Portals.Fi DeFi Weekly - October 17, 2025

The weekly DeFi market report from Portals.fi, the DeFi Super App. A one-click gateway to the entire on-chain economy.

Market Pulse

A snapshot of this week's market dynamics reveals a significant correction across crypto markets.

- Total Market Cap: $3.64 Trillion (24h: -6.16%)

- Trading Volume (24h): $254 Billion

- BTC Dominance: 57.67% (↑ from 56.7% last week)

- Gas (ETH): ~3 Gwei (up from ~0.15 Gwei last week)

- Sentiment: Fear & Greed Index: 22 (Extreme Fear) - dramatic shift from 74 (Greed)

Executive Summary

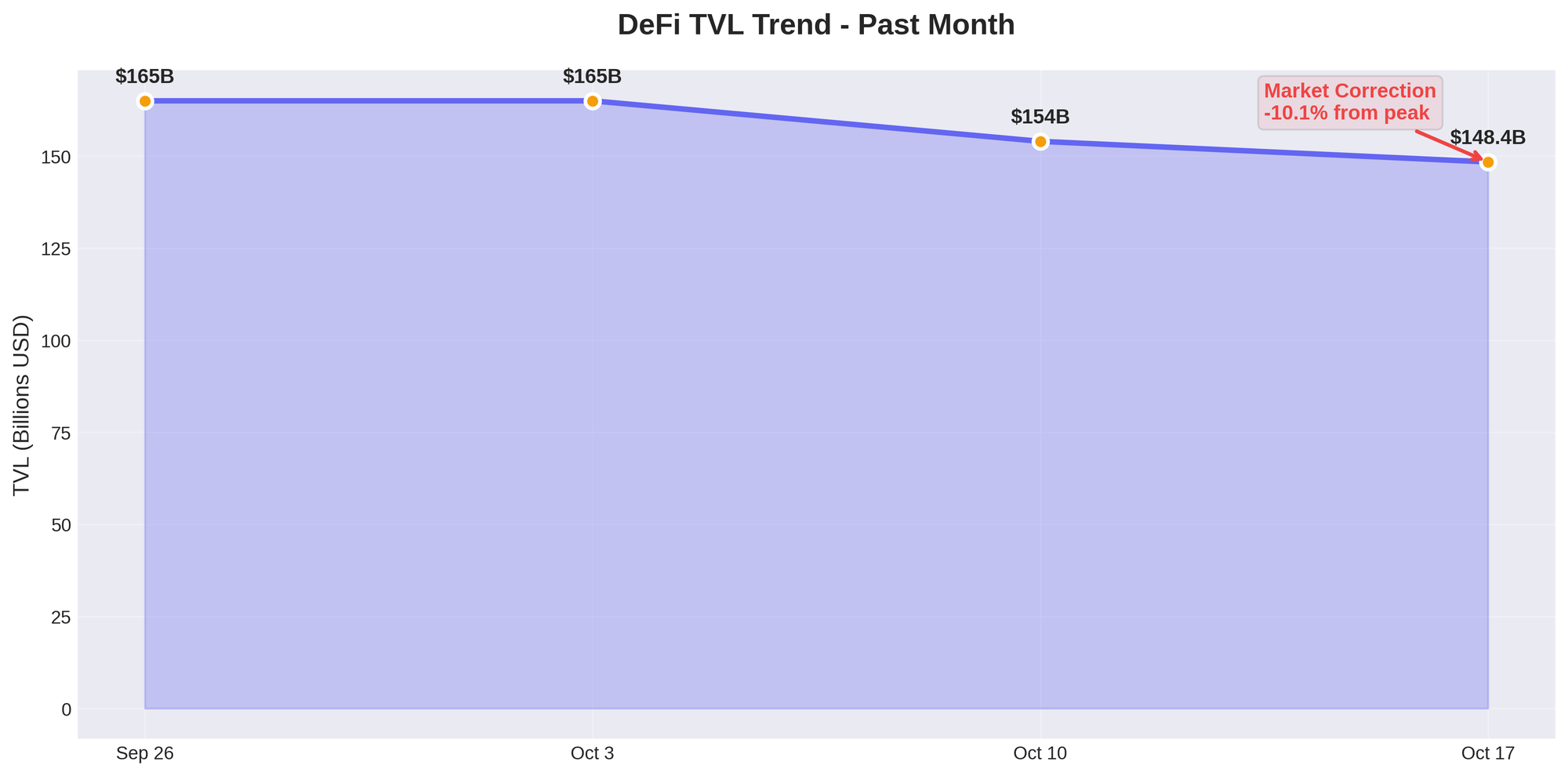

This week marked a significant shift in market sentiment as crypto markets experienced their largest correction in months. The Fear & Greed Index plummeted from 74 (Greed) to 22 (Extreme Fear), reflecting widespread uncertainty among investors. Despite the broader market turmoil, DeFi Total Value Locked (TVL) held relatively steady at $148.4 billion, showing the resilience of decentralized protocols during market stress.

