Portals.fi DeFi Weekly - November 21, 2025

Market Pulse

This week, the crypto market experienced a severe crash, with double-digit losses across the board. Here is a snapshot of the key market dynamics:

- Total Market Cap: $2.95 Trillion (24h: -9.78%)

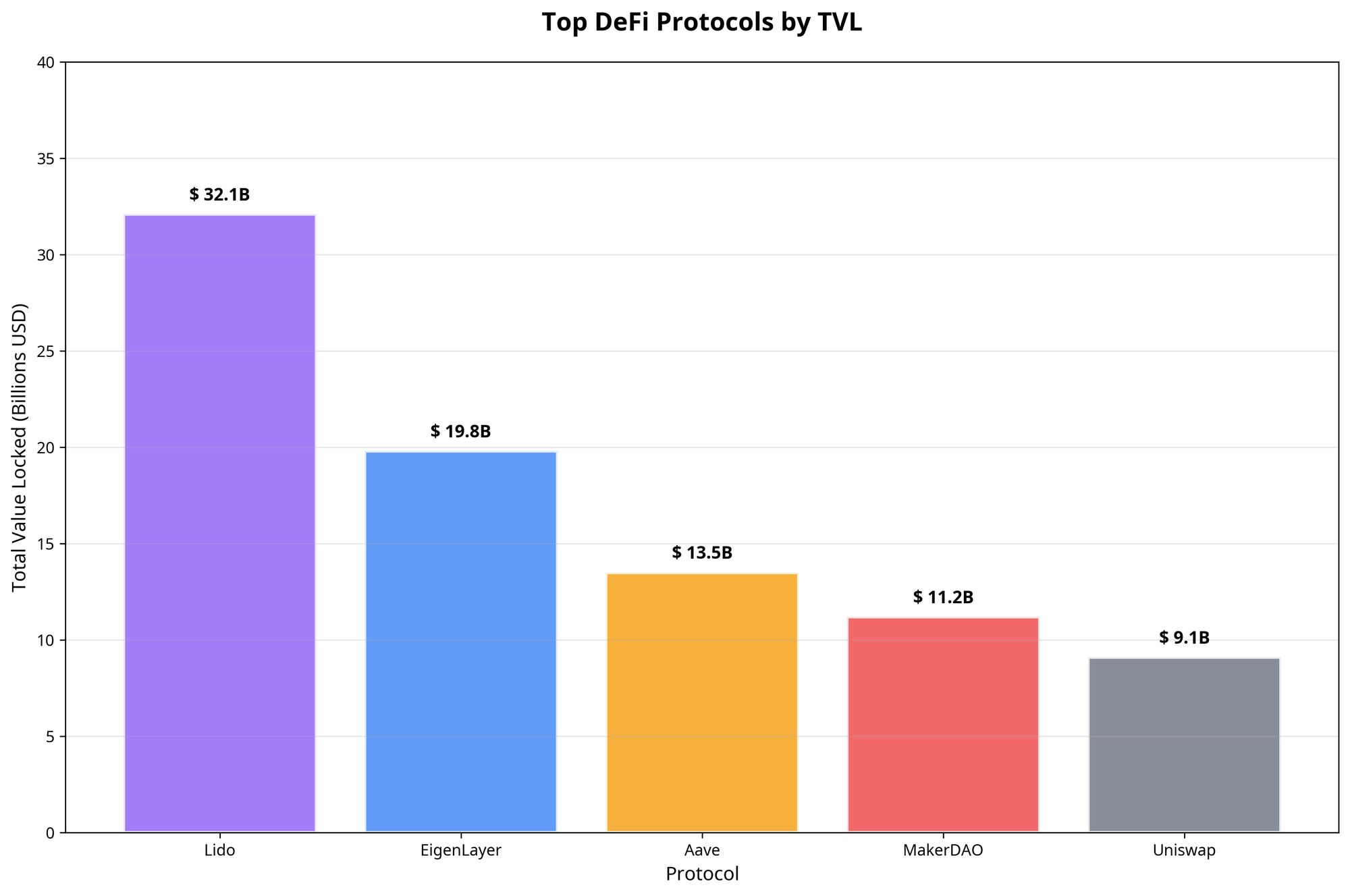

- DeFi TVL: $112 Billion (24h: -13.2%)

- BTC Dominance: 59.21%

- Gas (ETH): ~25 Gwei

- Sentiment: Fear & Greed Index: 18 (Extreme Fear)

Summary

The market has been gripped by extreme fear, with a massive sell-off wiping out over $300 billion from the total market cap in a single day. DeFi TVL has plummeted to $112 billion, its lowest level in months. This reflects a complete risk-off sentiment as investors flee to safety.

Bitcoin dominance has surged to a yearly high of 59.21%, as capital floods out of altcoins and into Bitcoin. Ethereum gas fees have spiked to ~25 Gwei, indicating a high level of on-chain activity, driven by panic selling and a rush to exit positions. The Fear & Greed Index has crashed to 18, a clear sign of extreme fear and capitulation in the market.

