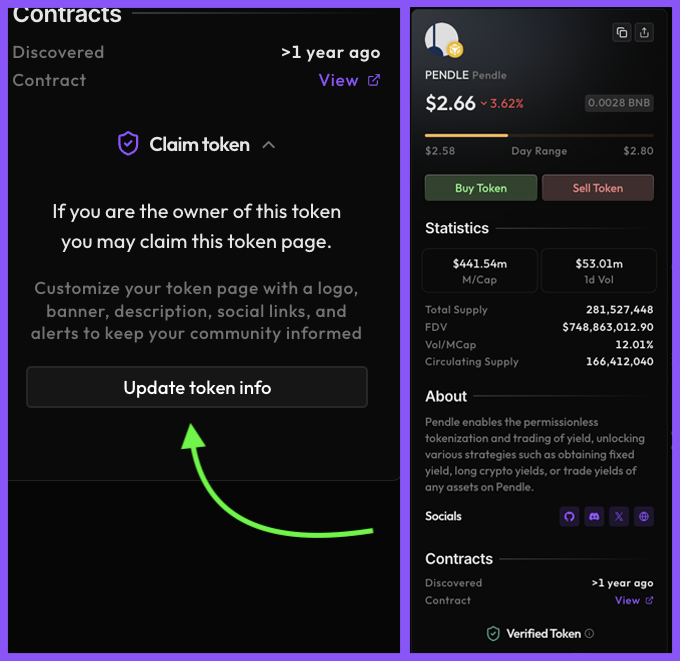

Token Claim Page: How to claim yours?

As you already know from our last update that the Token Claim page is LIVE. Protocols can now claim and verify their tokens on the Portals.fi platform. This feature allows projects to manage their token's presence and provide verified information, such as brand icon and socials, to the community.

Step-by-Step Instructions

- Find Your Token Page: Navigate to [explorer.portals.fi] and search for your token.

- Click the Claim Token Button: On the left-hand side of your token page, you will see the "Claim Token" button.

- Fill Out the Form: Complete the form with your project details and key information.

- Follow the Instructions: You will receive an email with payment instructions and a unique verification ID. Complete the payment and verify your claim by posting a tweet tagging @portals_fi with your verification ID.

Once verified, your customized token page will be live, providing your community with a trusted and comprehensive resource.

Cross-Chain Swaps are Live!

You can now seamlessly swap assets across different blockchains directly within the Portals.fi API. This is a major step forward in our mission to create a unified and frictionless DeFi experience.

The DeFi Drop Podcast by Portals.fi

The DeFi Drop Episode with Gauntlet coming soon. More is coming next week. Stay tuned to find out. If you missed the previous episodes, the full segment is available here.

Looking Ahead: A Market at a Crossroads

Market Outlook: The crypto market is at a crossroads. The recent sell-off has shaken investor confidence, and the path forward is uncertain. The market is in desperate need of a positive catalyst to reverse the current downward trend.

Key Catalysts to Watch:

- Macroeconomic Data: All eyes will be on the upcoming inflation data and central bank announcements, as these will have a significant impact on liquidity conditions.

- Regulatory Clarity: Any progress on the regulatory front could provide a much-needed boost to market sentiment.

- Innovation and Adoption: The continued development of innovative DeFi protocols and the growing adoption of crypto by institutional investors are key long-term drivers of the market.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.