Portals.fi DeFi Weekly - November 7, 2025

Market Pulse

This week, the market continues its consolidation with a slight downward drift. Here is a snapshot of the key market dynamics:

- Total Market Cap: $3.49 Trillion (24h: -0.7%)

- DeFi TVL: $129 Billion (24h: -1.7%)

- BTC Dominance: 58.38%

- Gas (ETH): ~12 Gwei

- Sentiment: Fear & Greed Index: 36 (Fear)

Summary

The crypto market remains in a holding pattern, characterized by sideways price action and a slight bearish sentiment. The total market cap has dipped to $3.49 trillion, and DeFi's TVL has seen a corresponding decrease to $129 billion. This reflects a risk-off attitude among investors, who are waiting for a clear market signal.

Bitcoin dominance has climbed to 58.38%, a classic sign of a flight to safety within the crypto market. Ethereum gas fees have remained stable at around 12 Gwei, suggesting that while on-chain activity has not disappeared, it has not seen a significant increase either. The Fear & Greed Index, at 36, remains firmly in "Fear" territory, indicating that market participants are not yet ready to take on significant risk.

The Yield Market Pulse: A Search for Resilient Yields

In the current market environment, the search for resilient yields has become paramount. While the high-octane returns of a bull market have subsided, the DeFi ecosystem continues to offer attractive opportunities for those who know where to look. The key is to focus on strategies that are not solely dependent on market direction.

