Portals.Fi DeFi Weekly - October 10, 2025

The weekly DeFi market report from Portals.fi, the DeFi Super App. A one-click gateway to the entire on-chain economy.

Market Pulse

A snapshot of this week's market dynamics.

- Total Market Cap: ~$4.34 Trillion (WoW: +1.2%)

- Trading Volume (24h): $163 Billion

- BTC Dominance: 56.7%

- Gas (ETH): ~0.13 Gwei (slow), ~0.18 Gwei (fast)

- Sentiment: Fear & Greed Index: 74 (Greed)

Executive Summary

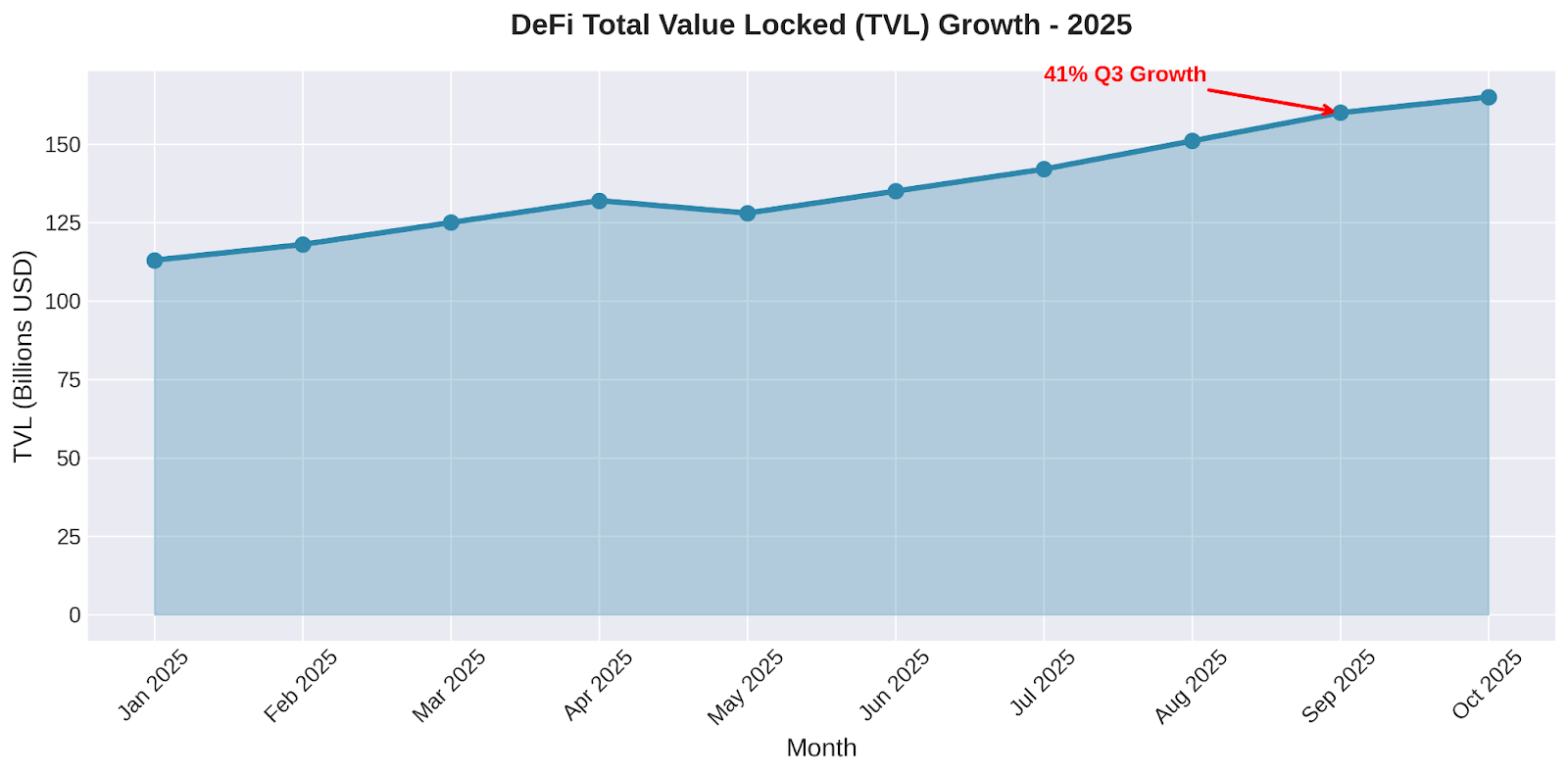

This week, the DeFi market continued its strong Q4 start, with Total Value Locked (TVL) reaching a new 18-month high of $165 billion. We are observing a significant rotation of capital from traditional finance into DeFi, driven by a combination of macroeconomic factors and renewed institutional interest. While Bitcoin and major Layer-1s have seen initial inflows, momentum is now building in the altcoin and yield sectors, setting the stage for a dynamic end to the year.

The Yield Market Pulse: A Cautious Surge

After a period of consolidation, yield opportunities are showing signs of life. Average APYs on stablecoin lending have ticked up to 5-15% on blue-chip protocols, a notable increase from previous months. This suggests that the demand for leverage is returning to the market, a bullish sign for the broader ecosystem.

The chart above illustrates the steady climb of DeFi TVL throughout 2025, with a significant 41% surge in Q3. This sustained growth, even in the face of macroeconomic uncertainty, points to the increasing stickiness of capital in the DeFi ecosystem.