The correction has created what many analysts view as a potential buying opportunity, with Bitcoin dominance rising to 57.67% as investors seek refuge in the market's most established asset. Gas prices have increased to around 3 Gwei but remain manageable for most DeFi operations.

The Yield Market Pulse: Opportunities in the Storm

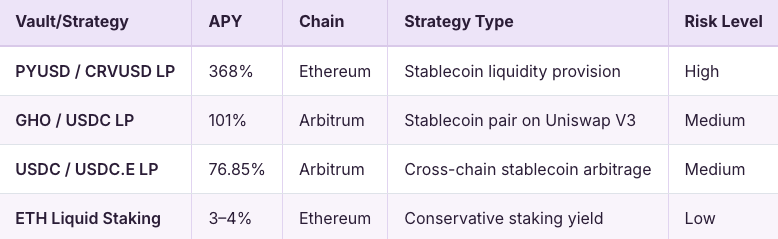

While market volatility has increased, yield opportunities remain attractive for those willing to navigate the current environment. **Stablecoin lending rates have actually improved** during the correction, with many protocols offering enhanced returns as demand for leverage and hedging increases.

Top Opportunities This Week

Despite market turbulence, several high-yield opportunities remain available across established protocols. The current environment favors conservative strategies with proven track records.

Risk Assessment: The extremely high APYs on stablecoin pairs reflect current market volatility and should be approached with caution. These yields often come with significant impermanent loss risk during volatile periods.

Protocol Spotlight: Defensive DeFi Strategies

During market corrections, defensive DeFi strategies become increasingly important. This week, we're seeing increased activity in:

Liquid Staking Protocols: Despite ETH price volatility, liquid staking continues to provide steady yields around 3-4% while maintaining liquidity. Lido (stETH) and Rocket Pool (rETH) remain the most popular choices.

Stablecoin Yield: Protocols offering stablecoin yield are experiencing increased demand as traders seek to preserve capital while earning returns. Aave and Compound continue to dominate this space.