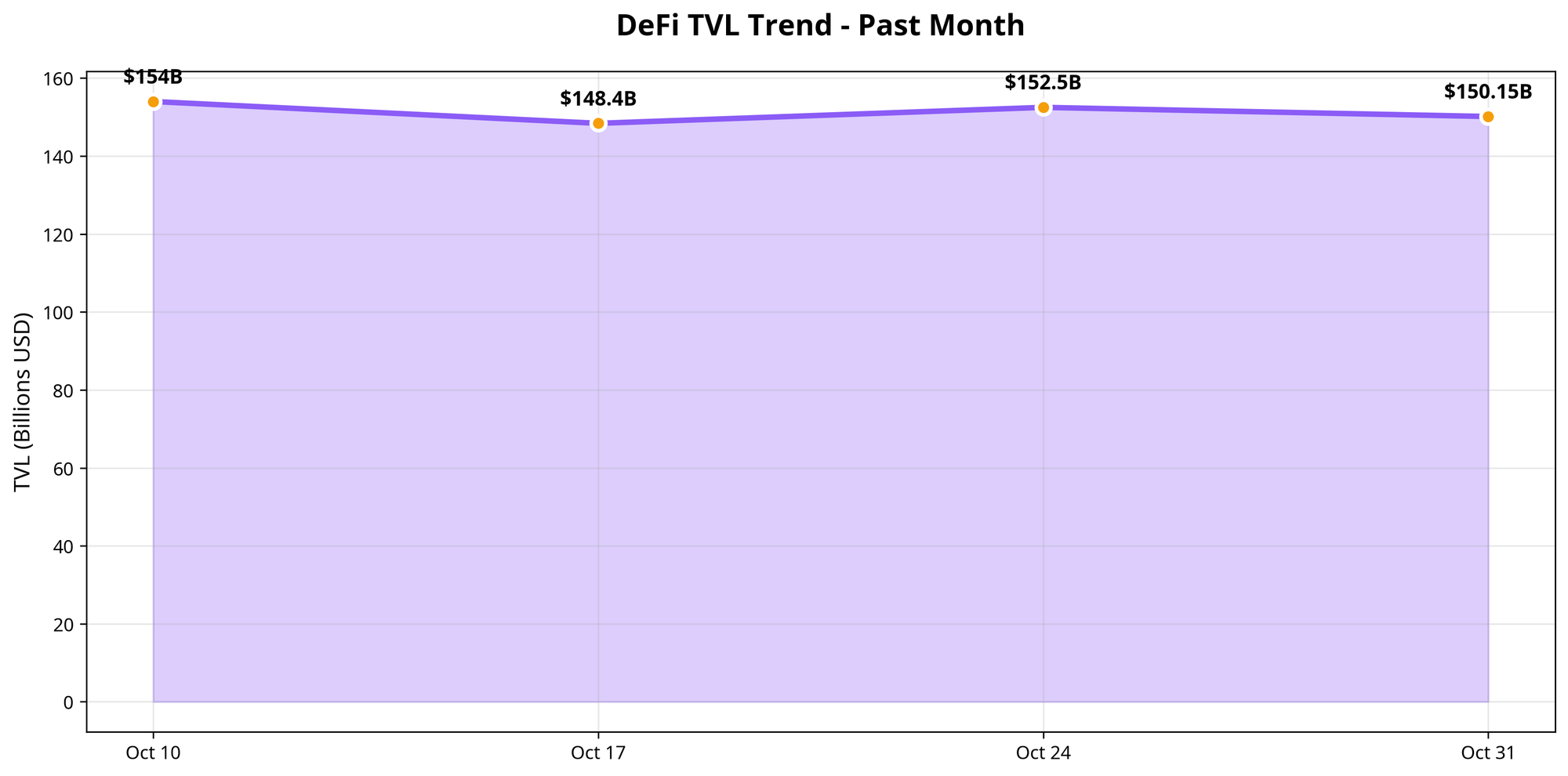

The chart above shows the DeFi TVL trend over the past month, illustrating the recent dip and subsequent stabilization. This period of consolidation is a natural part of the market cycle and can be an opportune time to deploy capital into strategies that have proven their resilience.

Top Opportunities This Week

This week, we are highlighting several yield opportunities that have remained robust despite the market's fluctuations. These strategies offer a combination of attractive APYs and well-managed risk.

- Fusion (by IPOR) (Ethereum): Offering a 23.96% APY, this stablecoin yield strategy on Ethereum has demonstrated its ability to generate consistent returns.

- Upshift (Ethereum): This delta-neutral strategy provides a 20% APY, making it an attractive option for those looking to minimize market exposure.

- Aegis (Ethereum): At 8.27% APY, this stablecoin yield strategy offers a more conservative, yet still attractive, return.

- Lazy Summer (Arbitrum): For those with a higher risk appetite, this leveraged stablecoin strategy on Arbitrum is offering a 54.59% APY.

- LAGOON Finance (Avalanche): This stablecoin yield strategy on Avalanche provides a solid 15.08% APY.

Protocol Spotlight: IPOR's Interest Rate Swaps

This week's protocol spotlight is on IPOR, a decentralized interest rate swap market. In a market where yield volatility is a major concern, IPOR provides a crucial piece of infrastructure that allows users to hedge against fluctuations in borrowing and lending rates.

DeFi News Spotlight

This week was marked by a major exploit and continued market turbulence. Here’s a rundown of the most significant news and its impact.

The Balancer Exploit: A Sophisticated Price Manipulation Attack

The biggest news of the week was a coordinated attack on Balancer's V2 Composable Stable Pools, resulting in losses of over $125 million. According to an in-depth analysis, the root cause was not a simple access control issue, but a sophisticated price manipulation attack that exploited a rounding inconsistency and precision loss in the protocol's invariant calculation.

The Attack: The attacker manipulated the price of Balancer Pool Tokens (BPT) through a carefully crafted series of swaps, allowing them to profit from the distorted prices. The attack was executed in two stages to evade detection, with the profit-taking happening in a separate transaction from the initial exploit.

The Vulnerability: The core issue was a subtle rounding inconsistency between the upscaling and downscaling operations in the smart contract, which the attacker was able to exploit to their advantage.

Compound Protocol Suspends Stablecoin Markets

Compound, one of DeFi's largest lending protocols with $2.26 billion in TVL, temporarily suspended withdrawals from its USDC, USDS, and USDT markets due to a liquidity crisis involving Elixir's deUSD token. The suspension was implemented after risk manager Gauntlet flagged potential bad debt risks.

Stream Finance Collapse Triggers Contagion

The collapse of Stream Finance, which disclosed over $90 million in losses, created a domino effect across multiple DeFi protocols. The failure led to the depegging of multiple synthetic stablecoins including deUSD (which fell to near zero) and affected protocols like Yei Finance on the Sei network.

This collapse demonstrated how yield optimization strategies can amplify risks, especially when involving recursive lending and synthetic assets. Multiple protocols had to pause operations to protect user funds.

High-yield strategies often come with hidden risks. Due diligence on underlying mechanisms and counterparty risks is essential.