Top Opportunities This Week

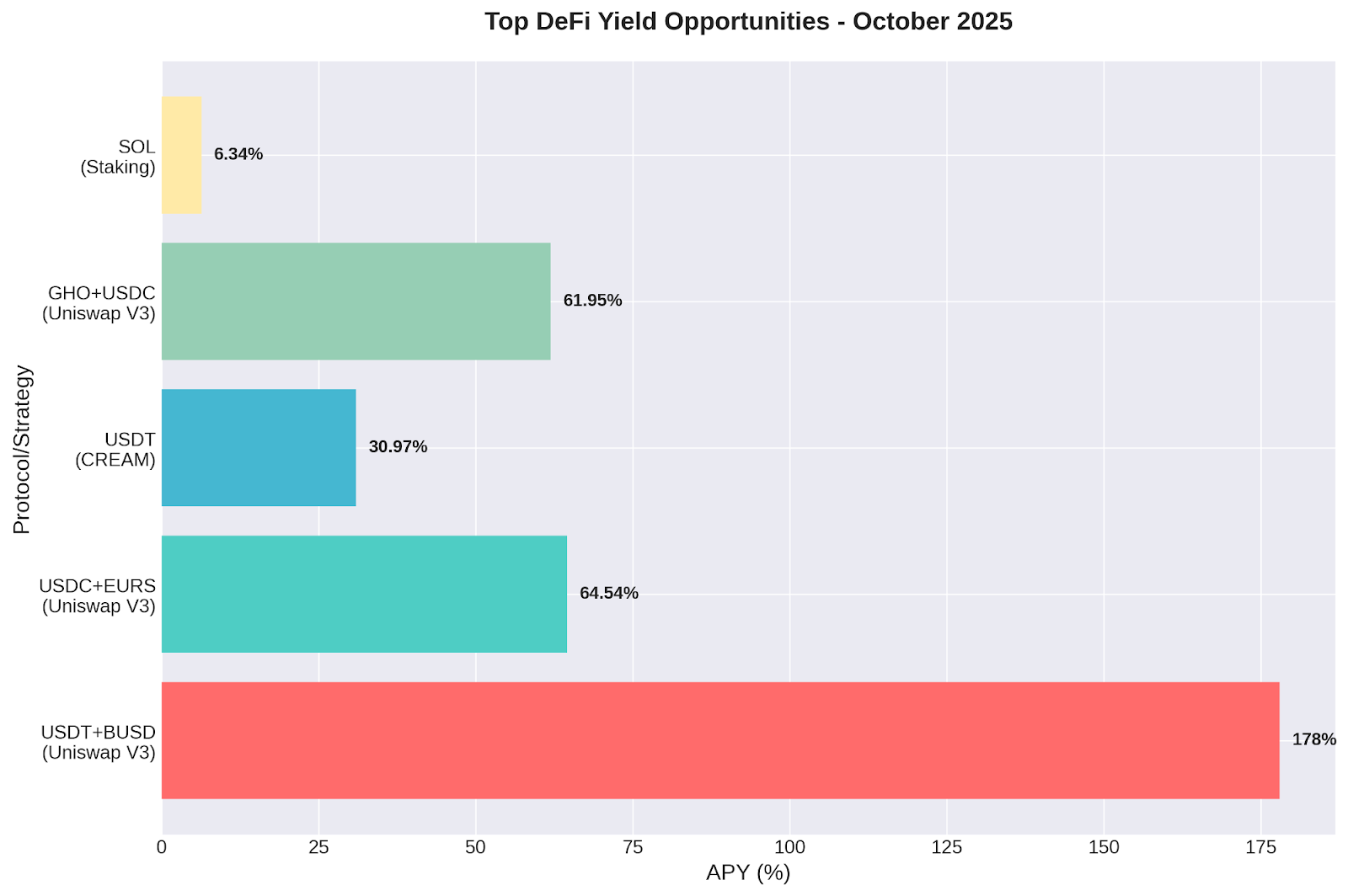

While the highest APYs often come with the highest risk, several opportunities on established protocols are offering attractive returns this week. As always, do your own research before investing.

- Stablecoin LPs: The USDT/BUSD pool on Uniswap V3 (BNB Chain) is currently offering a headline-grabbing 178% APY. This is likely driven by short-term incentives and high trading volume, and investors should be cautious of impermanent loss.

- Cross-Chain Stablecoins: The USDC/EURS pool on Uniswap V3 (Polygon) is showing a strong 64.54% APY, indicating high demand for Euro-pegged stablecoins.

- Blue-Chip Lending: For those with a lower risk appetite, lending USDT on CREAM Finance (BNB Chain) is providing a solid 30.97% APY.

Protocol Spotlight: Pendle Finance

The standout performer this week has been Pendle Finance, a protocol specializing in the tokenization and trading of future yield. Pendle’s TVL surged by over $318 million in just four days following the launch of its new Plasma pools. This rapid growth highlights the increasing demand for more sophisticated yield management strategies and the power of liquid staking derivatives.

This trend suggests that the next phase of DeFi growth may be driven not just by simple lending and borrowing, but by protocols that allow users to speculate on and hedge against fluctuations in yield itself.