The Yield Market Pulse: A Search for Safe Havens

In the midst of the market chaos, the yield market has seen a dramatic shift. The focus is no longer on high APYs, but on capital preservation. Yields on perpetual DEXes have become extremely volatile, while traditional, low-risk stablecoin yields have compressed even further.

Top Opportunities This Week

This week, we are highlighting realistic and sustainable yield opportunities across different risk profiles.

- Ethena Staked USDe (sUSDe): Offering 5.23% APY with $4.36B TVL, this is one of the most liquid and established stablecoin yield strategies on Ethereum.

- Syrup Finance USDC: Yielding 6.84% APY with $1.28B TVL, this protocol provides competitive returns on USDC with substantial liquidity backing.

- Euler Sentora RLUSD: At 9.91% APY with $173M TVL, this represents a medium-risk opportunity in the lending space with reasonable liquidity.

- Midas Hyperithm: Offering 15.38% APY with $115M TVL, this is a higher-risk strategy that still maintains substantial backing.

- Aave Ethereum USDC: The gold standard for conservative DeFi yields at 3.82% APY with massive $5.05B TVL, perfect for risk-averse investors.

DeFi News

This week was marked by several events that have contributed to the current market sentiment.

The Great Crypto Crash of November 2025

The crypto market experienced one of its most severe crashes in recent history, with Bitcoin plummeting below $85,000 and the total market cap shedding over $1 trillion in six weeks. The crash was triggered by a cascade of leveraged liquidations, with over $1.7 billion in long positions wiped out in a single day.

The Bitcoin DeFi Race Heats Up

In the midst of the market chaos, the race to build a robust DeFi ecosystem on Bitcoin is heating up. With institutions looking for more regulated and secure on-chain opportunities, projects that are building on Bitcoin are attracting significant attention.

DeFi Loan Growth Hits New Record, But Sector Struggles

A report from Galaxy Digital noted that DeFi and CeFi loans reached a new record in Q3, with most growth coming from DeFi. However, the same report also pointed out that the DeFi sector has struggled recently due to market crashes and exploits, which have eroded trust.

Aave Offers $1 Million in Insurance

Aave is offering $1 million in insurance for DeFi, potentially providing a higher level of protection than FDIC-insured banks. This move could help to attract more risk-averse investors to the DeFi space.

The Great Decentralization Debate

A former SEC aide and the founder of Uniswap clashed over the true meaning and role of decentralization. The debate highlights the ongoing regulatory uncertainty surrounding the DeFi space and the challenges of defining what it means to be truly decentralized.

The State of the Chains

The multi-chain landscape is in a state of turmoil, with capital fleeing from higher-risk ecosystems and consolidating in more established chains.

Chain Performance Analysis

- Ethereum: Remains the dominant settlement layer, but the high gas fees during the crash have once again highlighted its scalability issues.

- Layer 2 Solutions: Arbitrum and other L2s have seen a significant drop in TVL as users de-risk and move back to the mainnet.

- Alternative L1s: Avalanche and other alternative L1s have been hit hard by the market downturn, with many smaller projects struggling to survive.

Portals.fi Platform Updates

Cross-Chain Zaps are Live!

You can now execute complex, multi-step transactions across different blockchains with a single API call. Read more about it in our latest blog post: The Portals DeFi API is Now Cross-Chain!

Portals.fi at Devconnect, Argentina

Our developer team is on the ground at Devconnect in Argentina! If you are in town and want to connect, please reach out to us on X or here on LinkedIn. We would love to chat about the future of DeFi and how we can build it together. Today's the last day!

Updated Developer Docs

We have completely revamped our developer documentation to make it easier than ever to build on Portals.fi. Check out the new and improved docs here: https://build.portals.fi/docs

The DeFi Drop Podcast by Portals.fi

The DeFi Drop Episode with Squid coming soon. More episodes coming next week. Stay tuned to find out. If you missed the previous episodes, the full segment is available here.

The DeFi Drop is a podcast by Portals.fi 20-minute conversations with DeFi builders, vault curators, and protocol founders.

If you are building in DeFi and want to join us on a future episode, reach out via DM or Portals.fi We’d love to hear your story.

Looking Ahead: A Market in Search of a Bottom

Market Outlook: The crypto market is in a state of extreme fear and capitulation. The recent crash has been brutal, and it is unclear when the selling pressure will subside. The market is in desperate need of a period of stability to find a bottom and begin the process of rebuilding.

Key Catalysts to Watch:

- Deleveraging: The market needs to flush out the excess leverage that has built up over the past few months. This process is painful but necessary for a healthy recovery.

- Institutional Adoption: The continued entry of institutional investors into the space could provide a much-needed source of stability and long-term capital.

- Regulatory Developments: Any positive developments on the regulatory front could help to restore confidence in the market.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.