Virtuals Protocol Launches AI-Managed Fund

In more positive news, Virtuals Protocol launched its Agentic Fund of Funds, managed by an AI agent called Butler. This represents a new frontier in automated DeFi yield optimization, allowing users to deposit as little as $10 for AI-managed yield farming across multiple protocols.

Market Turmoil and Stablecoin Depegs

The market continued its downward trend this week, with the total crypto market cap falling below $3.5 trillion. This was exacerbated by several decentralized stablecoins losing their peg, adding to the sense of uncertainty and fear in the market.

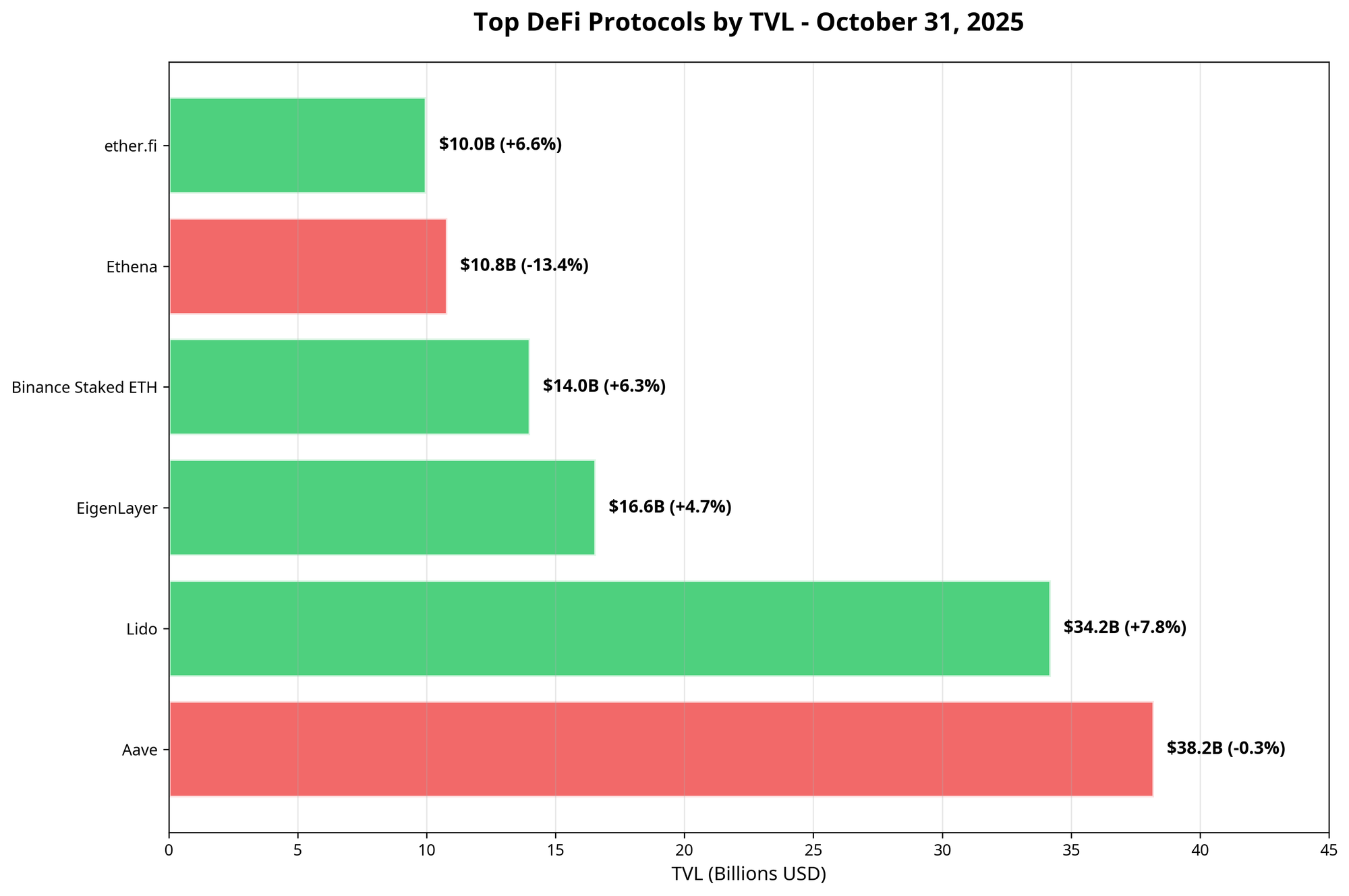

The State of the Chains

The multi-chain landscape continues to evolve, with different ecosystems showing varying degrees of strength. The overall trend is one of consolidation, with capital flowing to chains and protocols that offer clear value propositions.