The State of the Chains

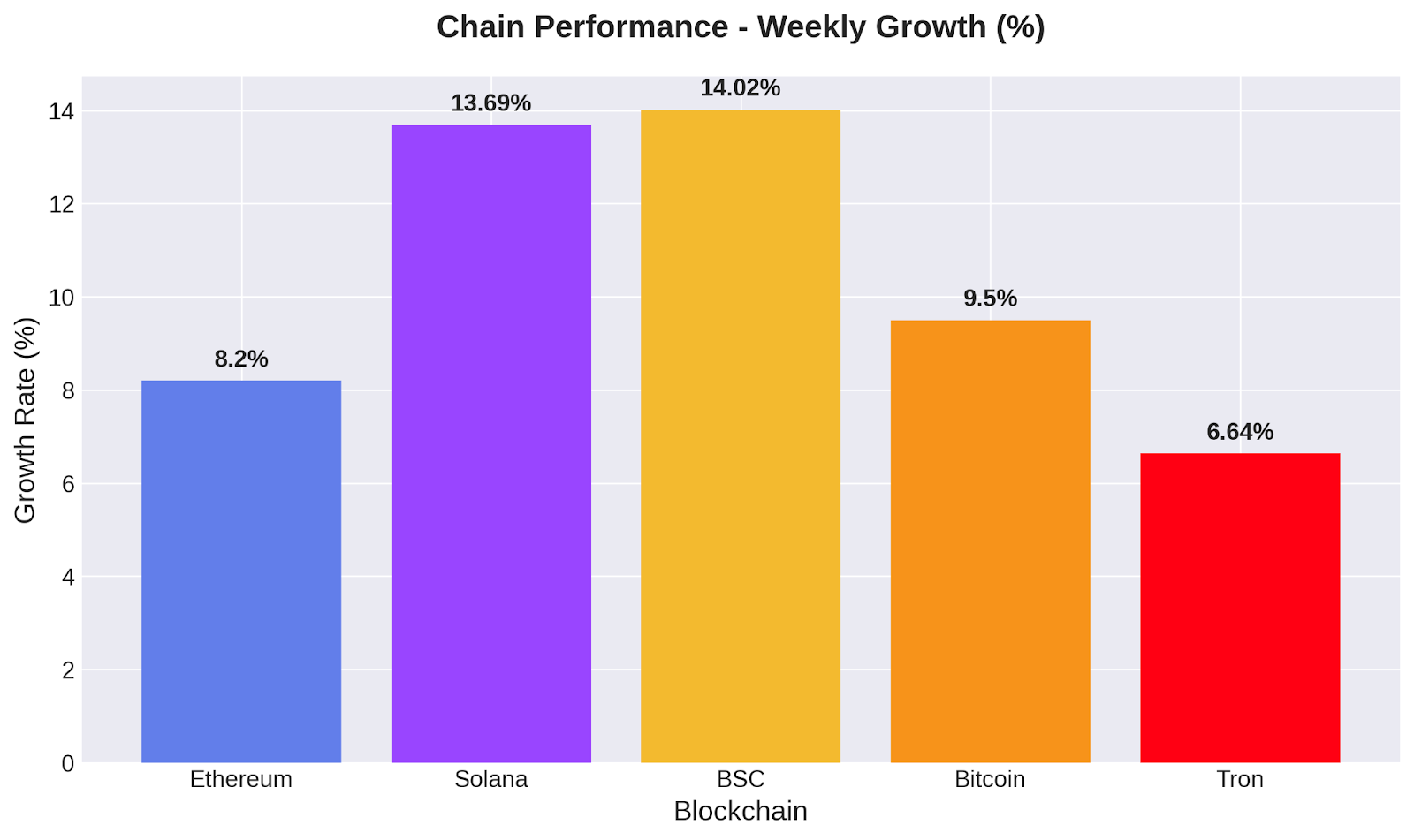

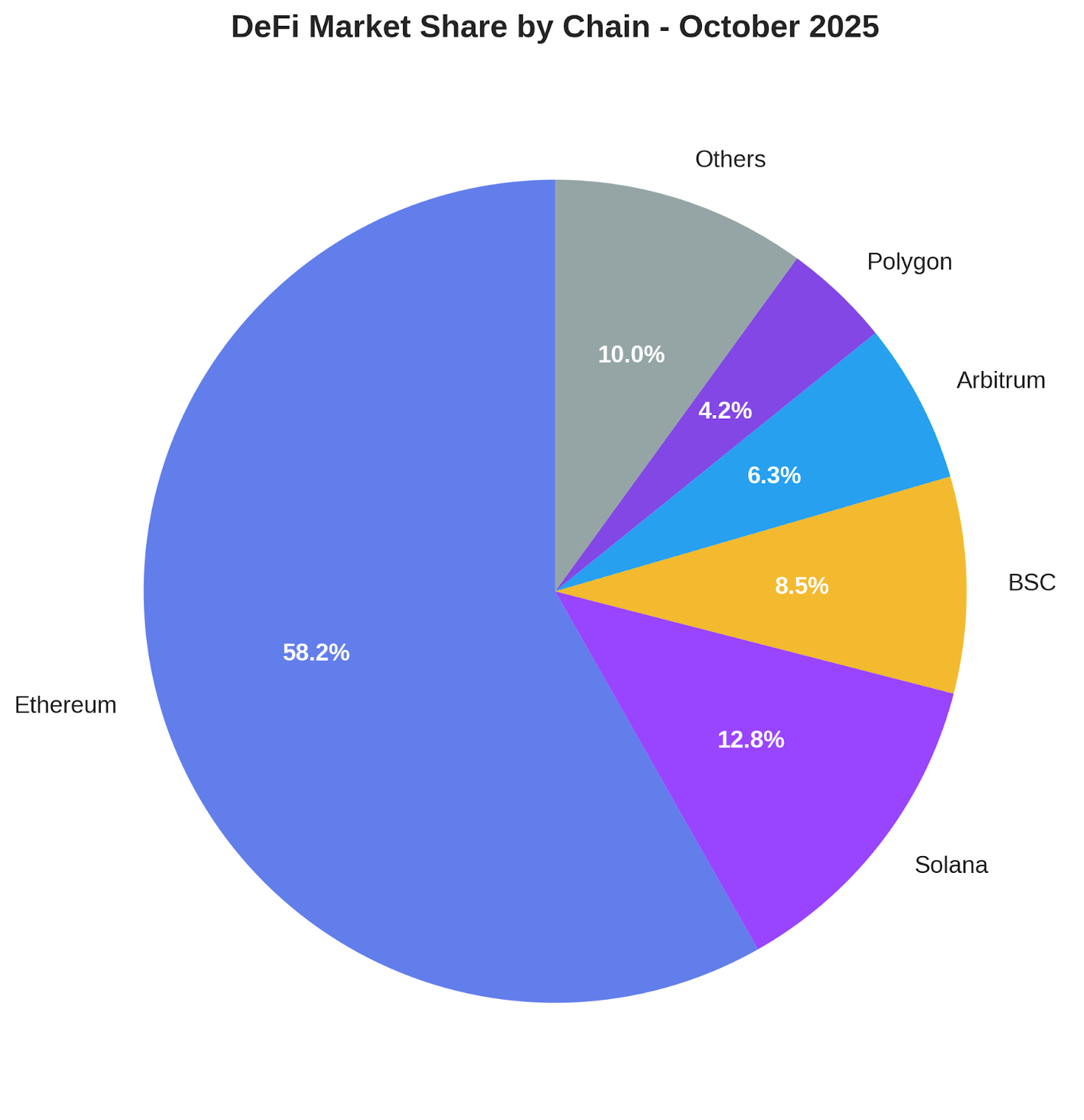

While Ethereum continues to dominate the DeFi landscape, other Layer-1s are showing strong momentum. The narrative of a multi-chain future is stronger than ever.

- Solana and BSC have shown impressive weekly growth, indicating a renewed appetite for risk in alternative ecosystems.

- Ethereum remains the undisputed king, with over 58% of the total DeFi TVL. Its deep liquidity and vast developer ecosystem make it the foundation of the DeFi world.

Portals.fi Platform Updates

- New Integration: Pendle Finance Now on Portals.fi: In response to the growing demand for yield trading, we have now integrated Pendle Finance into the Portals.fi dashboard. You can now track your Pendle positions and explore new yield opportunities directly from your Portals account.

- Enhanced Gas Fee Estimator: We have rolled out an update to our gas fee estimator, providing more accurate and real-time fee predictions to help you save on your transaction costs.

Looking Ahead: What to Watch Next Week

- Fed Meeting Minutes: The release of the latest Federal Reserve meeting minutes could impact market sentiment. A more dovish tone could fuel further rotation into risk assets like crypto.

- Altcoin Momentum: Keep an eye on the altcoin dominance chart. If it starts to reclaim lost ground, it could signal the start of a broader altcoin rally.

- Cross-Chain Bridge Volume: An increase in volume on cross-chain bridges can be a leading indicator of capital flowing into new ecosystems.

About Portals.fi:

Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.