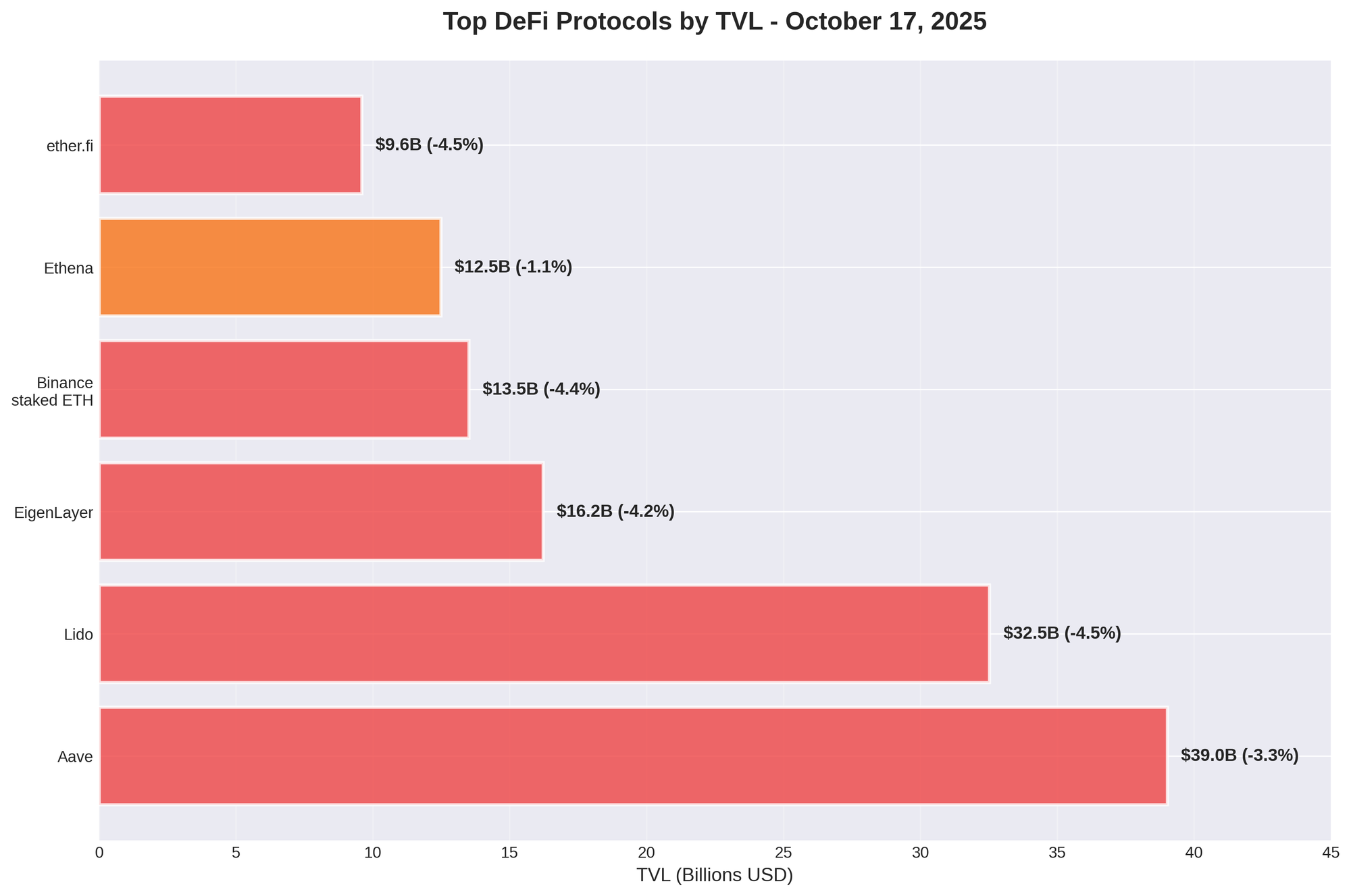

Restaking Opportunities: EigenLayer maintains strong TVL despite market conditions, suggesting institutional confidence in the restaking narrative for long-term yield enhancement.

The State of the Chains

The multi-chain DeFi ecosystem is showing varied responses to the market correction, with some chains proving more resilient than others.

Chain Performance Analysis:

• Ethereum continues to dominate with the largest protocols by TVL, though all major protocols experienced 3-4% declines

• Arbitrum and Polygon are seeing increased stablecoin activity as users seek lower-cost alternatives

• Solana DeFi protocols are showing mixed performance, with some gaining market share during the correction

Portals.fi Platform Updates

New Integrations: Despite market conditions, we continue expanding our protocol coverage. This week we've added support for several emerging yield aggregators focused on risk-adjusted returns.

Looking Ahead: Navigating the Correction

Market Outlook: The current correction appears to be driven by broader macroeconomic factors rather than DeFi-specific issues. Historical patterns suggest that such corrections often create excellent entry points for long-term yield strategies.

Key Metrics to Watch:

• Stablecoin market cap: Currently at $313B, any significant changes could signal broader market moves

• DeFi TVL stability: The relative resilience of DeFi TVL compared to token prices suggests underlying protocol strength

• Cross-chain bridge activity: Increased activity could signal capital rotation between ecosystems

Strategic Considerations:

• Dollar-cost averaging into established yield positions may be advantageous during this period

• Stablecoin strategies offer attractive risk-adjusted returns in the current environment

• Gas-efficient chains become more attractive as Ethereum fees increase

Risk Management in Volatile Markets

During periods of extreme fear, it's crucial to maintain disciplined risk management:

Portfolio Diversification: Spread exposure across multiple protocols and chains to reduce concentration risk.

Liquidity Management: Maintain higher cash positions to take advantage of opportunities that may arise.

Protocol Selection: Focus on battle-tested protocols with strong track records during market stress.

Yield vs. Risk: Remember that the highest APYs often come with the highest risks, especially during volatile periods.

About Portals.fi: Portals.fi is the DeFi Super App. A one-click gateway to the entire on-chain economy. Powered by real-time data and seamless execution, Portals.fi connects traders to over 20 million assets, thousands of protocols, and every major blockchain.

Disclaimer: The content of this newsletter is for informational purposes only. It is not investment advice. Please do your own research and consult with a qualified financial advisor before making any investment decisions. DeFi investments carry significant risks, especially during volatile market conditions.

Portals.fi Blog Newsletter

Join the newsletter to receive the latest updates in your inbox.