Chain Performance Analysis

- Ethereum: As the primary settlement layer for DeFi, Ethereum continues to command the largest share of TVL. The stable gas fees suggest a healthy balance between supply and demand for block space.

- Layer 2 Solutions: Arbitrum remains a key hub for yield farming, as evidenced by the high APY offered by the Lazy Summer vault. The competition among L2s is heating up, which is a net positive for users in the form of lower fees and more innovative products.

- Alternative L1s: Avalanche is also carving out a niche for itself, with protocols like Lagoon Finance offering competitive yields. The ability of these chains to attract and retain capital will be a key factor in their long-term success.

Portals.fi Platform Updates

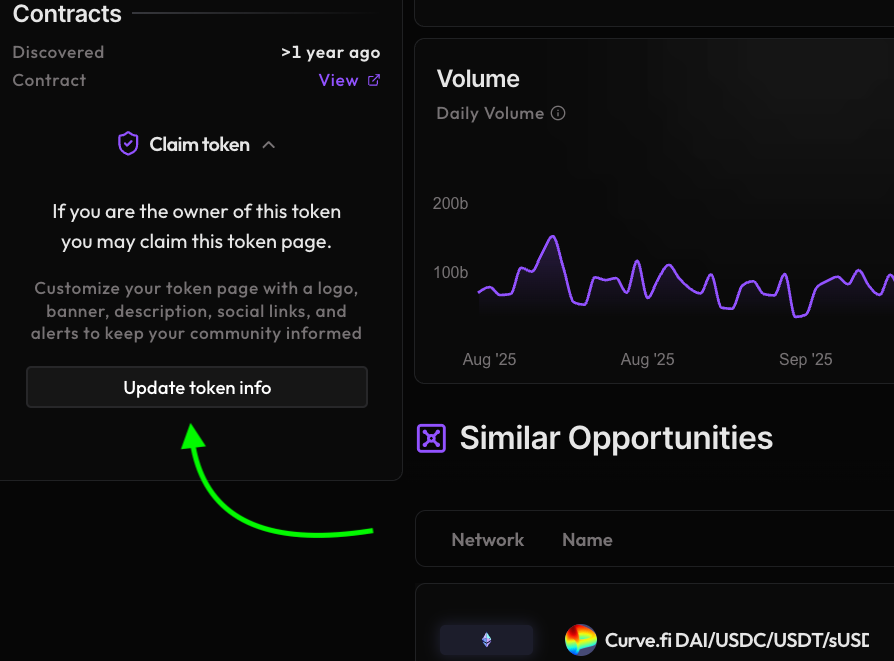

Token Claim is Live!

The Portals.fi claim token feature is now live and being actively used by our partner protocols. This feature will let the project add necessary information about the token. Teams like Pendle , PancakeSwap, and IPOR have already claimed their tokens, demonstrating the utility and ease of use of our platform.

The DeFi Drop Podcast by Portals.fi

We had an insightful session with TAU Labs and Fusion (by IPOR) this week. More coming next week, Stay tuned to find out. If you missed the previous episodes, the full segment is available here.

Looking Ahead: A Market in Search of a Catalyst

Market Outlook: The crypto market is currently in a state of anticipation, waiting for a catalyst to break the current consolidation range. The increasing Bitcoin dominance and the fear sentiment suggest that the path of least resistance may be to the downside in the short term. However, the underlying fundamentals of the DeFi ecosystem remain strong.

Key Catalysts to Watch:

- Macroeconomic Data: With the market being so sensitive to liquidity conditions, upcoming inflation data and central bank announcements will be closely watched.

- Regulatory Developments: Any news on the regulatory front, whether positive or negative, could have a significant impact on market sentiment.

- Technological Breakthroughs: Keep an eye out for any major technological breakthroughs or new product launches from leading protocols, as these can often serve as a catalyst for a new market narrative.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, and past performance does not guarantee future results. More details here.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.